Level 3 is where modernization starts to take hold and going fully paperless becomes a major priority. At this level, an organization’s finance department is using more sophisticated tools to keep track of expenses such as:

QuickBooks Online or other online accounting software

Payroll reimbursements for staff who use personal cards to pay for expenses, or to cover the several “house” cards used around the organization

So while the good news is that there’s some automation and digitization, for the most part, Level 3s are still contending with a sea of different systems—petty cash, payroll reimbursements, personal employee cards, company credit or debit cards loaned out when needed.

The few modern systems help maintain major financial functions, but that’s only part of the story. The other part is that these systems lack integration—it’s cumbersome to maintain so many systems. Plus, too often, Level 3s are still hanging onto some paper methods.

If your organization is a Level 3, using digital tools across the board will help you organize the chaos. Here are a few tips on what you can do:

Implement corporate cards with set limits

Reduce your workload and fees by using one uniform expense platform. While you’re on the path to becoming paperless, you’re still not quite there. Therefore, it’s time to say goodbye to payment by cash or personal check, or using your (personal or corporate) credit card as the go-to-card—it’s both inefficient and a security risk. Instead, give company cards to those with spending privileges—anyone from the Director of Procurement to the intern who does the twice daily Starbucks run—and install specific limits based on each person’s spending needs.

Increase integration

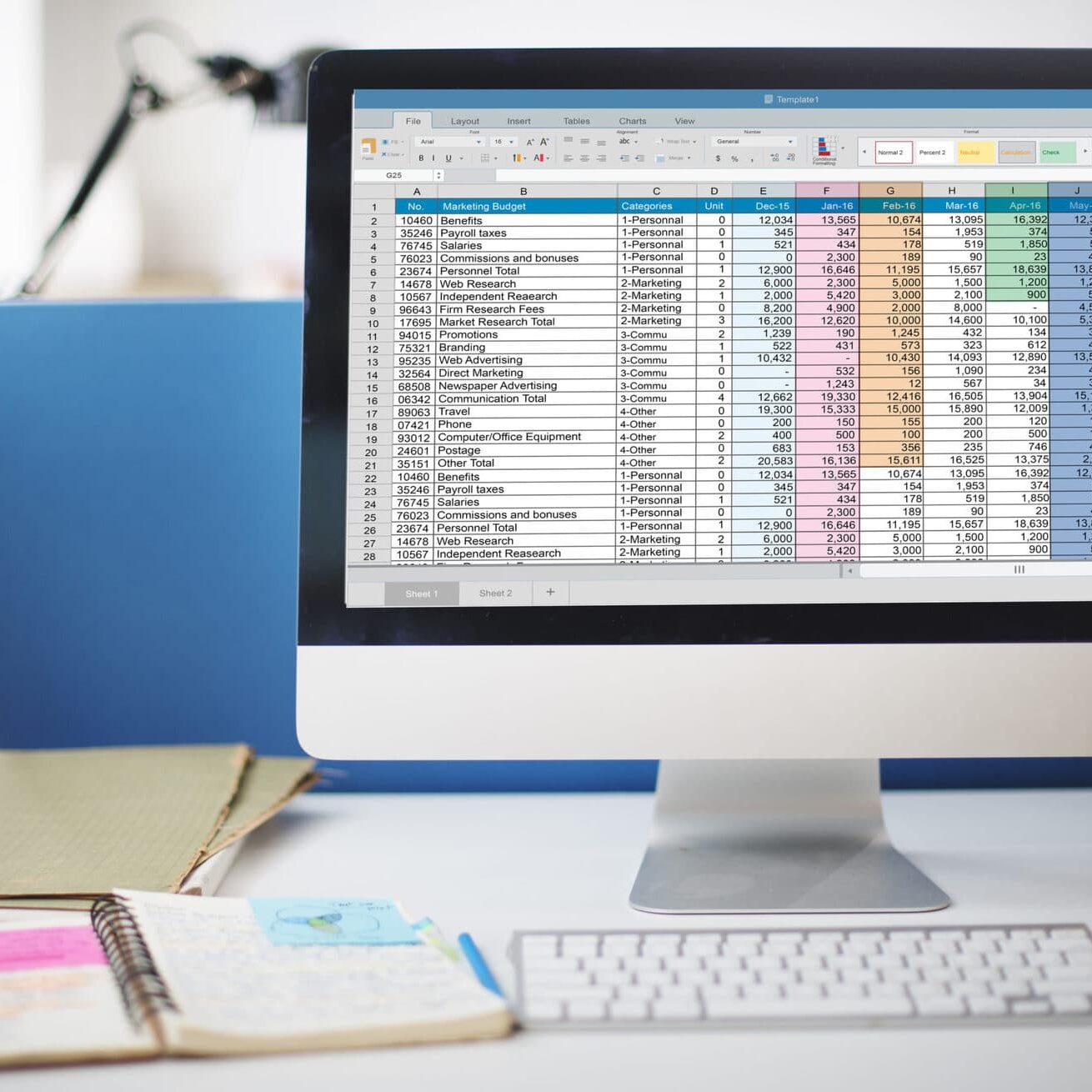

Integration among the systems currently in place will also push you a step further in the journey to becoming paperless. Your organization would greatly benefit from utilizing Receipt Capture. Adding this tool to cards with pre-approved budgets and spending categories gives cardholders the ability to photograph receipts at point-of-sale, automatically feeding all information into QuickBooks. Without having to manually sort through scanned receipts, your process is faster and your reporting more accurate.

Access real-time data

With one form of payment and an online AP system, you’ve got just one place to look for all of your organization’s real-time spending data. That means having greater accuracy and a better handle on expenses. When spending information is in one place and up-to-the-minute, it’s significantly easier for you to manage your general ledger, spot expense issues, and forecast.