PEX Prepaid Expense

Take control of your company expenses with prepaid cards and a flexible platform.

How PEX Spend & Expense Works

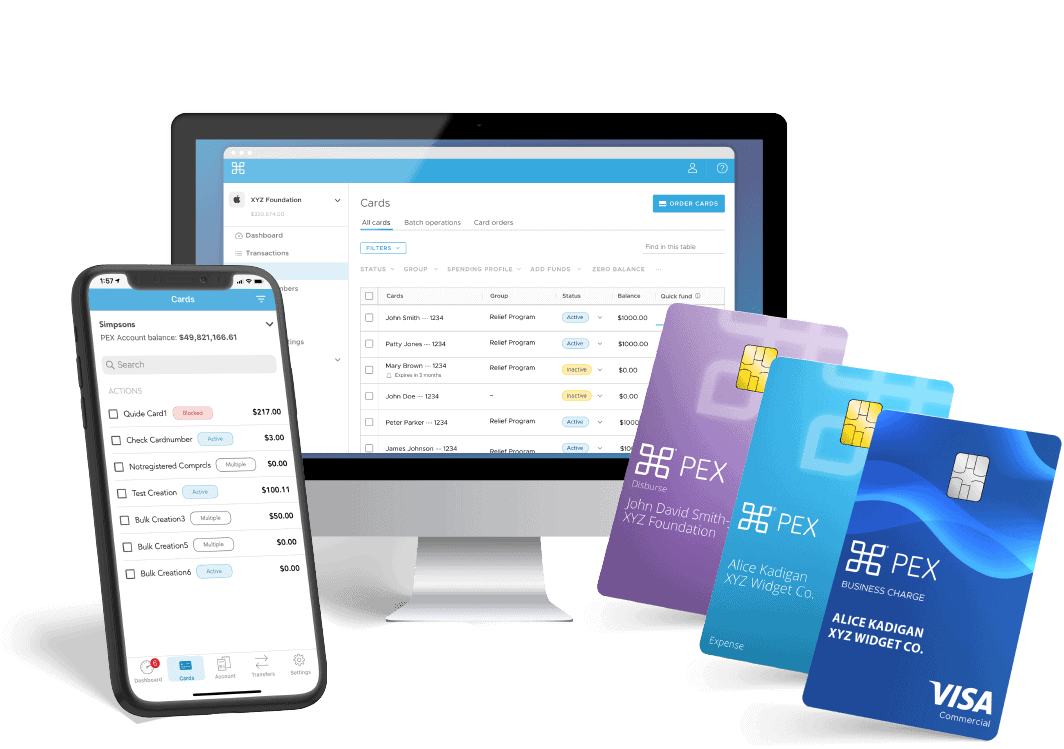

Meet the card platform tailored to what you and your staff need. Get card spending under control and gain visibility into your business expenses.

-

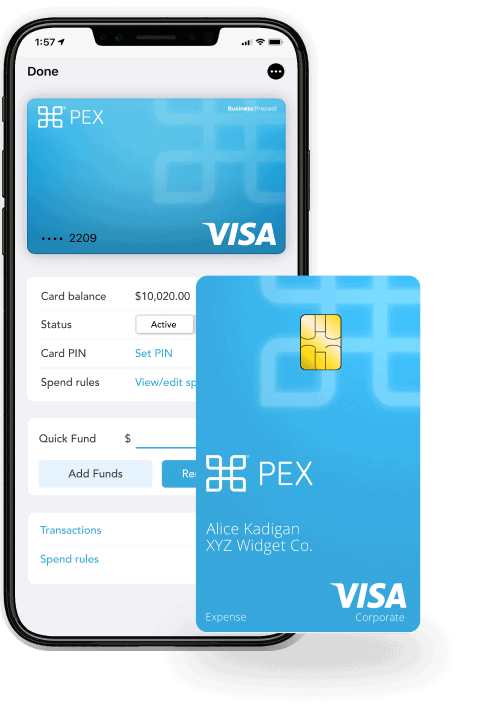

Easily distribute physical or virtual cards.

Provide your employees with physical cards or digital cards for their mobile wallets. Structure and simplify your corporate card program the way that works for you.

-

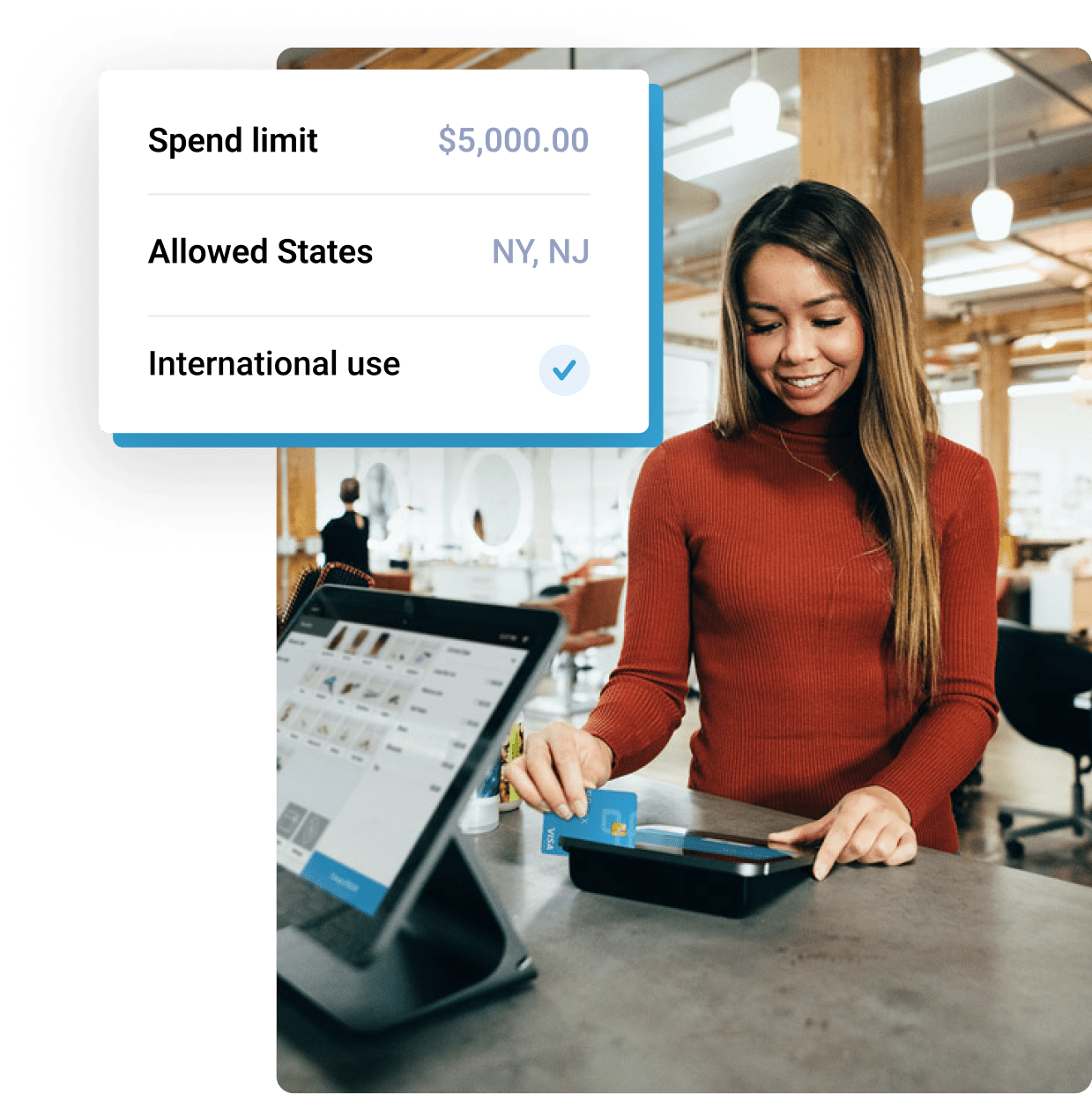

Set rules. Set budgets. Or set nothing.

Every card or group can have their own approved category and spending limits. PEX keeps spending in check and you in control.

-

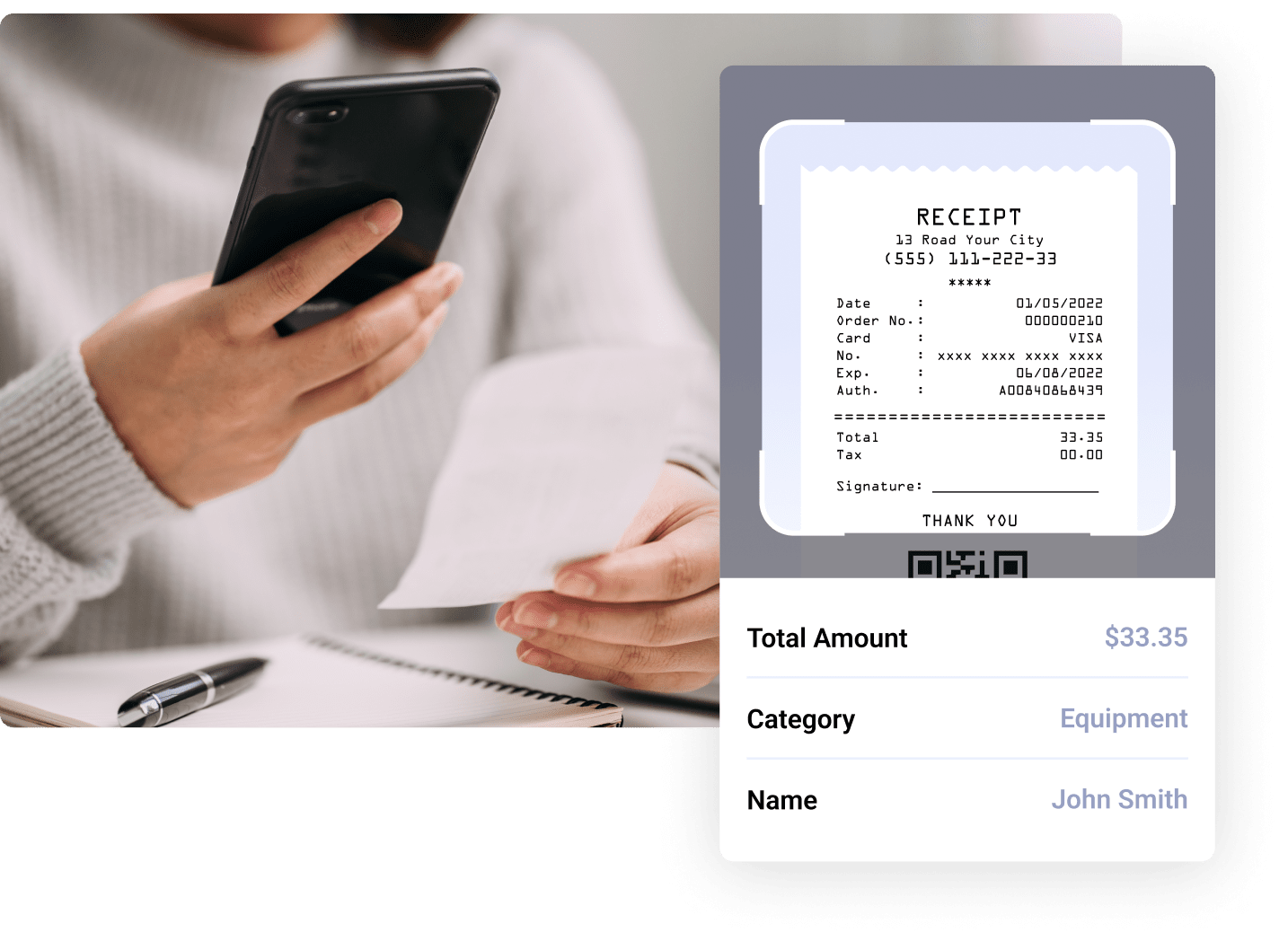

Track spending anywhere.

No end-of-billing-cycle surprises. PEX reports transactions in real-time. Cardholders submit receipts and accounting codes with a mobile app. Admins can manage cards online or via mobile app.

-

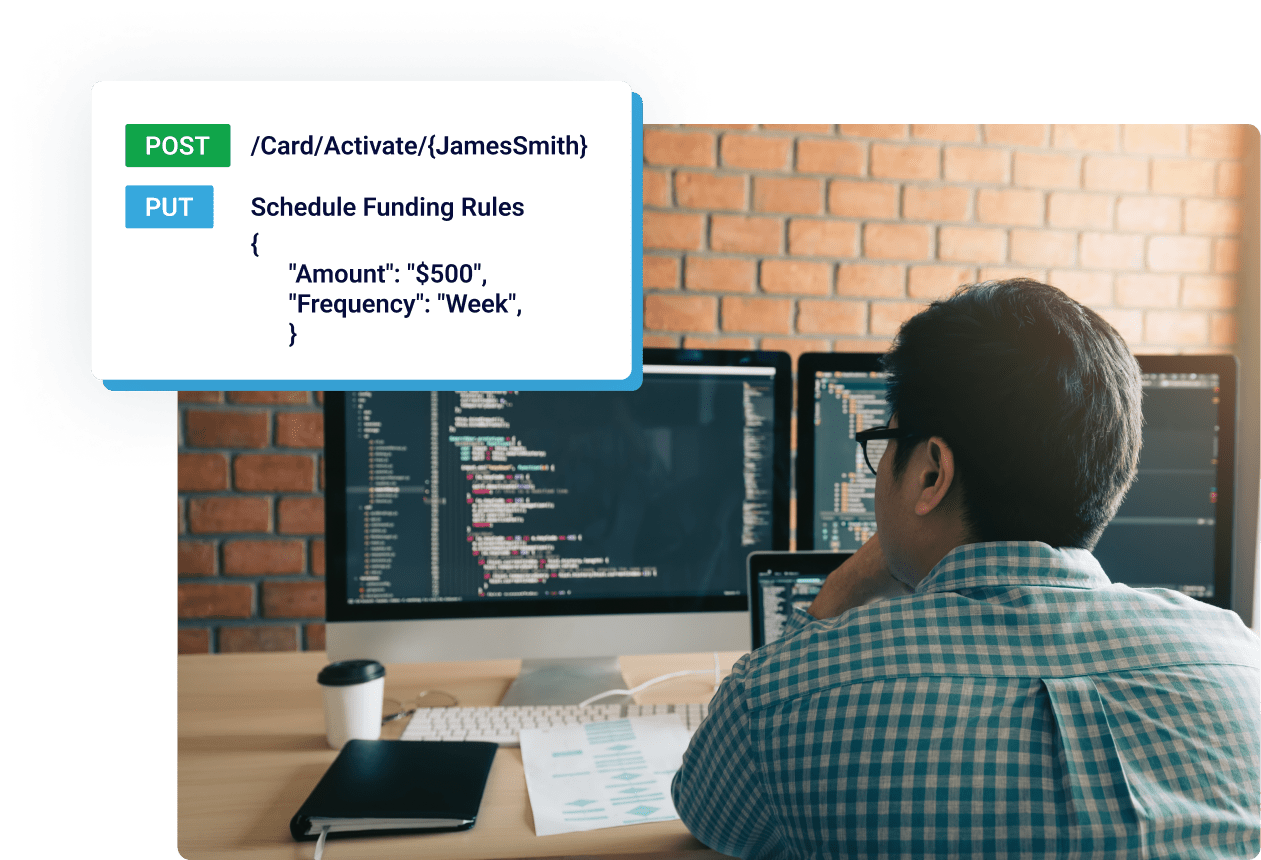

Our data, platform and capabilities can all be yours.

The PEX API can integrate with your systems to give you a custom, automated payment platform, able to process millions of transactions a day.

PEX Works for Everybody in Your Organization

PEX Prepaid Expense allows you to control spending, so you can decide when and where funds are used.

Empower anybody in your organization to spend appropriately.

No cash or check hassles; just run your business.

Simple interface to define spending privileges by department, individual cardholder, merchant category, time and more.

PEX Platform instantly approves or declines purchases according to your settings.

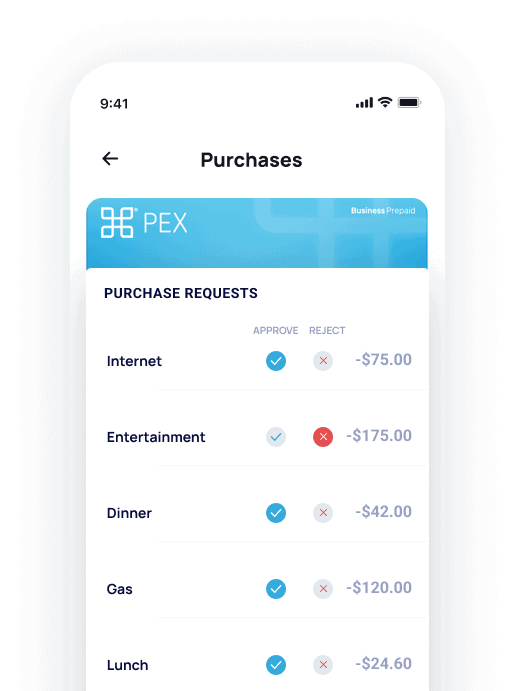

Mobile app lets administrators monitor spending and authorize purchases from anywhere, anytime.

Scalable solution grows with your needs.

Real-time, customizable reporting features save time and help you manage cash flow.

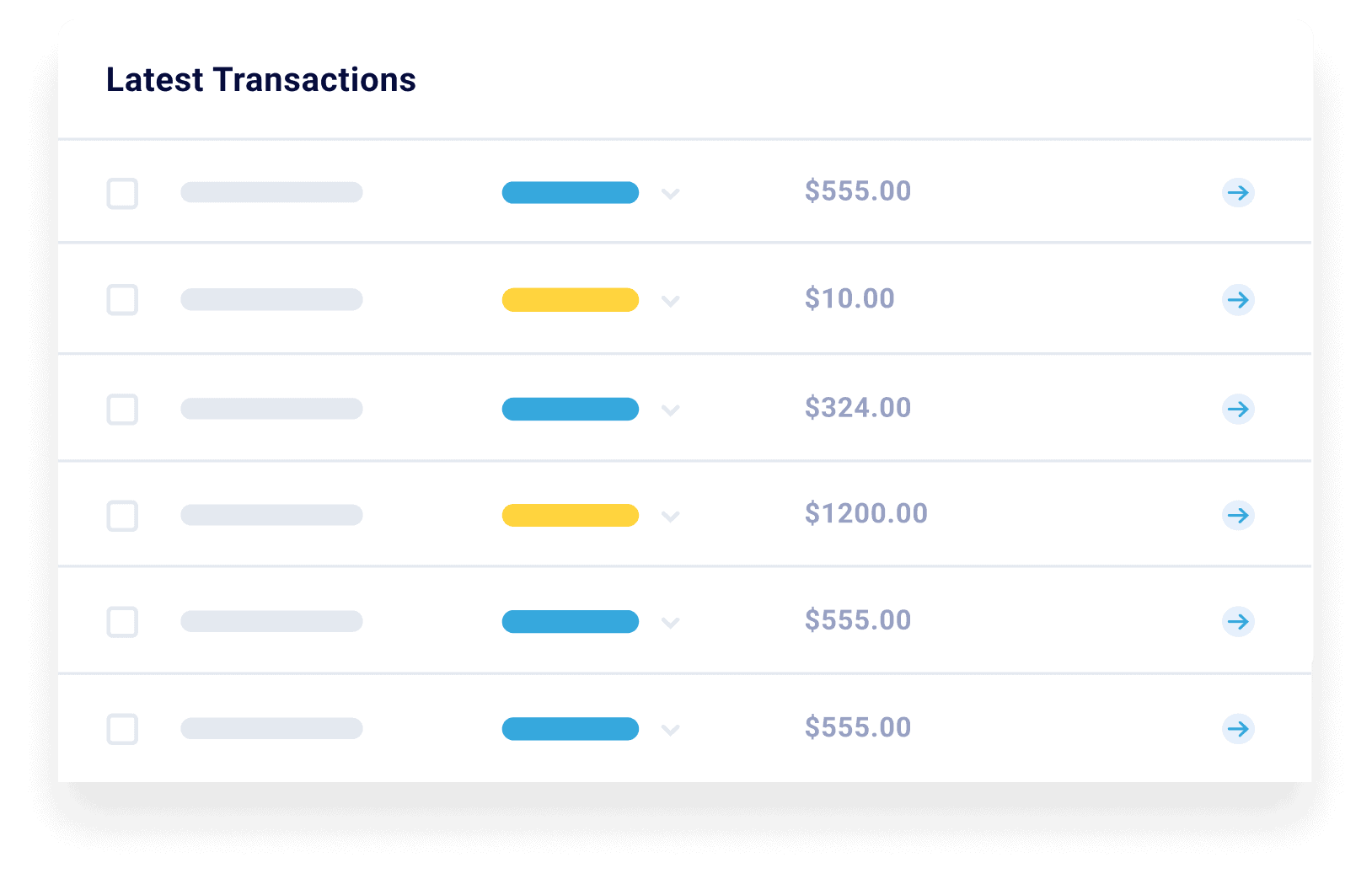

Transactions reported in real time; you always know exactly where you stand.

Platform can automatically reallocate unspent budgets and per-diems.

Up-to-the-second reports are never more than a couple of clicks away.

No stacks of receipts; cardholders submit them through a mobile app.

Save time and aggravation; PEX automatically allocates purchases to departments or cost centers.

PEX integrates with your accounting software for instant reconciliations.

Having to spend money for a boss or organization can be a major hassle. Not with PEX.

With PEX, nobody has to use their own money and wait for reimbursement.

PEX allocates purchases, making expense reports unnecessary.

Cardholder's mobile app lets them know exactly what they can spend on..

Mobile receipt capture means one less piece of paper to lose.

Administrators issue cards without time-consuming applications or credit checks as this is not a credit card.

Our customer service team is always on call, so administrators don't have to be.

Use PEX out of the box. Or go under the hood to build an advanced, custom payment platform for your business.

Secure API integrates with your systems to give you automated control of all your payments.

Your systems can tap into PEX transaction data to dynamically approve and fund purchases, based on complex, granular rules.

Real-time webhooks push data to your systems, to trigger processes, communications, and more.

Cards have no value; platform can fund a purchase at the precise moment it occurs.

PEX Platform can scale to let you process millions of transactions a day.

Case Studies

"PEX has been an integral part of the success in our program's ability to provide easy access to funds for our grantees. We're so grateful to have come across knowledgeable employees that have given us guidance, patience and partnership through the process."

K. Dorfman

Program Coordinator

Related Resources

Start Growing with PEX

PEX offers tools and support to help you to turn workforce spending into a competitive advantage. What can we do for you?