Work smarter with mobile-friendly features, AI enhancements and increased flexibility

Managing business expenses should be simple and seamless, whether you’re working on the go or as a part of your 9-5. That’s why we’re excited to share our latest updates designed to streamline approval policies, improve flexibility and enhance integrations. Whether you’re customizing expense policies, managing reimbursements on the go, streamlining operations or syncing with your accounting platform. Here’s a closer look at the changes we’ve made to help you work smarter and more efficiently.

Let’s dive into the new features and updates below.

The big one: Credit expense now available in North Dakota and California

Exciting news for residents of North Dakota and California, you can now access PEX’s Credit Expense product. Learn more and get started here.

Tools for easier administrative and approval processes

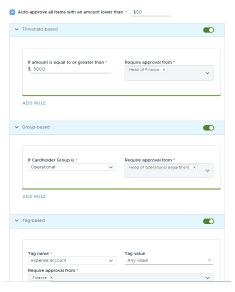

Streamline your approval process with advanced approval policies

Thanks to great feedback from you, PEX continues to enhance our approval policy capabilities. Now PEX admins can combine threshold, group and/or tag-based rules into a single policy―. tailoring approvals to meet the unique needs of your organization. The advanced approval policy feature puts you in complete control, ensuring compliance and efficiency at every step.

Learn more here.

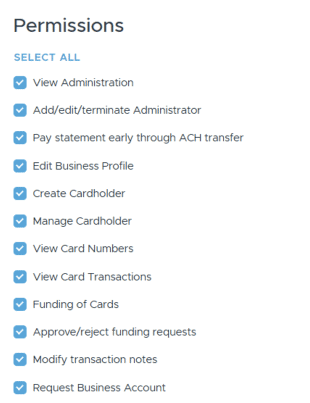

Invite new admins with ease

Inviting new admins with full permissions is faster and simpler with the ability to select all permissions. Instead of manually checking each permission, you can now grant full access to a new admin in just one click. Learn how to add administrator permissions here.

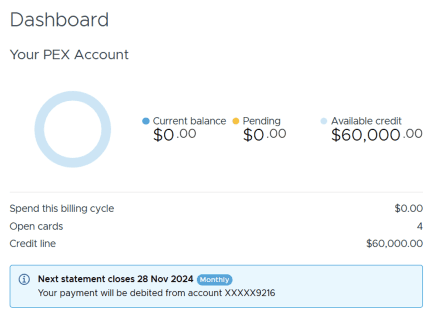

Credit limit and cycle term transparency

Get real-time insights into your credit limits and repayment cycles,to plan for upcoming expenses and stay on top of due dates to avoid unexpected limits. Credit expense customers can now view credit line assignments and repayment cycles directly on your dashboard.

Streamline operations with automation and policy management

Set advanced receipt reminders

Simplify your transaction review process with custom settings to flag which transactions need review. Admins can now set a dollar threshold for receipts to require a manual review for transactions based on the amount. Check out the ‘review requirements’ feature under business settings on the dashboard.

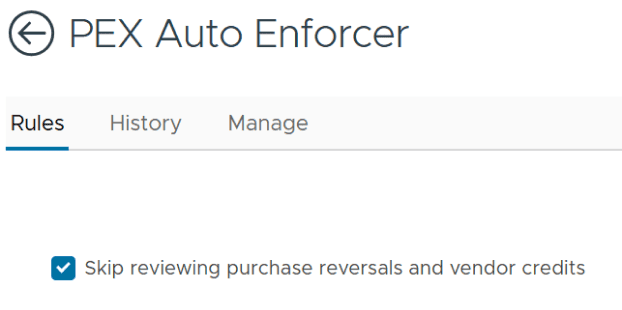

Auto enforcer enhancements

Our popular Auto Enforcer app just got even better. Designed to ensure compliance while removing the need for manual follow-ups, auto enforcer warns cardholders of missing items such as receipts and tags. Here are the latest updates:

- Daily warning emails: Cardholders now receive daily reminders before their cards are blocked

- Enhanced flexibility: Admins can include or exclude reversals and credits when creating or editing rules

- Optimized rule processing: Updates to rule processing creates a more seamless experience for both admins and cardholders

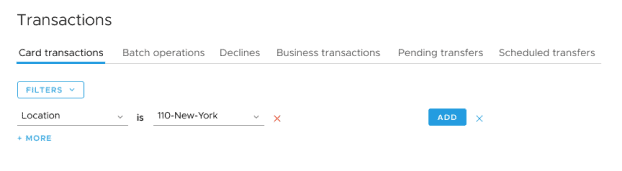

Filter purchases by budget and account

By popular demand, PEX added new filtering capabilities to the transaction page. Now admins can sort by account, budget or any tag value. This is especially helpful if you are managing multiple projects or budgets.

Greater flexibility while working at the office or on-the-go

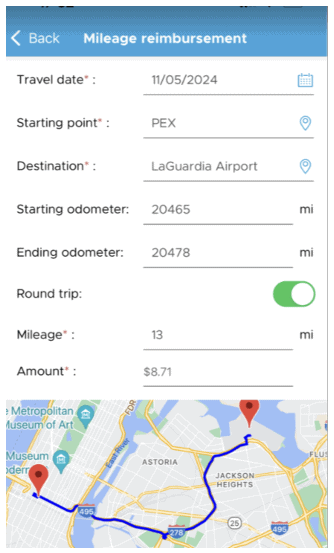

Mileage reimbursements now available in our mobile application

Last year we rolled out mileage reimbursement feature that allows cardholders to request reimbursements for business travel. By popular demand, this feature is now available within the PEX mobile app. Share with your team and find more information here.

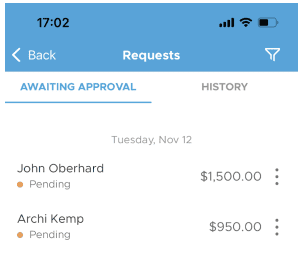

Improved cardholder funding on-the-go

Did you know that as an admin you can approve funding requests on-the-go? This new and improved experience allows you to filter requests by those that await your approval vs. past approvals in your queue.

Manage receipt reminders within the PEX mobile app

Receipt submission while on the go has never been easier. Cardholders can now turn on SMS receipt reminders directly from the mobile app. From there, all you need to do is reply back with a copy of your receipt and PEX will match to a purchase with our text to PEX feature.

Hotel and travel receipts

Planning for work travel in 2025? We have got you covered. PEX continues to invest in AI receipt matching capabilities, with our latest focus on improving the match rate for travel-related receipts. The team added advanced logic to better account for nuances with airline receipts including checked baggage and upgraded seats as well as hotel receipts which can sometimes have multiple associated line items.

Expanded integration support with Sage Intacct, Xero and NetSuite

Upgrades to the Sage Intacct connector

We constantly make improvements to our integrations based on your feedback. This time we made two enhancements for our Sage Intacct connector.

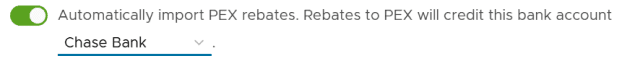

Sage Intacct customers can now sync rebates earned on PEX prepaid and credit expense cards directly into your accounting platform. To activate this, simply navigate to the apps tab and launch Sage Intacct. Edit the connector and toggle on rebates.

We also enhanced support for ISA fees to better account for international transactions. Now the Sage Intacct connector allows you to sync ISA fees as purchases. To activate, simply toggle ISA fees as business fees off on your connector set up.

![]()

Learn more for Prepaid Expense customers here and Credit Expense customers here.

Expanded support for NetSuite custom fields

Based on feedback from NetSuite customers, PEX enhanced support to sync all types of custom fields including dropdown, text, numeric, and boolean.

PEX’s NetSuite integration is now available for early access testing. To learn more, sign up here.

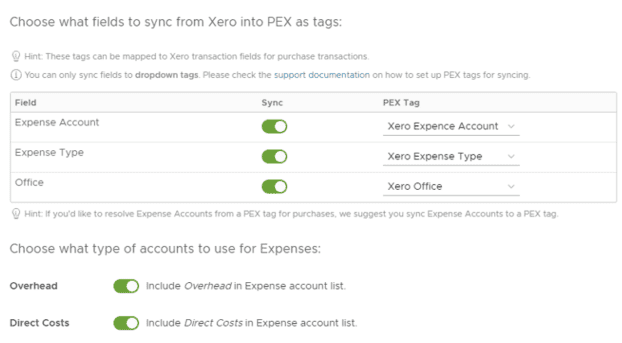

Added flexibility to sync overhead expense accounts into Xero

Xero customers now have the choice to include both overhead and/or direct costs when syncing PEX purchases into your Xero. Learn more here.

Already a PEX customer? Reach out to your customer success manager to explore how these new features can streamline your workflows and improve efficiency.

Not yet a PEX customer? Get a demo today.

Similar resources

Opinions, advice, services, or other information or content expressed or contributed here by customers, users, or others, are those of the respective author(s) or contributor(s) and do not necessarily state or reflect those of The Bancorp Bank, N.A. (“Bank”). Bank is not responsible for the accuracy of any content provided by author(s) or contributor(s).