PEX Prepaid Expense

Go cashless and stay on budget

Say goodbye to checks and cash, and hello to flexible, reloadable cards with control

Key benefits

Power your business with the control and flexibility you need

Eliminate cash and checks, and control spend before it happens

Instantly fund and issue physical or virtual Visa® cards to the field

Earn 1% back 1 on qualifying vendor spend

Spend Use Cases

A flexible, pre-funded card solution designed with your workforce in mind

Instantly distribute funds to team members and contractors, pay vendors and more

Per diem payments

Allocate funds to team members for meals, travel and other subsidies

Petty cash

Go cashless and pay for small, everyday expenses using PEX

Vendor management

Pay for recurring expenses, like SaaS subscription fees, & earn 1% back1 on qualifying spend

Fuel

Pre-fund cards to pay for fuel

and other vehicle-related field

purchases

Production

Get funding today, and start production tomorrow using PEX’s declining balance cards

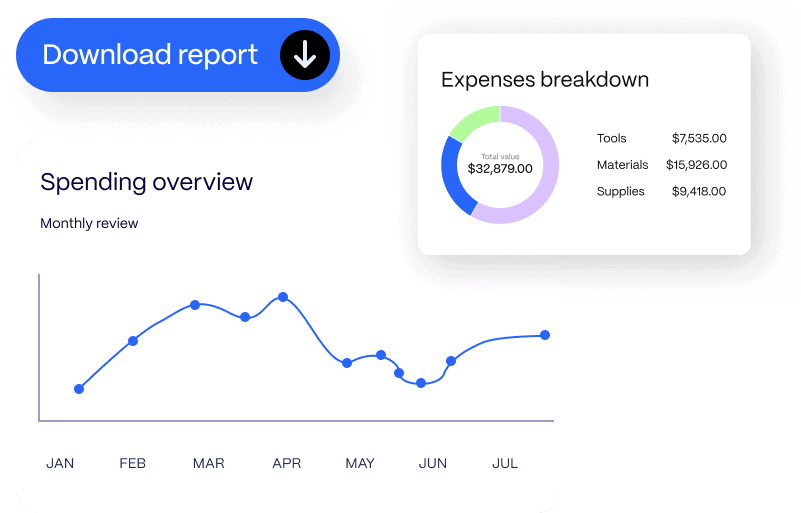

Spend smarter and simplify your expense management process

PEX automates previously manual tasks, improving team productivity by up to 25% 2

Automate finance team tasks

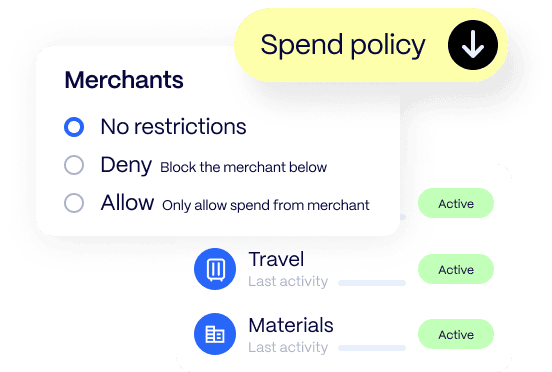

Customize spend limits and controls

Set limits by cardholder, card, MCC or merchant - plus, enforce day of week or state-based spend limits, and more

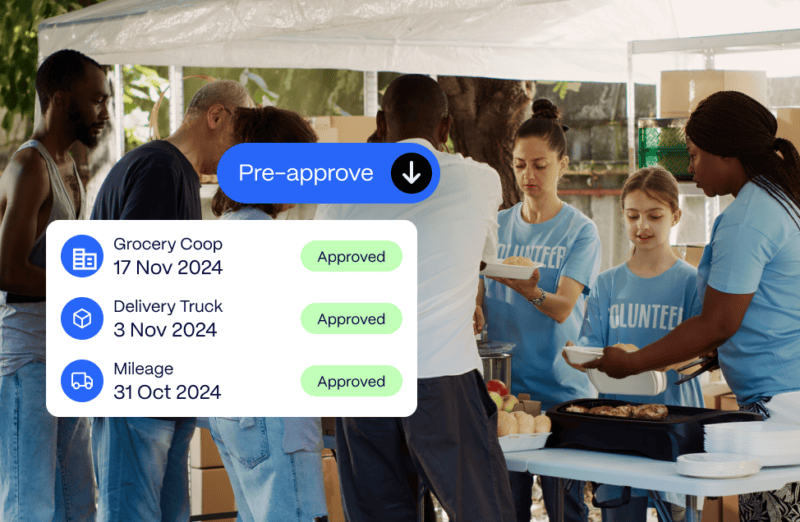

Automate

approval workflows

Pre-approve purchases to prevent overspend, or enforce compliance for purchases that already occurred

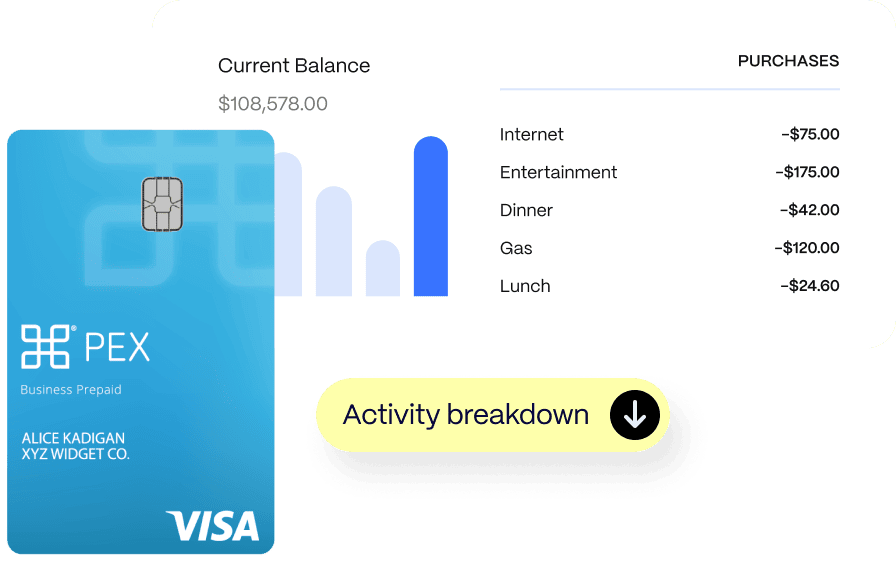

Get real-time

spend visibility

Monitor employee, project or department spend to maintain accurate forecasts and oversight

Empower your employees

Eliminate the receipt chase

Employees can snap, text or email receipts to PEX, ensuring timely and compliant submission

Reimburse out-of-pocket expenses

Pay employees back for mileage and non-card spend, directly through the PEX platform

Integrations

Improve productivity - connect PEX to your accounting software, at no extra cost

No monthly fees for the first 60 days 3

We use the pre-paid debit card feature on the PEX cards, and I really like the flexibility of adding funds to cards as spending comes in cycles. It gives us the flexibility to add and remove funds easily. I also like the built in reviewing and approvals for great internal controls."

David S., Director of Finance

Book a meeting

Talk to an expert

Learn how PEX can help you streamline your expense management process, improve receipt collection and close your books faster. Talk to an expert today.