How PEX simplified expense management in 2024 and what’s next

2024 was a remarkable year for PEX as we focused on empowering finance teams with tools to simplify and optimize their operations. From AI-driven innovations to expanded credit offerings, we delivered solutions designed to address the most pressing challenges in expense management. We’re excited to highlight the key milestones and product advancements that defined our year and set the stage for continued growth in 2025.

In addition to putting out some amazing features, here were some of our highlights of the year:

- Achieved 500% growth in our credit product

- Launched reimbursements mid-year, including mileage reimbursements. From zero to thousands of reimbursement requests for over $10M. (Hundreds of thousands in reimbursements have been paid out). More than 20K miles reimbursed.

- Released 6 new marketplace apps including integrations for Concur and Netsuite.

- Processed and matched over 100K receipts with new options including SMS and emailed receipts.

- Earned 32 badges from review sites like G2, Capterra and Software Advice. These badges include best customer support, best admin, and easiest to use for both SMB and midmarket companies

New product feature: employee reimbursements

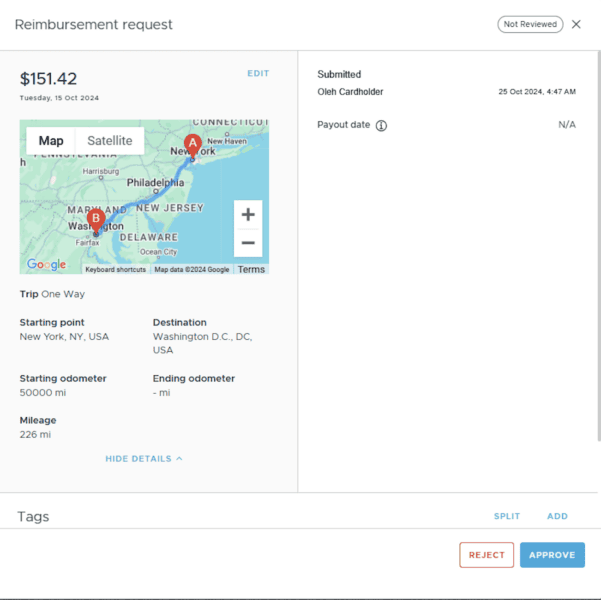

To complement PEX Prepaid Expense and Credit Expense, PEX launched employee reimbursements to manage out-of-pocket employee expenses. Cardholders can submit receipts made on a personal card through PEX. Once approved, the payment will be sent directly to the cardholder’s bank account.

In addition to card expenses, PEX enhanced this functionality to support mileage reimbursements. This functionality enables cardholders to request reimbursements for business travel by entering the starting and ending address or odometer apps. Reimbursement capabilities are available on all Expense accounts and available on dashboard and within the PEX mobile app. A walk through of this feature is available here.

Expanded Credit Expense offering

PEX’s Credit Expense offering is better than ever. This product is now available in 49 states, with recent expansion to California, New Mexico, North Dakota, and South Dakota. In addition to expanded availability, companies can now spend up to $2 million monthly through PEX Credit Expense.

Other exciting functionality upgrades include:

- Option to pre-pay off part or all of a user’s spending between weekly or monthly cycles, and reset the spending limit mid-cycle

- View line assignment and repayment terms directly on the PEX dashboard for real-time visibility

- Increased reconciliation support for users of Blackbaud, Xero and Oracle NetSuite accounting systems

AI-enabled receipt management

PEX constantly evaluates new technologies to automate expense management with accuracy while reducing work for PEX users. Throughout 2024, PEX made incremental improvements to ease the receipt submission process, with the help of AI. Each time a receipt is submitted, AI is used to match the receipt image to the proper transaction by looking at attributes like the merchant name, amount, and the date of transaction.

As AI enthusiasts know, AI requires human coaching along the way. To increase match rates, the team focused on specific improvements to target fuel receipts, travel-related receipts including Airline and Hotel (hotel/airline) as well as international purchases.

In addition to the matching, PEX expanded the channels that receipts can be submitted beyond the mobile app and dashboard. Cardholders and admins alike can now email or text receipts directly to PEX and AI will take care of matching the receipt to its transaction.

Enhanced approvals and automated workflows

In 2024, PEX launched several new workflow capabilities to streamline the spend management experience.

- Approval policies are a new capability that allows admins to set conditions for items that require approval including transactions, funding requests, and reimbursement requests. Each policy can be configured based on a $ threshold, group/department, tag/account-based or a combination of all options depending on your organization’s requirements.

- To ensure purchases have all required items before they are sent for review, PEX introduced review requirements. This is a new setting that allows admins to set specific criteria including tags and/or receipts.

- To ease the cardholder experience, PEX added a new card unblocking workflow that allows cardholders to send an unblock request to their admin. From there, admins can unblock the card right from their inbox.

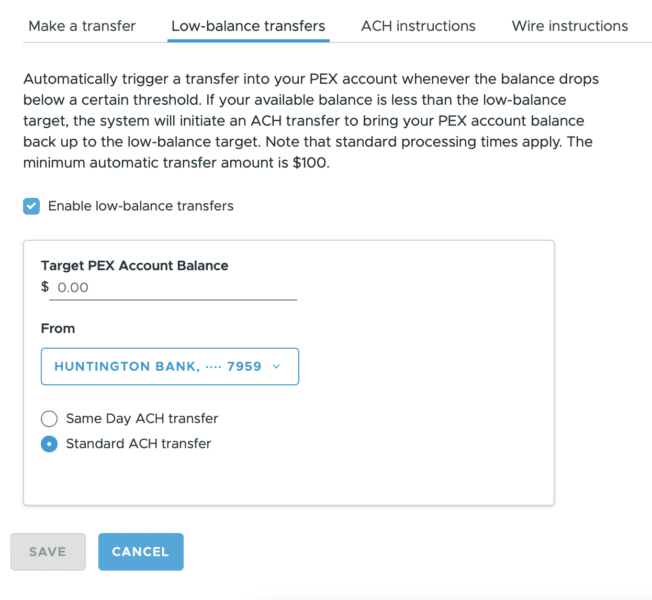

- Low balance transfers ensure admins never run out of funds within their PEX Prepaid Account. Admins can set rules that can automatically replenish a PEX account balance via ACH if the balance drops below a certain level.

- Vendor card delivery makes it easier than ever to send PEX transaction information to suppliers with enhanced Virtual Vendor Card delivery features. Suppliers receive a secure email to capture the payment details. Card limits are set to the exact invoice amount to avoid overpayment.

New integrations and productivity tools

Based on feedback from our Customers, PEX added new apps to the ever-growing integrations marketplace to drive productivity and ease reconciliation with other software used by your organization. In addition to expanding the marketplace to cardholders, the following new apps are now available for use:

- Auto enforcer is a PEX productivity app that enables admins to create rules that require purchase items including receipts, tags and notes. If cardholders do not submit these items in the timeframe set by an admin, their card will be temporarily blocked.

- The SAP Concur connector auto-syncs cardholder purchases and fees directly into Concur Expense, making it easier and more secure for customers to manage and reconcile expenses.

- The Oracle NetSuite connector auto-syncs purchases, transfers, fees, rebates and receipt images from PEX into NetSuite. admins can map NetSuite fields including accounts, vendors, classes, departments and locations to PEX tags. Custom fields are also supported. Receipt images are stored directly in the NetSuite journal entry to serve as your system of record.

Support for larger organizations

For customers juggling multiple accounts with hundreds of users, we’ve introduced several features to make it easier to manage your organization’s accounts at scale.

- Set default account: PEX customers love the ability to administer and link multiple PEX accounts. This year, we introduced a new feature that allows both cardholder and admin users to set their default account upon logging in

- Tag restrictions: specify available account codes for each group or department

- Filter by tag/account code: By popular demand, PEX added new filtering capabilities to the transaction page. Now admins can sort by account, budget or any tag value. This is especially helpful if you are managing multiple projects or budgets

What’s next in 2025?

The PEX team continues to cook up new features. A few teasers include more workflows to simplify the cardholder and admin experience, added payment rails to provide increased flexibility for paying suppliers and business expenses and a continued focus on improving the experience/feedback from customers.

Stay tuned to upcoming webinars and product blogs to learn more. Thank you all for a great 2024 and we look forward to hearing and implementing more feedback in 2025!

If you’re already a customer, reach out to your Customer Success Manager to explore how you can implement these features into your workflows.

If you’re new to PEX, schedule a demo to see how our solutions can simplify expense management for your team.

Similar resources

Opinions, advice, services, or other information or content expressed or contributed here by customers, users, or others, are those of the respective author(s) or contributor(s) and do not necessarily state or reflect those of The Bancorp Bank, N.A. (“Bank”). Bank is not responsible for the accuracy of any content provided by author(s) or contributor(s).