Card on file. In so many ways, it makes business operations so simple. No accounts-payable bottlenecks. No interruptions in service. No late-payment penalties.

However, every time you give someone a credit or debit card number, you inadvertently give them control over what they charge and when they charge it. And with every vendor you provide that number to, you raise the odds that your payment information will be compromised.

So it’s no surprise that Virtual Vendor cards are becoming a preferred payment method among business owners.

What Is a Virtual Vendor Card?

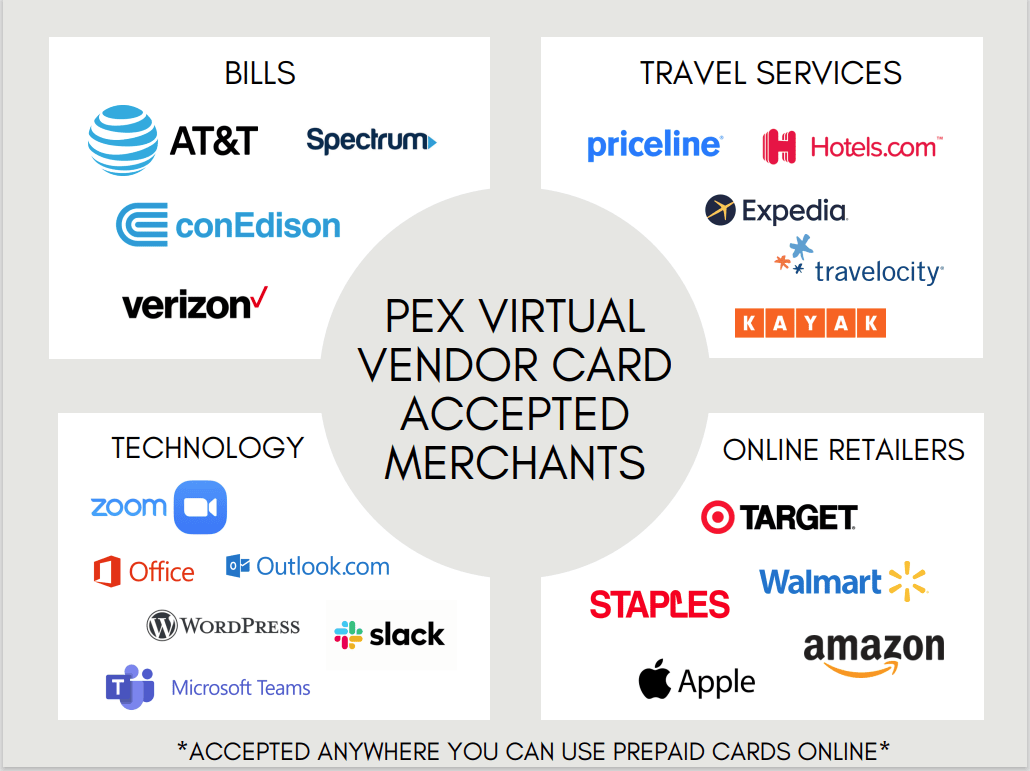

A Virtual Vendor card (or VVC) is an electronic prepaid, debit, or credit card that you can easily create and cancel, as needed, for a specific vendor, transaction, or series of transactions. These cardless “cards” have 16-digit numbers, expiration dates, and CVVs, just like regular, physical cards. You can use them with any vendor that accepts Visa cards*.

Built-in Security

Because you create each VVC for a distinct purpose, you can build highly granular rules into its operation. And you can create different rules for each card you issue. Only transactions that follow each card’s specific rules will clear. Each card will only work when and how you intend it to work.

Negligible Risk of Fraud and Misuse

Virtual Vendor cards come with a broad range of controls. You can restrict purchases to specific times, dates, and vendors. You can limit transaction sizes and total spending on the card. Any attempt to use a card outside those pre-defined parameters will be met with a declined transaction.

Real-Time Alerts to Fight Fraud

No credit card number can be 100% secure. But if a Virtual Vendor card’s number gets compromised, perhaps in a data breach, your preset rules greatly limit its utility. If your vendor is PEX, you receive an alert when a charge is denied. Should the charge prove legitimate, you can approve it. If not, you can cancel the card and issue another. It only takes a few seconds.

No Surprise Charges

It’s easy to cancel or limit transactions with Virtual Vendor cards. If a vendor bills you for a subscription you tried to cancel, the charge will be denied. Or if a vendor tacks numerous discretionary add-ons to a small, approved purchase, that charge, too, will be declined. The same rules that keep bad guys from using Virtual Vendor cards can help keep legitimate vendors from abusing them.

Safer and More Efficient than Checks

A compromised Virtual Vendor card may be harder to use than a stolen check is to cash. The rules you program into the card can make it worthless to anyone but the vendor you intend to pay with it. Virtual Vendor card transactions are secure and instantaneous. And they keep your bank information private.

What’s more, when you pay with a Virtual Vendor card, you save the time and cost to print, sign, and mail a check. And you eliminate the risk of a check getting “lost in the mail.”

No Physical Card to Get Lost or Stolen

Unlike physical credit and debit cards, which are subject to mishandling, a Virtual Vendor card exists only in yours and a vendor’s system. They have no chip, magnetic strip, or printed plastic—no physical data store for thieves to steal.

And even if a number gets compromised, you only have to cancel and replace it for that one use, not your whole business.

Cards Are Easy to Cancel; Easy to Create

PEX lets you issue and cancel Virtual Vendor cards through the interface on the dashboard or mobile app. No applications. No credit checks. No need to directly contact a bank or card company. And you set the rules for their usage right through the same interface. As a result, tracking and managing many cards can be easier than keeping track of one card’s usage.

Streamlined Account Payable Processes

Getting an invoice approved and paid can be expensive and time-consuming in any finance department. Using Virtual Vendor cards lets you pay recurring or pre-approved charges without this process. You can get more done in less time.

Automated Allocations and Reconciliations

When you issue a Virtual Vendor card through PEX, you can assign general ledger codes to each card. When the vendor runs a charge, the software automatically allocates it to the proper account. The tracking software also integrates with QuickBooks and other major accounting software programs. You can reconcile the purchase and enter it in your books with one click. What used to be a chore, you can now complete in seconds.

See How Virtual Vendor Cards Can Work With Your Operations

In short, Virtual Vendor cards give you the convenience of paying invoices with credit and debit cards, but with much less risk. And if you’re using PEX Virtual Vendor cards, they’re easy to administer and can streamline your back office financial operations.

Stay up to date on the latest PEX news!

Thank you, you're now subscribed!

Opinions, advice, services, or other information or content expressed or contributed here by customers, users, or others, are those of the respective author(s) or contributor(s) and do not necessarily state or reflect those of The Bancorp Bank, N.A. (“Bank”). Bank is not responsible for the accuracy of any content provided by author(s) or contributor(s).