Simplify your spend,

amplify your impact

Streamline spend and grant distribution, automate manual tasks with AI, get real-time visibility and more

Trusted by 10,000+ organizations

Why PEX

PEX makes it possible to spend efficiently and responsibly

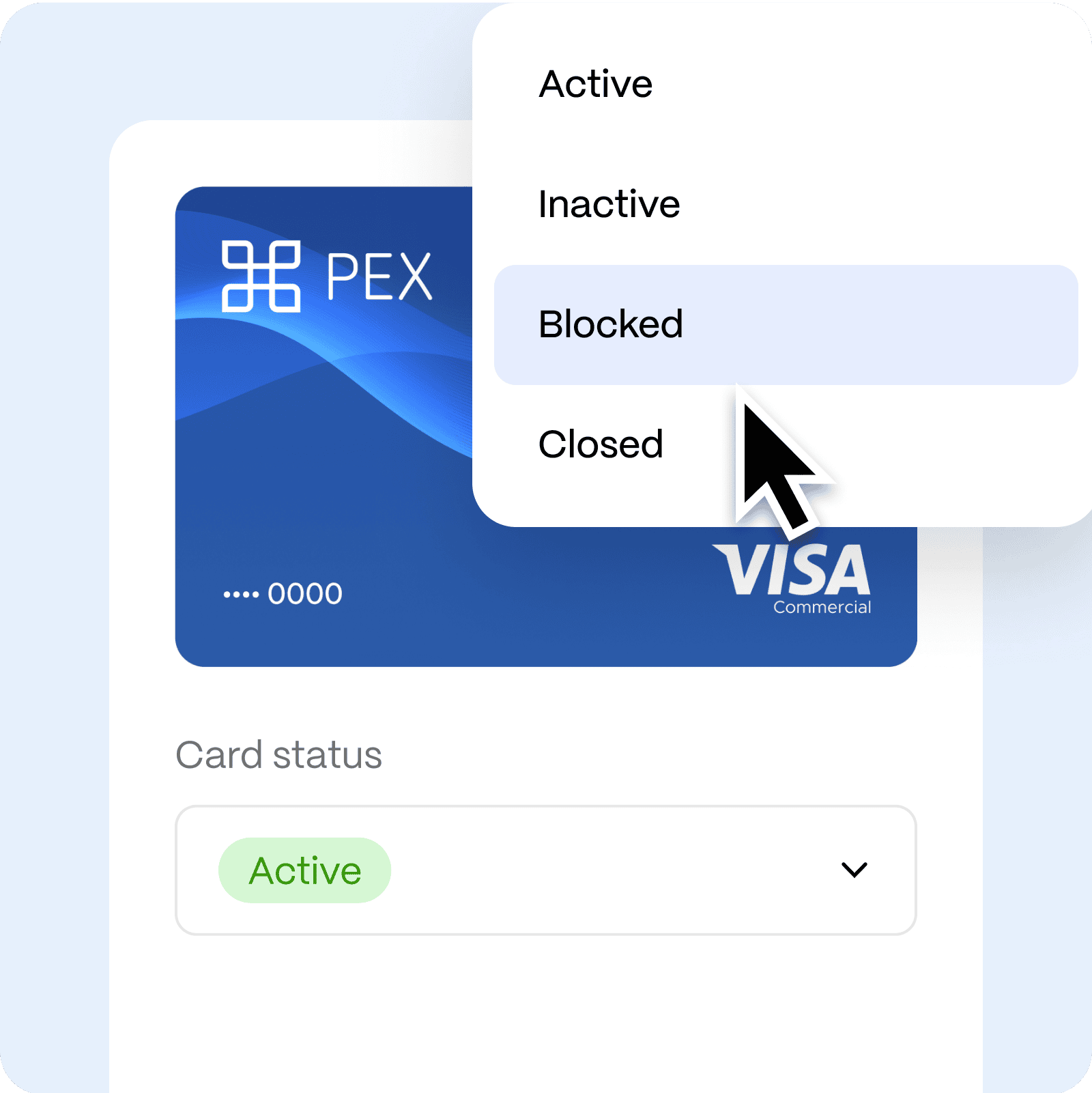

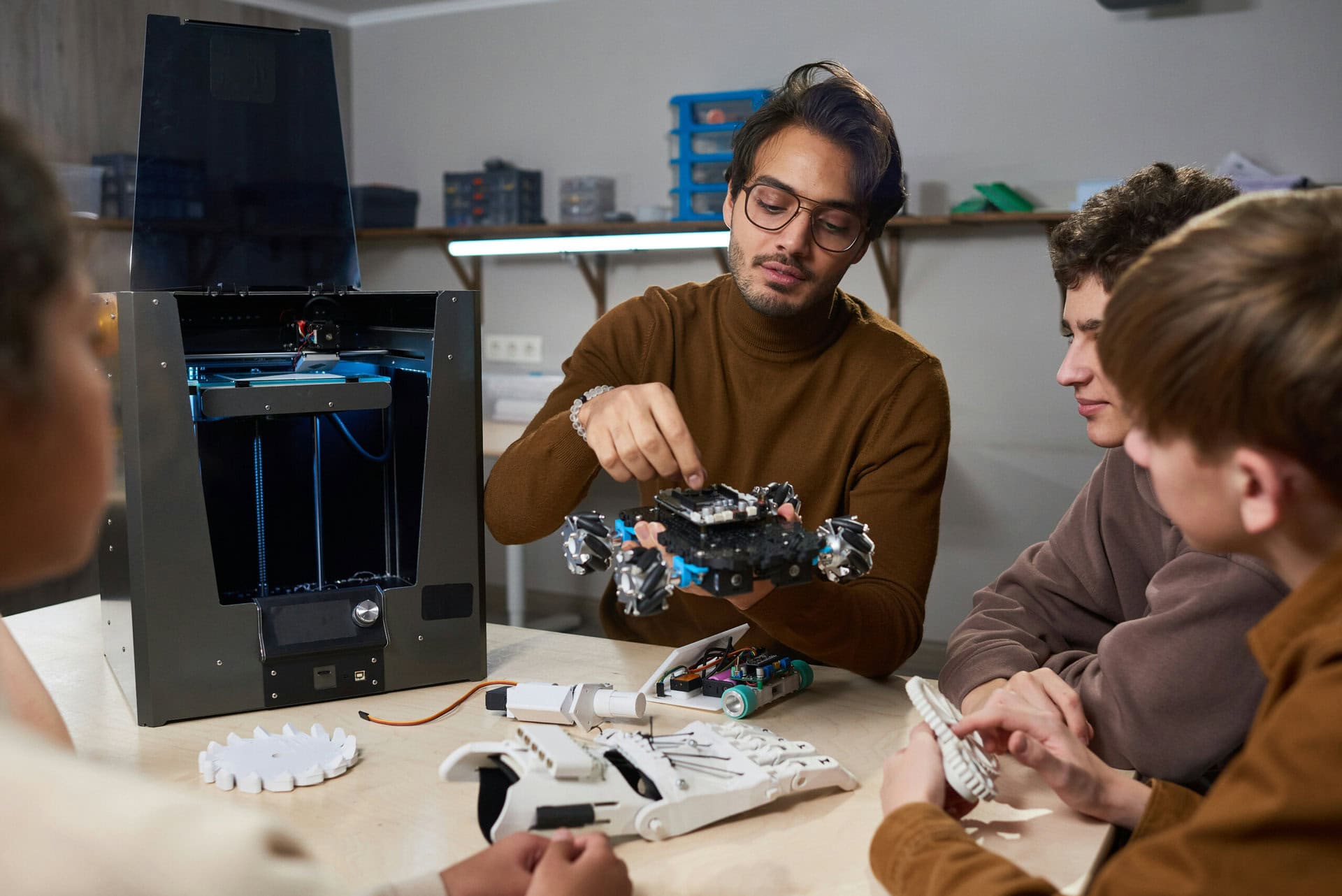

Issue physical and virtual cards to staff and beneficiaries

Control spend and earn up to 1% back 1 for your organization

Automate receipt collection, approvals and reconciliation

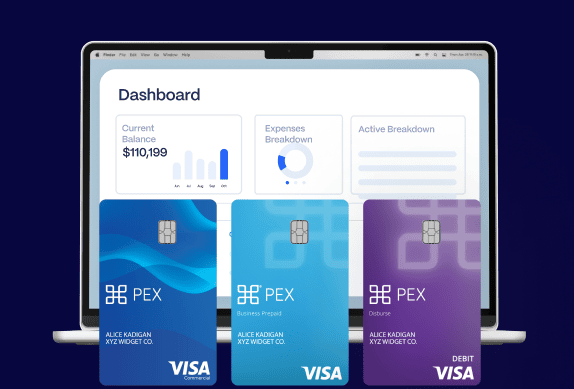

Your all-in-one expense management platform

Say goodbye to spreadsheets, and hello to improved productivity

Spend Use Cases

Manage your organization’s spend in one place

Pay vendors, power team travel and deploy funds to field volunteers or beneficiaries - all from the PEX platform

Program expenses

Pay for program expenses, from supplies to vendor invoices, professional development and tech

Travel and lodging

Enjoy worldwide acceptance to power field work, field trips, missions, conferences and more

Events

Pay for supplies and marketing expenses for fundraisers and donor engagements

Community outreach

Provide funding for outreach programs like food drives, shelter support and other initiatives

Grant disbursement

Issue ready-to-use purchase cards, and track funds to ensure they’re used as intended

How PEX helps you do more with less

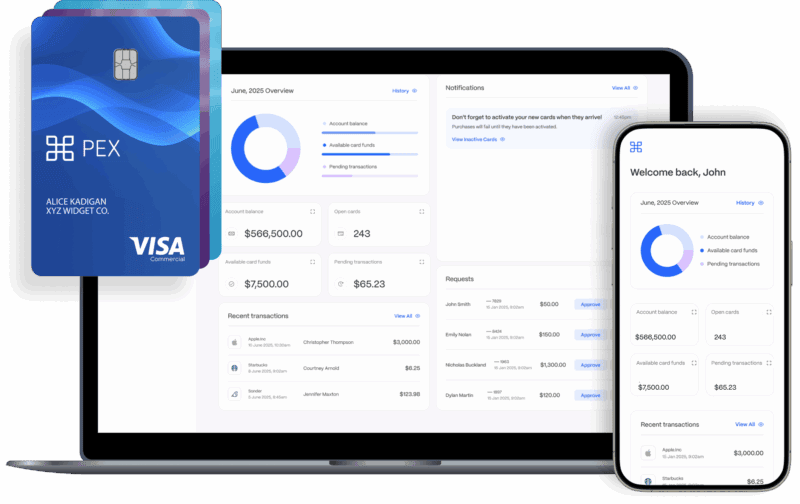

Stay on budget and ensure compliance with the leading corporate card and spend management platform

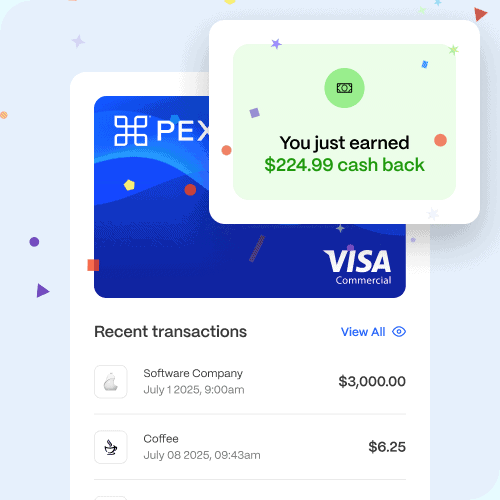

Spend smarter, and earn up to 1% back1

Issue PEX corporate cards with customizable spend controls and real-time tracking - no spreadsheet needed. Plus, earn cash back to invest back into your mission.

Snap, text and email receipts - matched by AI

Submit receipts faster with AI-powered receipt

capture. PEX automatically matches each receipt

to the right transaction.

Auto-categorize expenses with AI-powered coding

PEX learns your organization's unique coding patterns and applies them instantly, automatically matching each transaction to the correct GL code and cost center.

Sync your PEX transactions and receipts to your accounting and productivity software

PEX has provided a great option for our organization to implement spend cards that sync automatically into our accounting software with associated tagging. They continue to innovate with the use of AI for process efficiency… our staff transitioned really well to the new card system.”

Alicia A.

Nonprofit administrator

Pricing

Get started today for free

Centralize spend, submit receipts, track and reconcile your expenses - in one easy to use platform

Book a meeting

Talk to an expert

** 2023 PEX customer survey