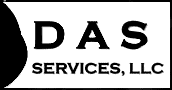

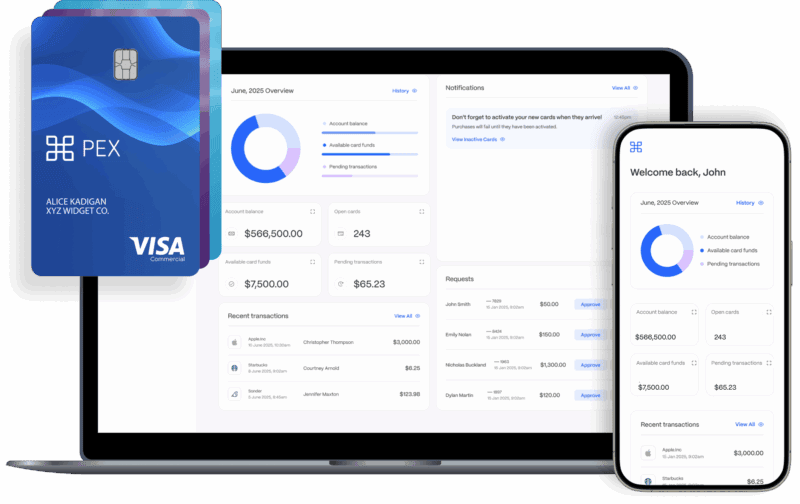

Scale your business and close your books faster

PEX makes it easy with smart corporate cards, AI-powered expense automation and more

Trusted by 10,000+ customers

Why PEX

Simplify your financial operations and supercharge growth

Instantly issue physical and virtual cards, even for clients

Get up to $2M in purchasing power and 1% cash back 1

Automate receipt collection and month end reconciliation

Spend Use Cases

A corporate card for all your spending needs

Pay vendors, power team travel or use business credit as a flexible financing tool

Back office spend

Optimize cash flow and earn rewards on invoices that accept card payments

Vendor payments

Prevent overspend and issue virtual cards to specific merchants, like SaaS and ad vendors

T&E

Enjoy worldwide Visa® acceptance for client entertainment and travel expenses on-the-go

Purchasing

Instantly issue cards tied to custom spend policies and enhanced approval workflows

Fuel

Distribute corporate cards to employees in the field with custom spend and merchant limits

Work smarter, not harder

PEX automates manual tasks, improving team productivity by up to 25% 2

Minimize busywork for busy teams

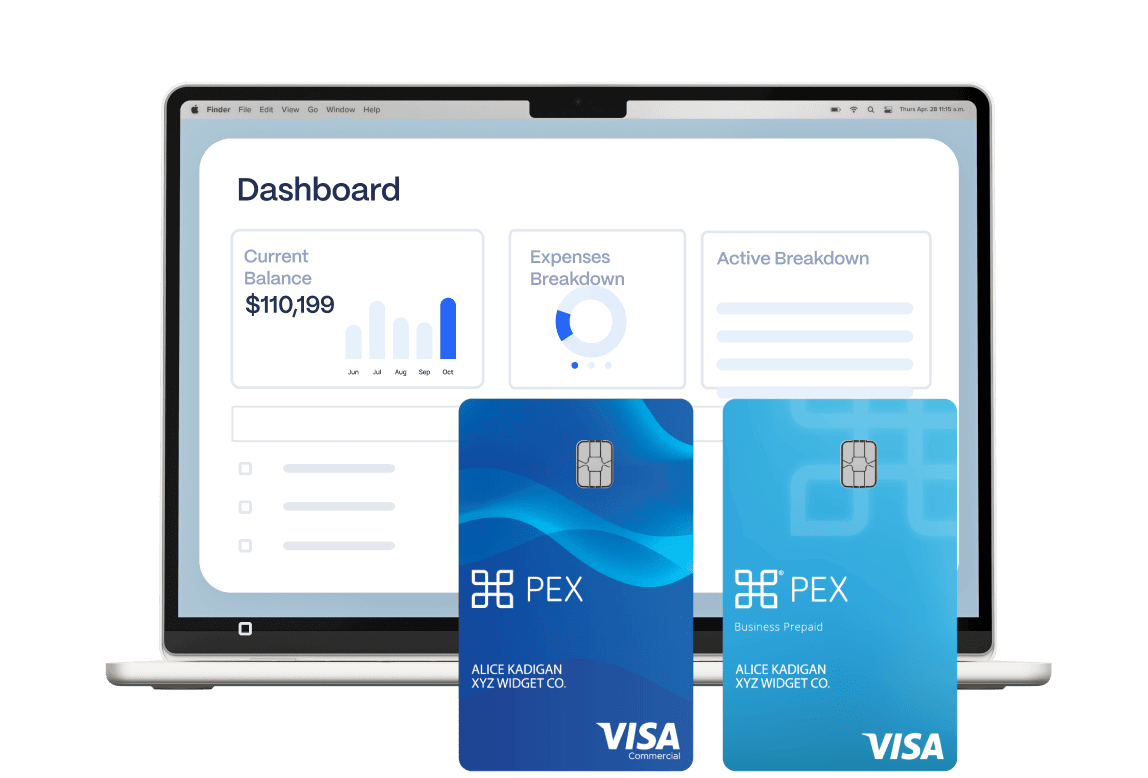

Automate receipt capture and coding

Employees can upload, text or email receipts to PEX, and auto-categorize purchases using AI

Simplify client billing & expense allocation

Automatically allocate expenses to specific clients or projects for seamless, transparent billing

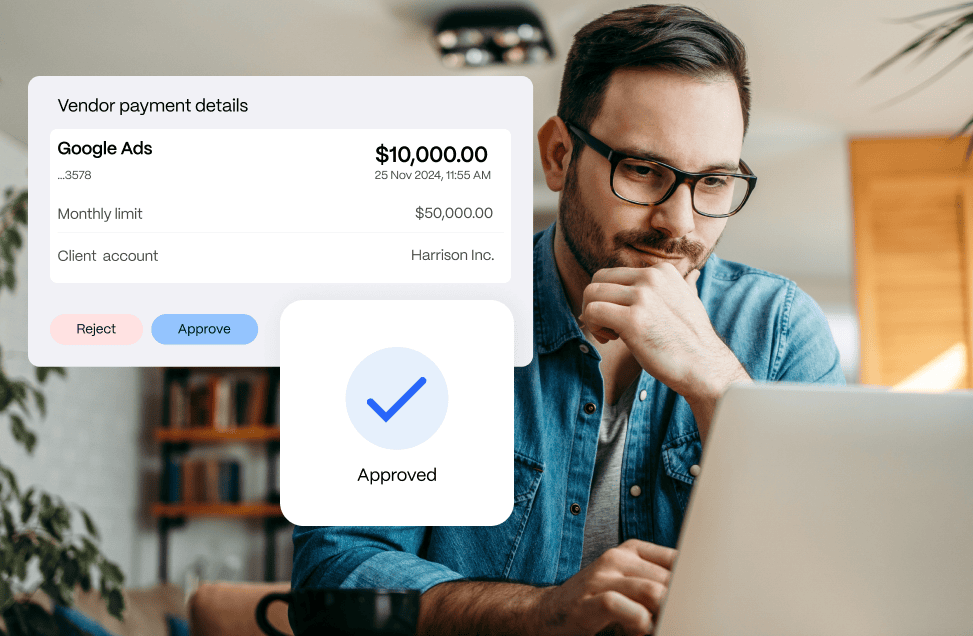

Streamline your process while staying in control

Automate your workflows

as you scale

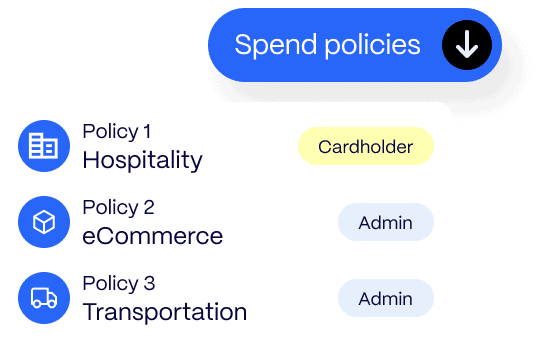

Customize approval hierarchies and spend policies, and adapt them as your organization grows

Simplify client billing & expense allocation

Automatically allocate expenses to specific clients or projects for seamless, transparent billing

Keep an eye on spend as it happens

Monitor real-time employee, project or department spend to maintain accurate forecasts and oversight

Sync your PEX transactions and receipts to your accounting and productivity software

PEX is a reliable platform for managing client expenses, and is fairly easy to navigate... Being able to see transactions and then download them into Excel is great for validating purchase receipts. Implementation was straightforward. Customer support response to our questions is usually quick."

Kevin A., Corporate Controller

Pricing

Get started today for free

Centralize spend, submit receipts, track and reconcile your expenses - in one easy to use platform

Book a meeting

Talk to an expert

Learn how PEX can help you streamline your expense management process, improve receipt collection and close your books faster. Talk to an expert today.