PEX for Gig Economy

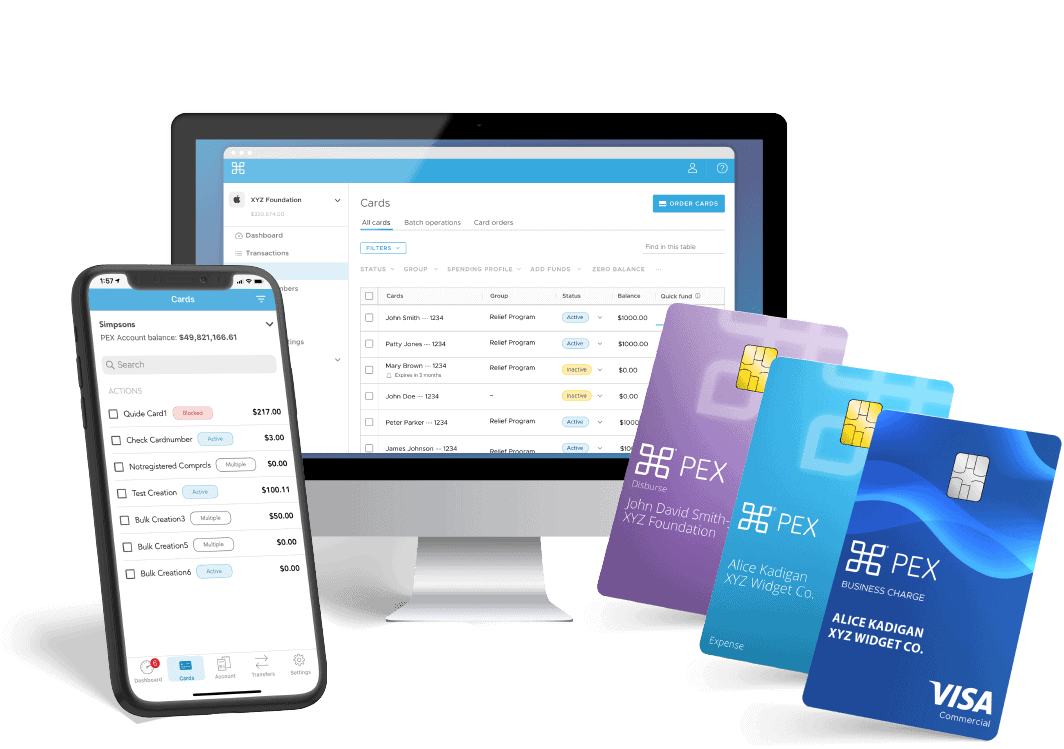

How do organizations distribute spending power to dozens, hundreds, or even tens of thousands of remote workers, without creating thousands of hours of headaches? Without opening their business to fraud and misuse? They use PEX.

More than 10,000,000 Cards Issued

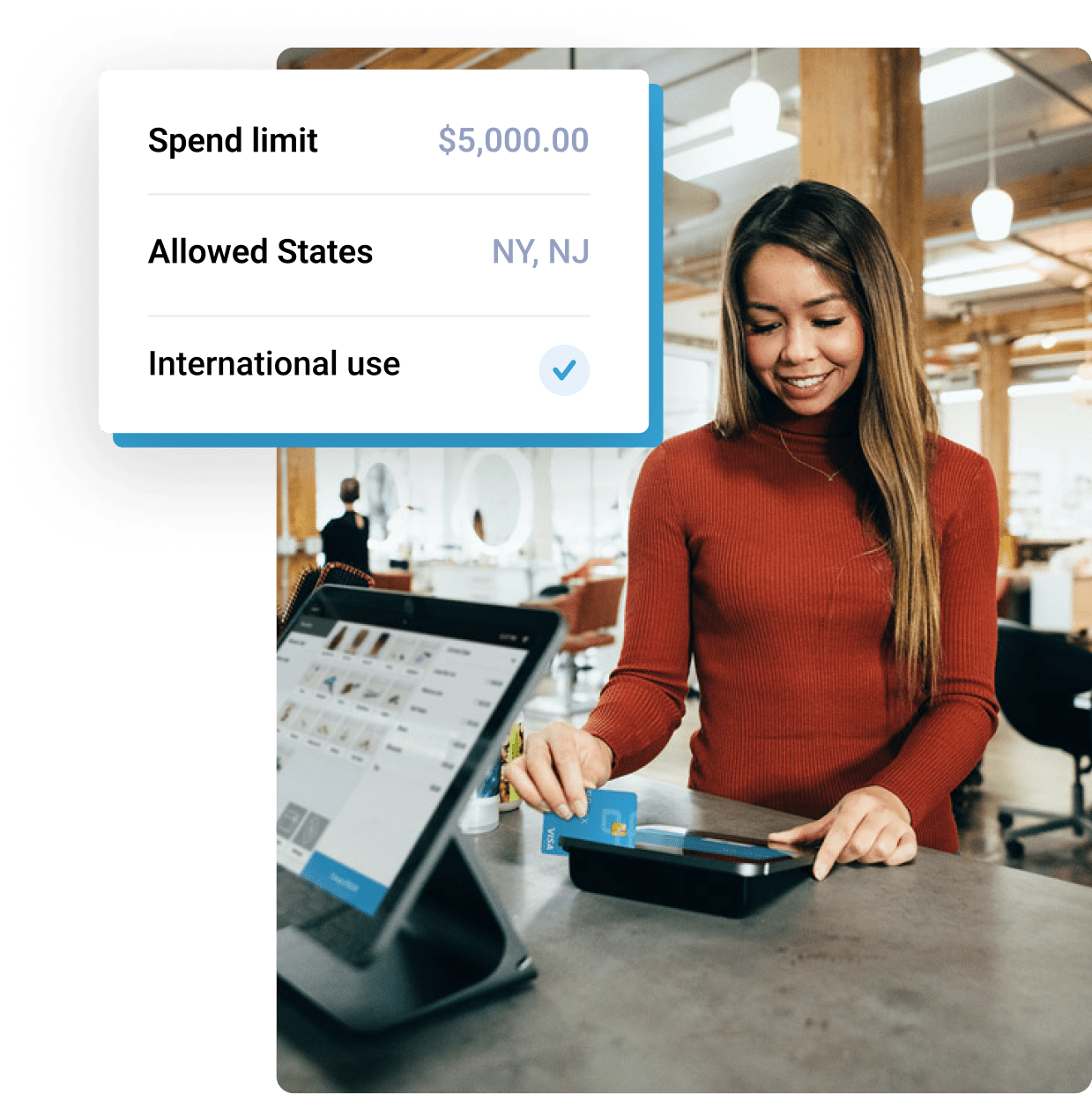

Tailor PEX to your business model

With PEX, you can shape all the rules that govern card distribution and usage to fit your business. From who gets a prepaid card to when, where and how much they can spend.

-

Issue a corporate card alternative without applications or credit checks

-

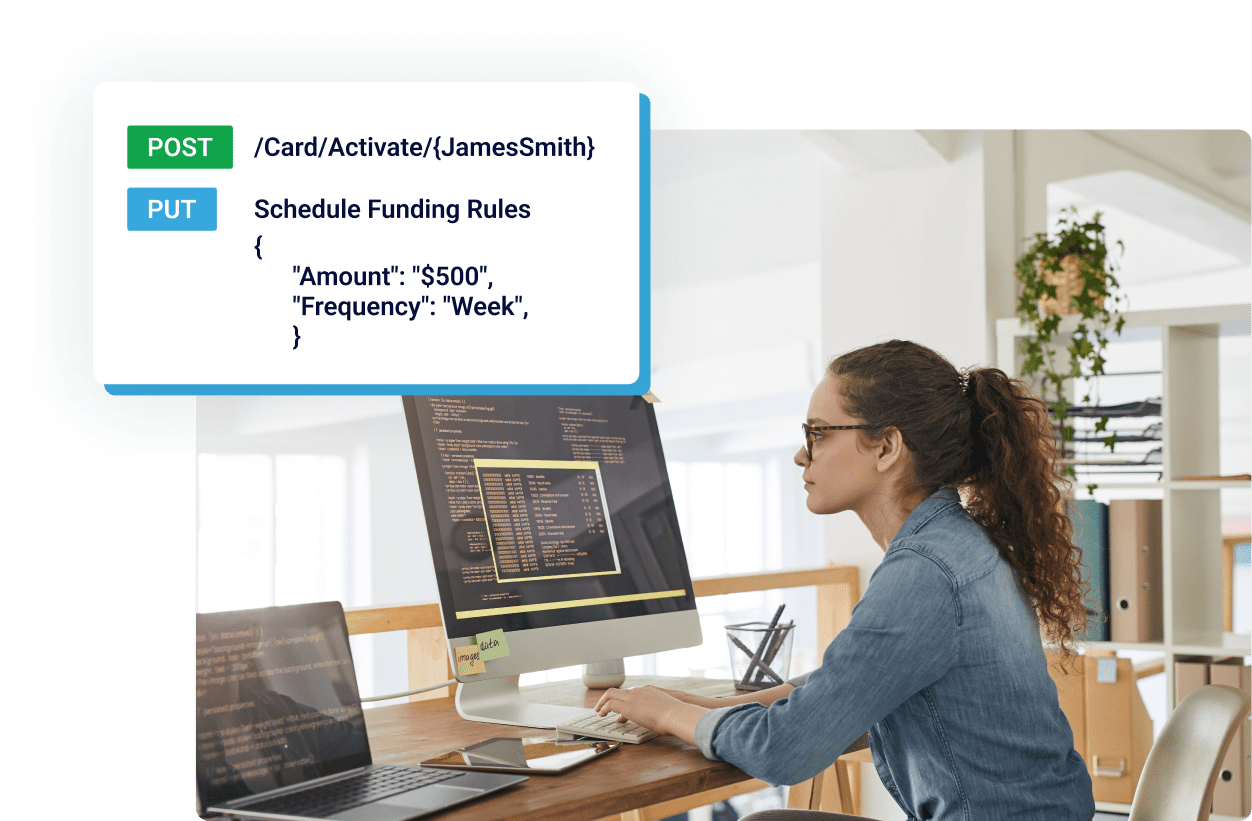

Set rules and administer program through web app, mobile app or API

-

Available white-label program puts your logo on card

Ability to fully automate admin with PEX API

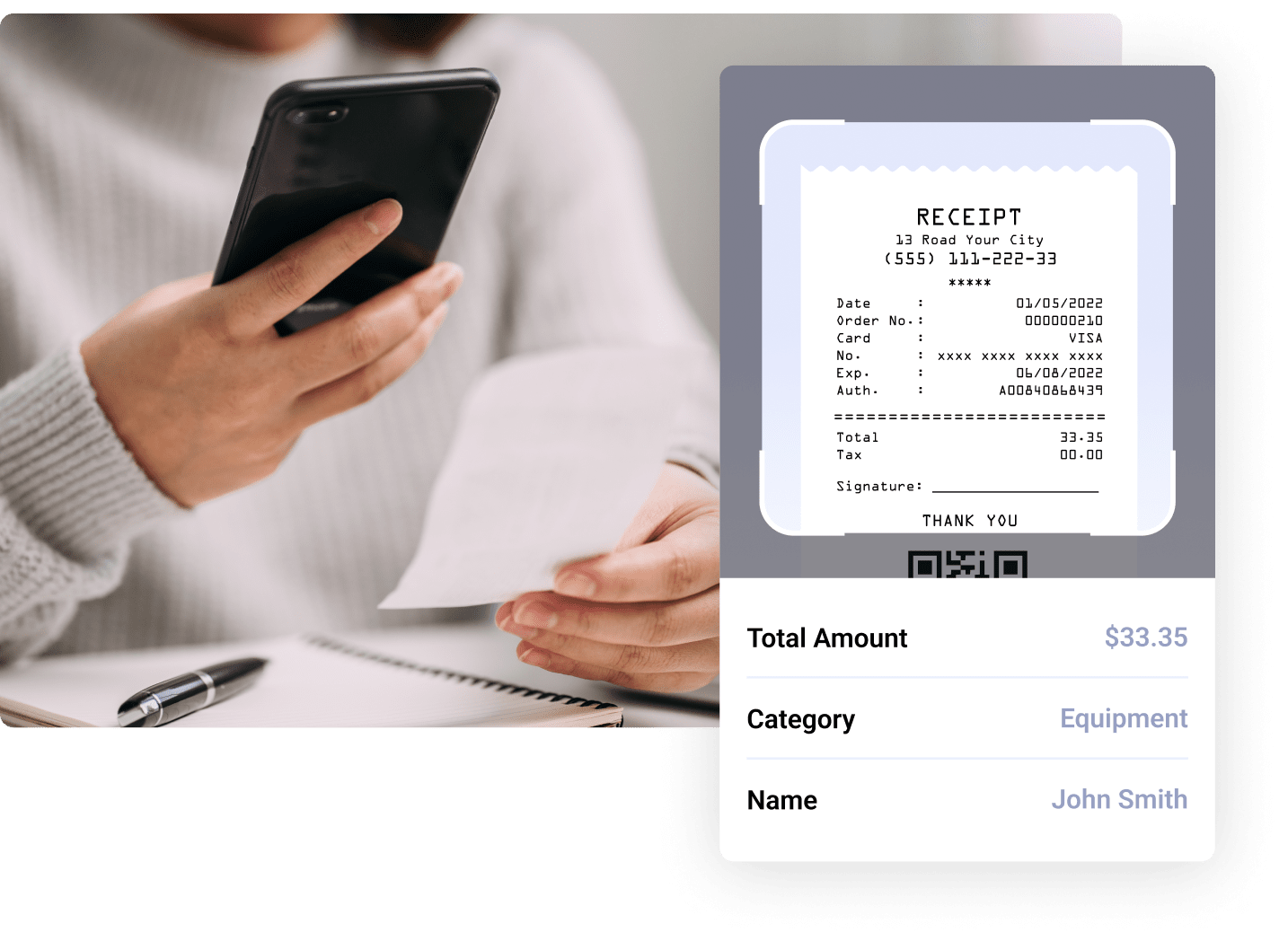

PEX captures transaction details as soon as the purchase is made, and reports them with your accounting codes. This saves hours in bookkeeping time by:

-

Instantly allocating spending to specific cost centers or accounts

-

Capturing receipts through a camera on cardholder’s smartphone

-

Producing reports for managers and auditor

Automate bookkeeping and reconciliations

The PEX Platform can allocate purchases to departments, accounts or other cost centers—the instant the purchase is made. PEX also integrates with your accounting software, so reconciliation is a breeze.

-

Capture receipts through the PEX Mobile App

-

Eliminate need for expense reports or reimbursements

-

Generate reports for managers or clients

PEX pricing is so affordable and the platform allows us to easily. Our employees spend way less time writing their receipt reports.”

Kevin Kepes

Corporate Controler

Related Resources

Get Your Free Demo

PEX offers tools and support to help you to turn workforce spending into a competitive advantage. What can we do for you?