Try PEX vs Amex

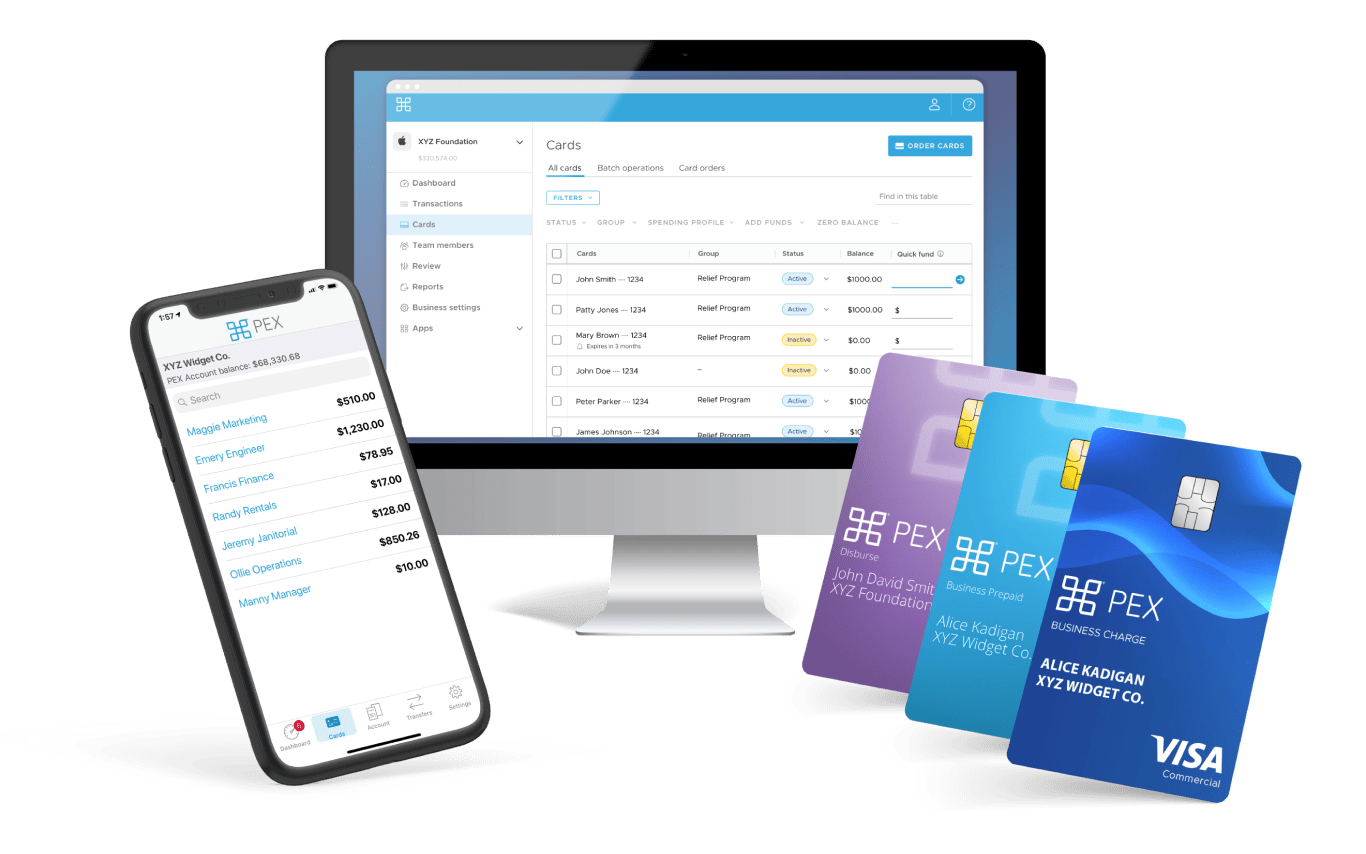

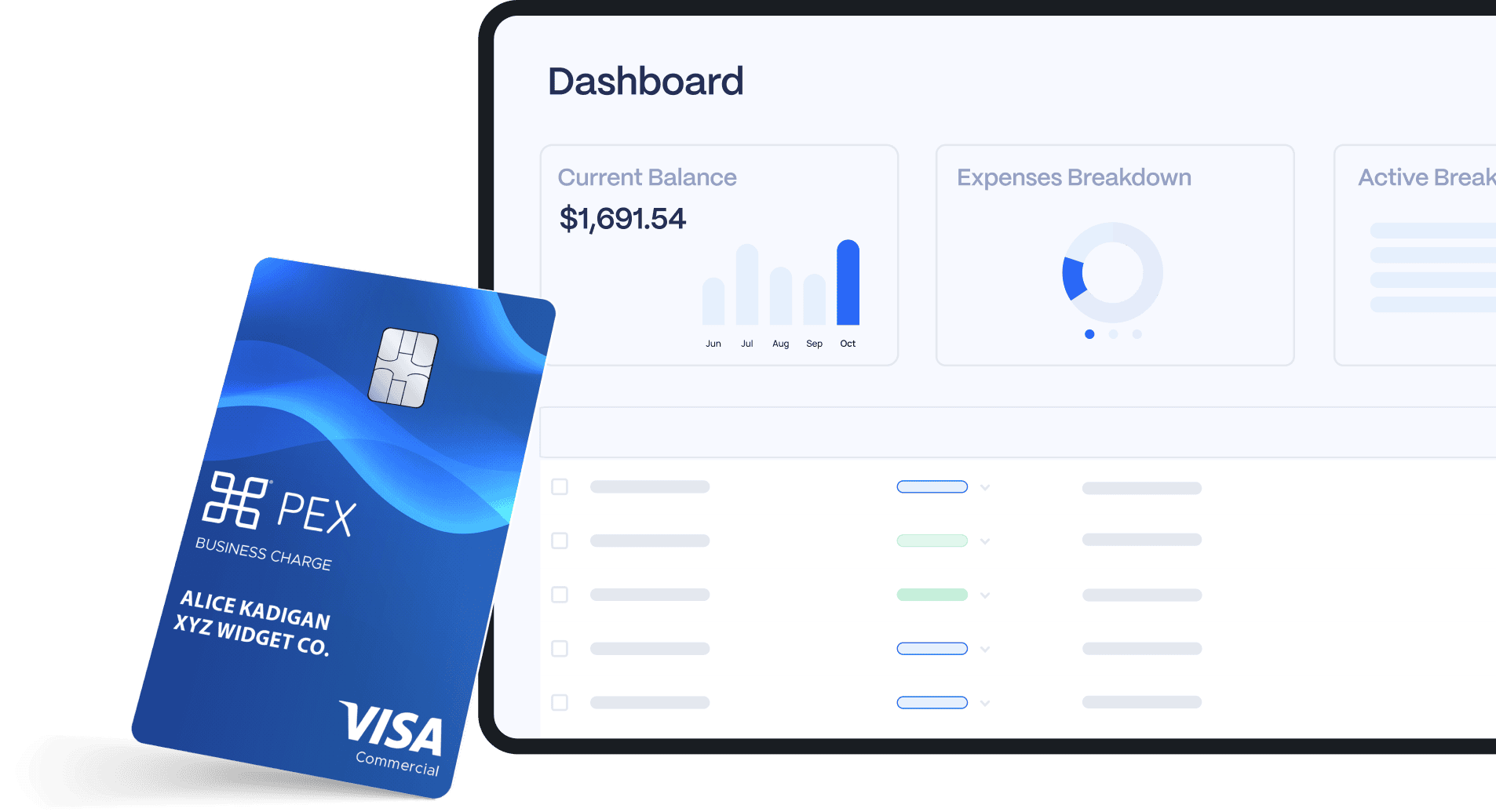

While Amex only offers basic spend management tools, PEX revolutionizes finance with real-time reporting, customizable controls, and an AI-enhanced platform, seamlessly integrating with top accounting software.

Compare PEX vs Amex*

PEX is so user friendly. Creating and controlling cards is so easy. The app helps a lot when you are away from the office/desk. The ability to add receipts and notes to all transactions is great.

Anahid K.

Discover What’s Possible

With PEX Integrations

Why Our Customers Choose PEX

Apply in Minutes with No Personal Guarantee

No personal credit check** and no personal guarantee means your executive team doesn’t need to put their personal credit on the line. Apply online in minutes, without needing to play phone tag with a representative.

**The PEX Visa® Prepaid Card, PEX Disburse Visa® Prepaid Card, and PEX Visa® Commercial Card are not credit cards.

Specialized Integrations

PEX syncs with many popular and specialized accounting systems, including QuickBooks, Xero, Sage Intacct, & many others. These integrations enable businesses like yours to leverage PEX's expense management capabilities within their existing workflows and systems.

Highly Rated & Dedicated Customer Success Team

You can trust our highly rated Customer Success team for their expertise with expense management in organizations like yours. 24/7 live support (from a person!) is available for both program administrators and cardholders.

Save More Time & Money With PEX***

Make the change to PEX today

Ready to Learn More?

Request a FREE Demo to see how easy it is to expand your possibilities with PEX Credit Expense.

*Information cited from company websites as of May 10, 2024 and is subject to change.***PEX customer survey, 2023.