PEX Credit Expense:

Corporate Cards with Incredible Control

Corporate charge cards that come with greater flexibility. Simple application and approval process.

Apply now to receive up to $250 back on on your first purchases. *Terms Apply.

A smarter corporate card platform

Wider Merchant Acceptance

Use for travel, paying bills, or any on-the-go purchasing your team needs to make. Visa® Commercial Cards are accepted worldwide

Greater Savings

Card controls that keep you within budget. Fast card distribution and instant funding vastly improve bookkeeping and productivity

Control Card Usage

Control who spends, how much and on what, individually or based on groups. Identify what job the spend applies to.

Instant Funds and Incredible Flexibility

Same great PEX expense management tools, now with the added flexibility of credit.

-

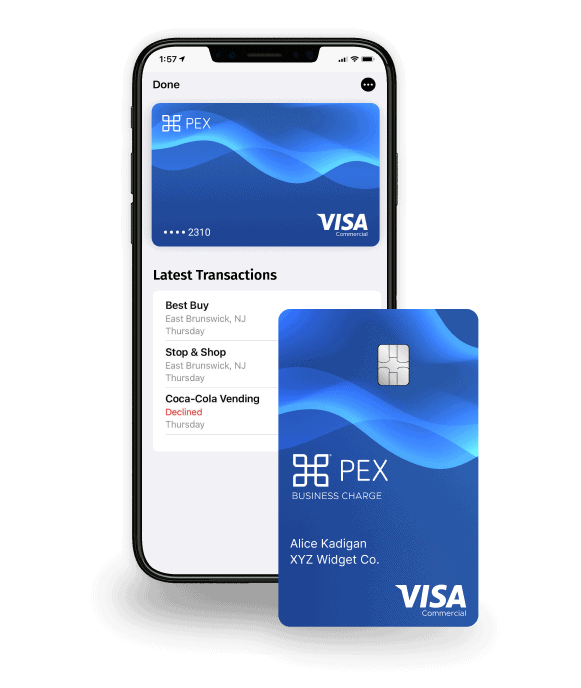

Easily distribute physical or virtual cards.

Give physical cards to staff and management, use virtual cards to pay bills, arrange travel, manage subscriptions and other repeating expenses. All managed from your desktop or mobile device.

-

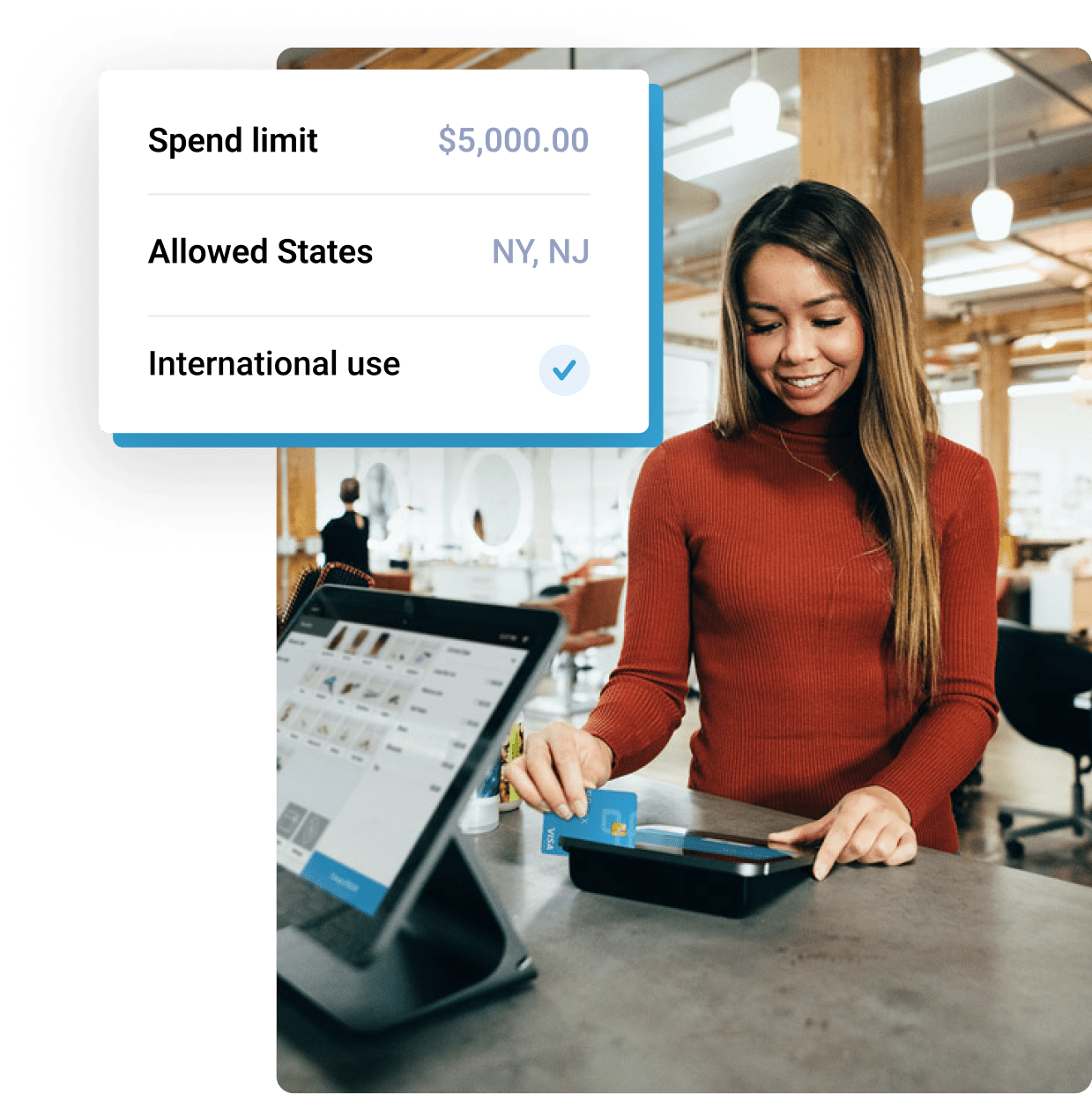

Set rules. Set budgets. Or set nothing.

Every card or group can have their own approved categories and spending limits. PEX keeps spending in check and you in control.

-

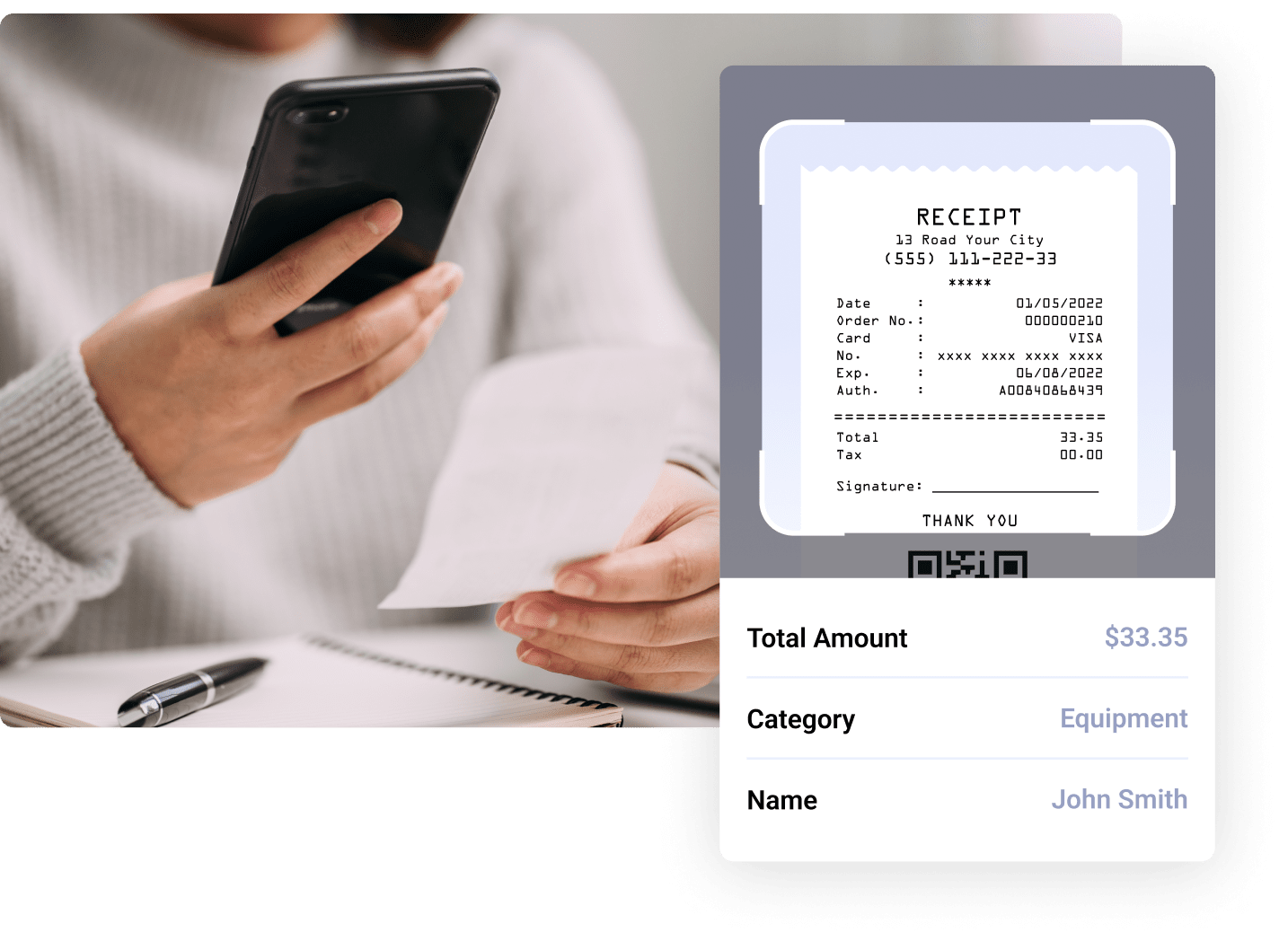

Track spending anywhere.

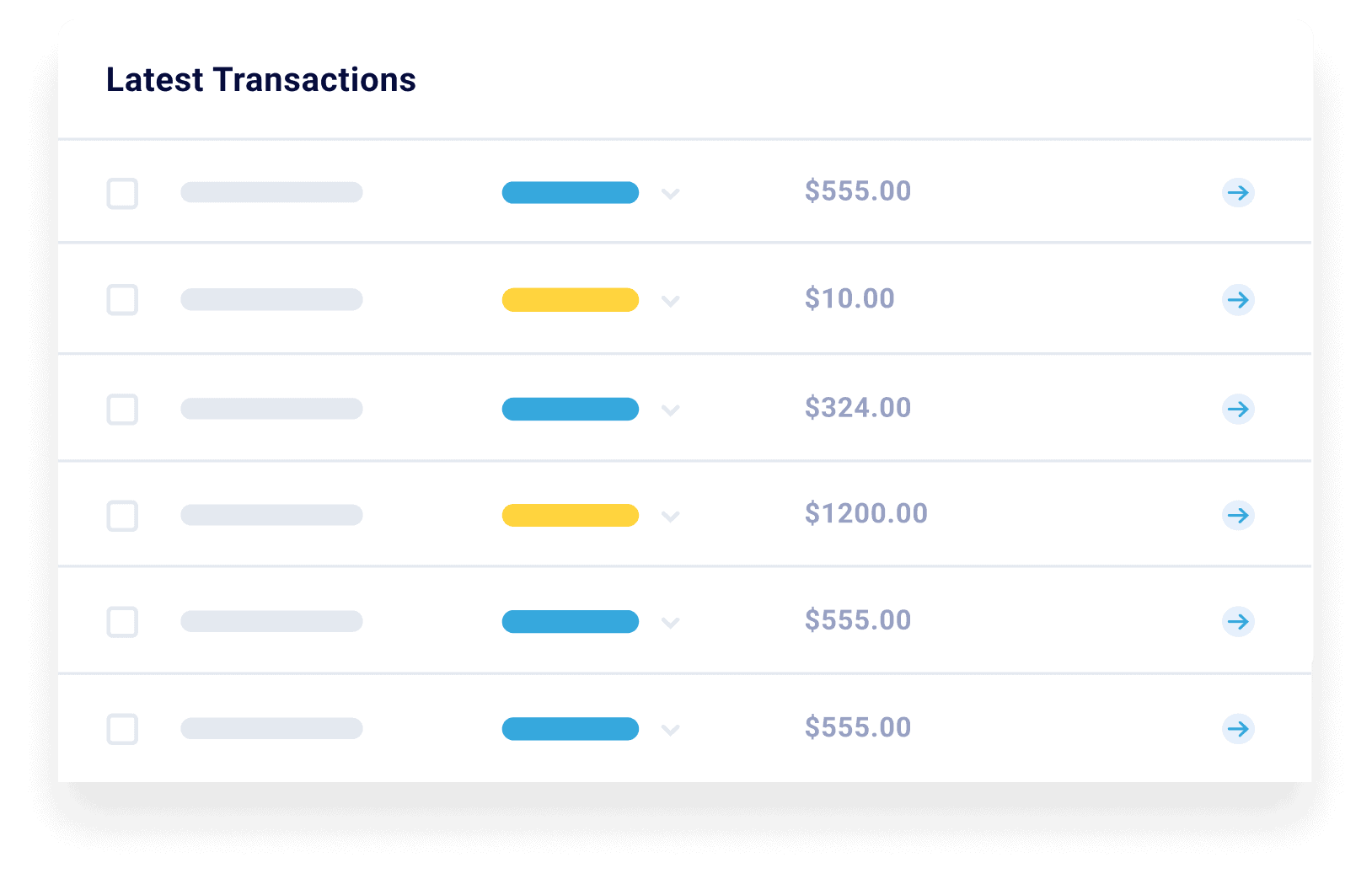

No end-of-billing-cycle surprises. PEX reports transactions in real-time. Cardholders can submit receipts and accounting codes within the mobile app. Admins can manage cards online or via mobile app.

-

Connect to your accounting.

Sync transactions with your systems to automate expense reporting, allocations, and reconciliations. Deep reporting options put the information you need at your fingertips. Find a list of software PEX integrates with here.

PEX Works for Everybody in Your Organization

A smarter approach to managing expenses without credit risk.

Instant funds, allocated to the right employees.

Avoid cash or check reimbursements; just run your business.

Simple interface to set spending privileges by cardholder, merchant category, time, and more.

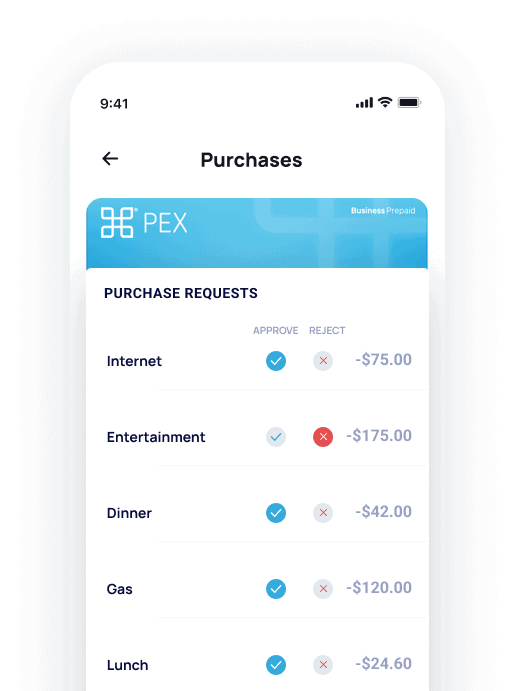

Instantly approve or decline purchases according to your preset controls.

Use the mobile app to monitor spending and authorize purchases from anywhere, anytime.

Real-time reporting allows you to spend less time on expense report reconciliation.

Real-time, customizable reporting that saves time and helps you manage cash flow.

Transactions are reported in real-time; get a better grip on cash flow.

Automatically distribute credit funds to multiple cardholders

Receive 1 % back on eligible transactions.Terms Apply*.

No more expense report drama; cardholders can submit receipts through a mobile app.

Automatically allocate purchases based on GI codes and tags.

PEX integrates with your accounting software for instant reconciliations.

Provide employees with a fluid way to safely use corporate funds.

Eliminate employees using their own money and waiting for reimbursement.

Cardholders can attach GL codes and tags to purchases for easier allocation.

Employees can review their card budgets and their spend rules.

Mobile receipt capture means one less piece of paper to lose.

Cardholders can request funds when needed.

Our customer service team is always on call, so admins don't have to be.

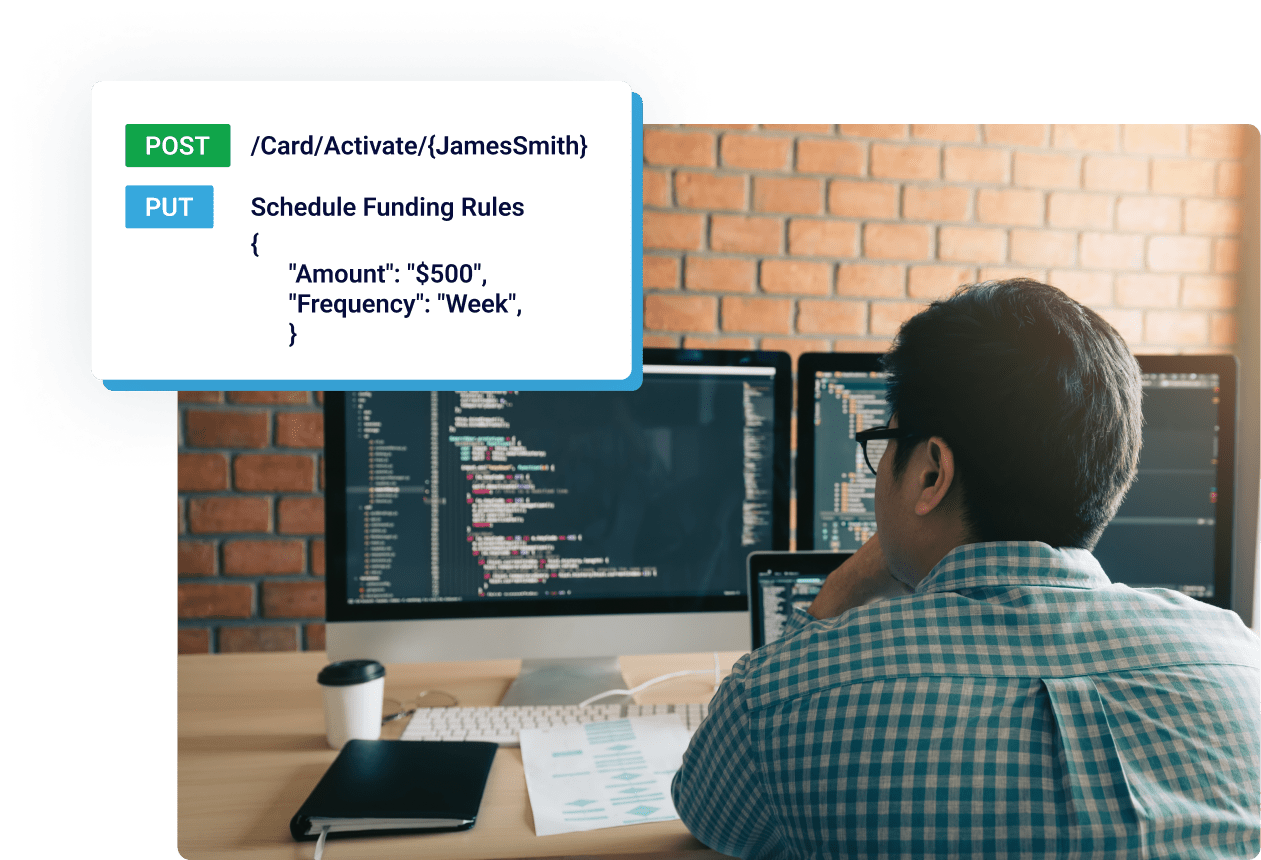

Use PEX out of the box. Or go under the hood to build an advanced, custom payment platform for your business.

Secure API integrates with your systems to give you automated control of all your payments.

Your systems can tap into PEX transaction data to dynamically approve and fund purchases, based on complex, granular rules.

Real-time webhooks push data to your systems, to trigger processes, communications, and more.

PEX Platform can scale to let you process millions of transactions a day.

Credit Expense FAQS

"PEX has been an integral part of the success in our program's ability to provide easy access to funds for our grantees. We're so grateful to have come across knowledgeable employees that have given us guidance, patience and partnership through the process."

K. Dorfman

Program Coordinator

Related Resources

Ready to Learn More?

Request a FREE DEMO to see how easy it is to expand your possibilities with PEX Credit Expense

*PEX requires linking an external business bank account for credit approval & mandatory autopay enrollment. With PEX Credit Expense, repayment of charge card purchases is due in full every seven days at the end of the statement period. A minimum bank account balance is required to qualify. Please view the PEX Master Service Agreement for more information.

1The PEX Visa® Commercial Card is not a credit card.