Why bank cards cost you more than you think

More than a corporate card: Unlock over 10% back with PEX

Finance leaders face mounting inefficiencies in expense management—from delayed month-end closes to audit risks caused by uncontrolled spending and manual processes. Traditional bank cards may offer headline rebates up to 2%, but they fail to address these deeper frustrations that significantly impact a company’s bottom line.

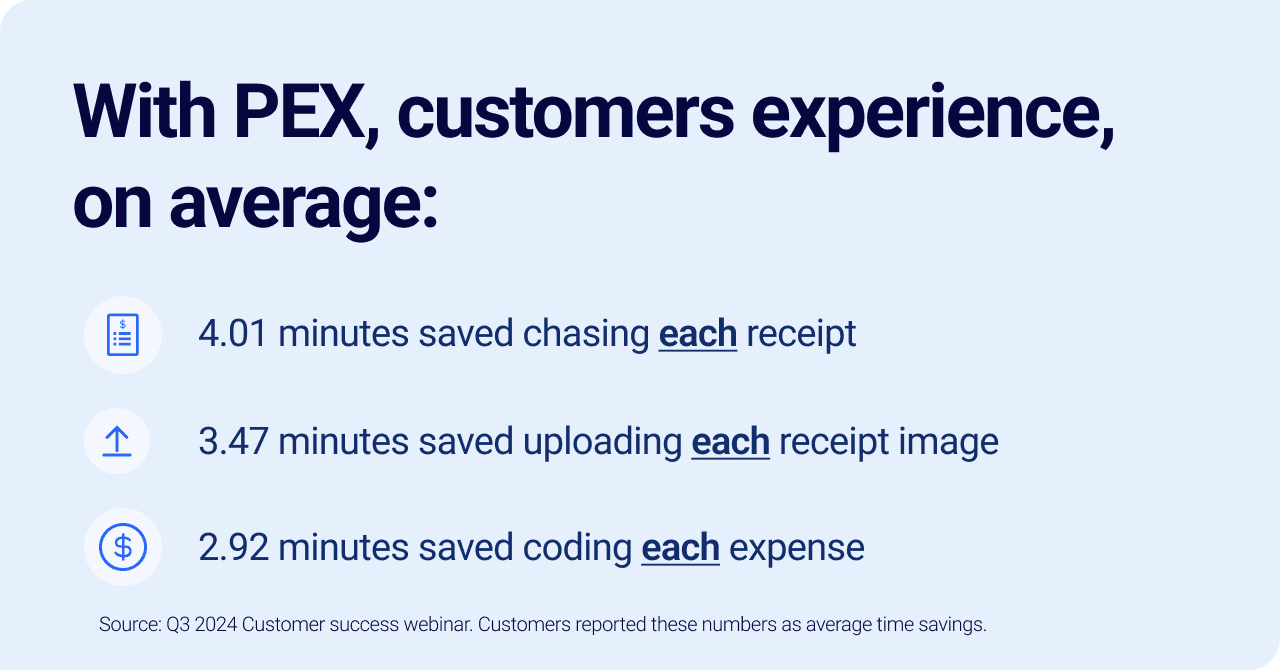

To determine exactly how much inefficient expense management processes cost an organization, and how much they can gain from PEX, we surveyed and analyzed savings from over 10,000 customers.

The results show that PEX delivers a staggering 10.85% effective ROI via meaningful savings and productivity gains. In addition to earning up to 1% cash back on eligible purchases (terms apply), PEX customers can gain an additional 9.85% in value through increased productivity savings – equal to $35,476 in annual labor costs.

PEX customers realized productivity gains through:

- Time savings: Customers eliminate over 657 hours of manual tasks per year by using PEX, enabling finance teams to focus on closing their books faster and make more informed decisions

- Simplified expense management: Finance teams improve efficiency, reduced audit risks, and gain visibility with PEX’s real-time spend controls, easy integrations, and automated tracking

While banks stop at rebates, PEX delivers more than 5X the value by pairing financial savings with operational efficiency. It’s not just a rebate—it’s a tool to solve the frustrations holding your finance team back.

The hidden costs of traditional bank cards

Managing business expenses is complex. For finance teams, inefficiencies mean wasted resources, missed opportunities and unnecessary frustration.

Uncontrolled spending, outdated processes and fragmented tools make managing expenses harder than it needs to be. Traditional bank cards might offer rebates, but the rebates are often confusing and cause persistent challenges caused by their lack of platform capabilities. Finance teams face challenges such as:

- Unchecked spending with little to no real-time visibility

- Time-intensive manual tasks tied to end of month close, like chasing down receipts and coding expenses

- Systems that don’t integrate, making it hard to get a clear, real-time financial picture

In order to improve their expense management and oversight, finance leaders need a tool that delivers both savings and clarity. This foundation leads to two critical areas of focus: time and cost savings, and simplicity through superior capabilities and improved visibility.

Simplicity + modern technology = time and cost savings

By moving beyond outdated bank systems, improving processes and reducing manual effort, PEX streamlines expense management by tackling inefficiencies head-on – resulting in significant time and cost savings. PEX ensures that finance teams can focus on company priorities instead of repetitive tasks through its modern tools and automation capabilities.

Here’s how PEX makes expense management simpler for its customers:

Time savings

25% of PEX customers save 10+ hours per month, reclaiming time for strategic work. According to Jose C., on G2, “With 200+ cards issued, PEX is easy to use and has helped us complete projects quickly with minimal paperwork from accounting.”

This adds up to 656.8 hours saved annually for the average company, equivalent to $35,467 in labor costs based on a fully-burdened hourly rate of $54. ( Based on reports of The Bureau of Labor and Statistics)

These powerful PEX features help companies save time:

- Seamless integrations: PEX syncs with accounting and financial systems to simplify data entry and reconciliation. According to Rick B., “Expense management, automation of purchase approvals, paperwork reduction [from PEX] have reduced a significant amount of manual effort in our acquisition processes.”

- Comprehensive tracking: PEX enables real-time insights into expenses, eliminating tedious manual adjustments. According to Stephen P., a production finance manager, “In the past we used 3″ binders, paper, tape and Excel to track every expense on our 30+ projects a year. Enter PEX which captures expense data automatically and has mobile photo uploads of receipts, completely revolutionizing our process.”

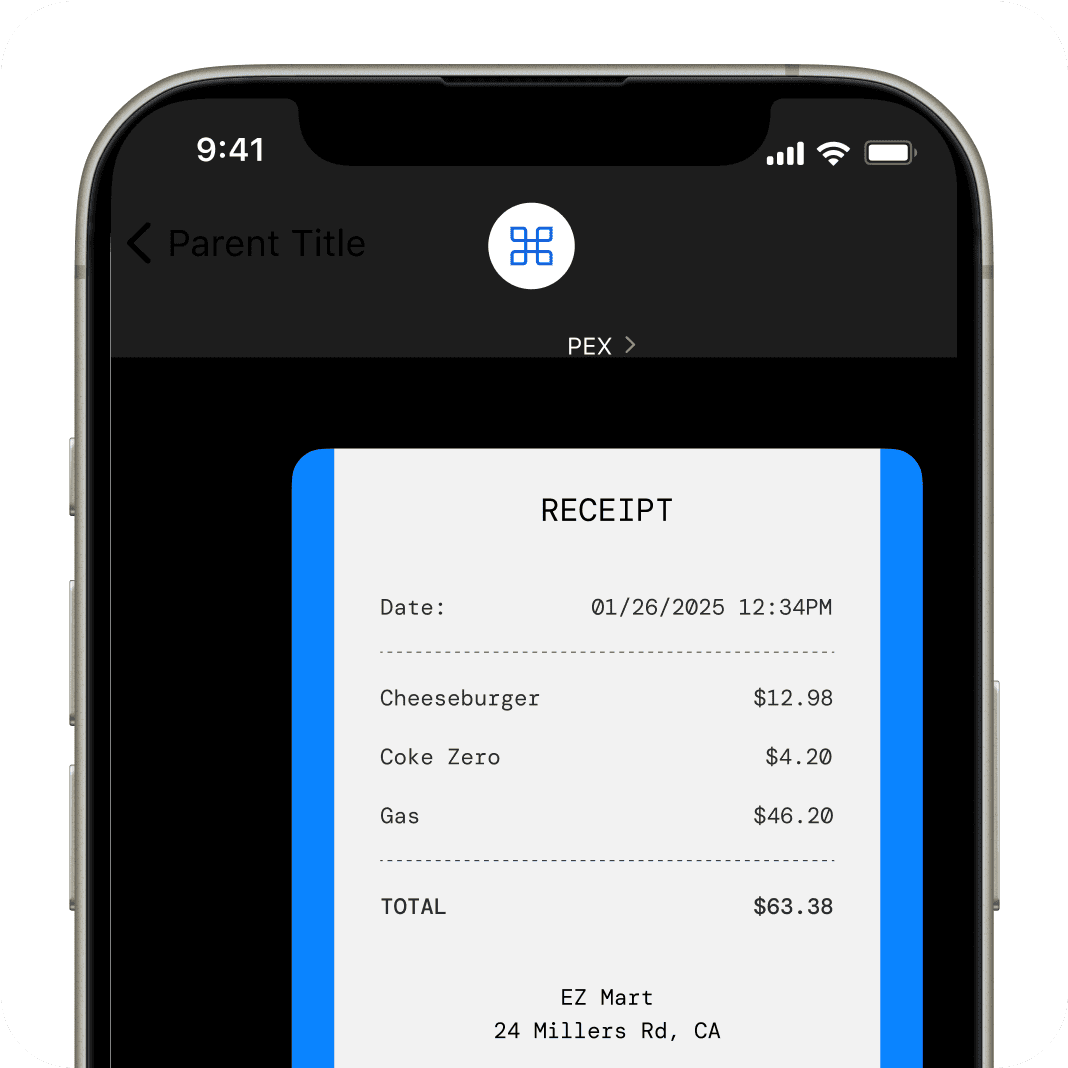

- Smart receipt management: With PEX’s mobile app, users submit receipts via text, email or upload effortlessly. AI then matches them to transactions for greater efficiency and accuracy, eliminating time spent sorting and filing receipts. Jenni Ashby, Controller of Southwestern Healthcare says, “Employees can snap pictures of receipts and upload them right away, instead of us having to chase down receipts. And employees no longer have to worry about keeping track of or losing receipts, saving them time on expense management as well.”

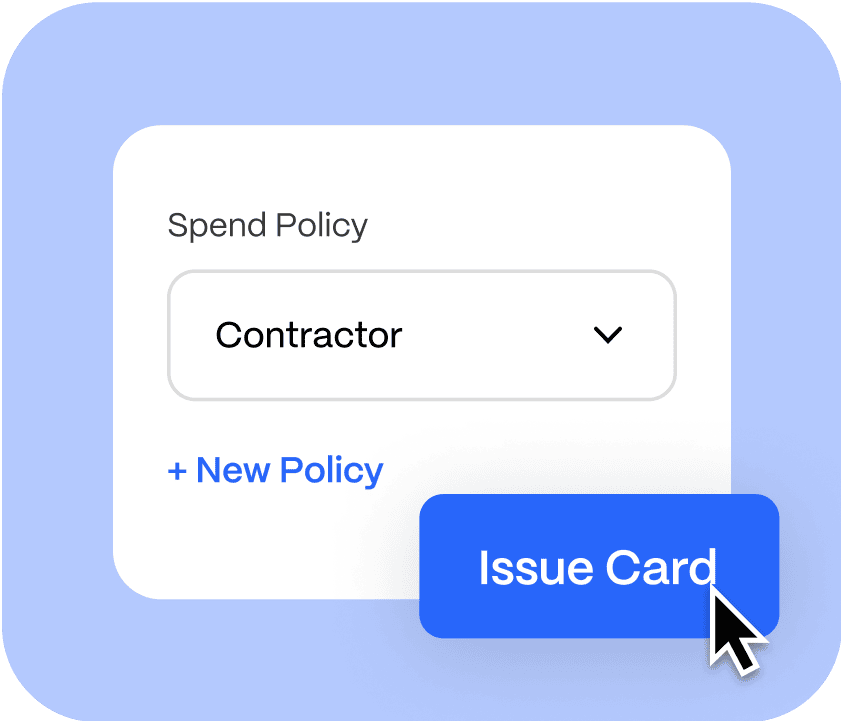

- Auto Tagger: PEX automatically tags transactions based on predefined rules, reducing coding time and ensuring consistency in expense categorization. According to Joshua M., the owner of a small business, PEX makes it easy to set spend controls and automate GL codes and approvals from the app. He says, “We were previously using credit cards and chasing down receipts and budget codes, but now no one asks me for budget codes anymore (they’re autocompleted in the app) and I get spend requests directly in the app. The comments make it easy to remember upon later review what each spend was for.”

Cost reduction

60% of customers save money using PEX to keep company expenses in check. From custom spend controls to a transparent cash back rebate, customers can invest these savings back into growth or cost optimization initiatives. According to Justin Schuff, Deacon at First Argyle Baptist Church, “The time [PEX] saves is invaluable, allowing you to focus more on your mission rather than getting caught up in administrative tasks.”

How PEX helps customers reduce costs

- Real-time spend controls: Automatically prevent overspending and ensure compliance without manual effort. Set limits on spending categories, enforce policy rules and eliminate surprise expenses. Danny F., a transportation company Controller, says he loves PEX because “the usability of the cards and dynamic functionality of the merchant codes create a great environment for control and spend management.”

- Virtual cards: Use virtual cards for vendors or travel and entertainment (T&E) expenses, locking them down to a single merchant, a specific amount or a set time frame. This prevents misuse, enhances security and simplifies reconciliation.

- Cash back: Earn 1% cash back on eligible PEX Credit Expense purchases and PEX Prepaid Expense vendor spend. Every transaction not only provides savings but also gives finance teams access to powerful tools that save hours of work. These savings have provided customers, like the production company, Wheelhouse Group, increased working capital.

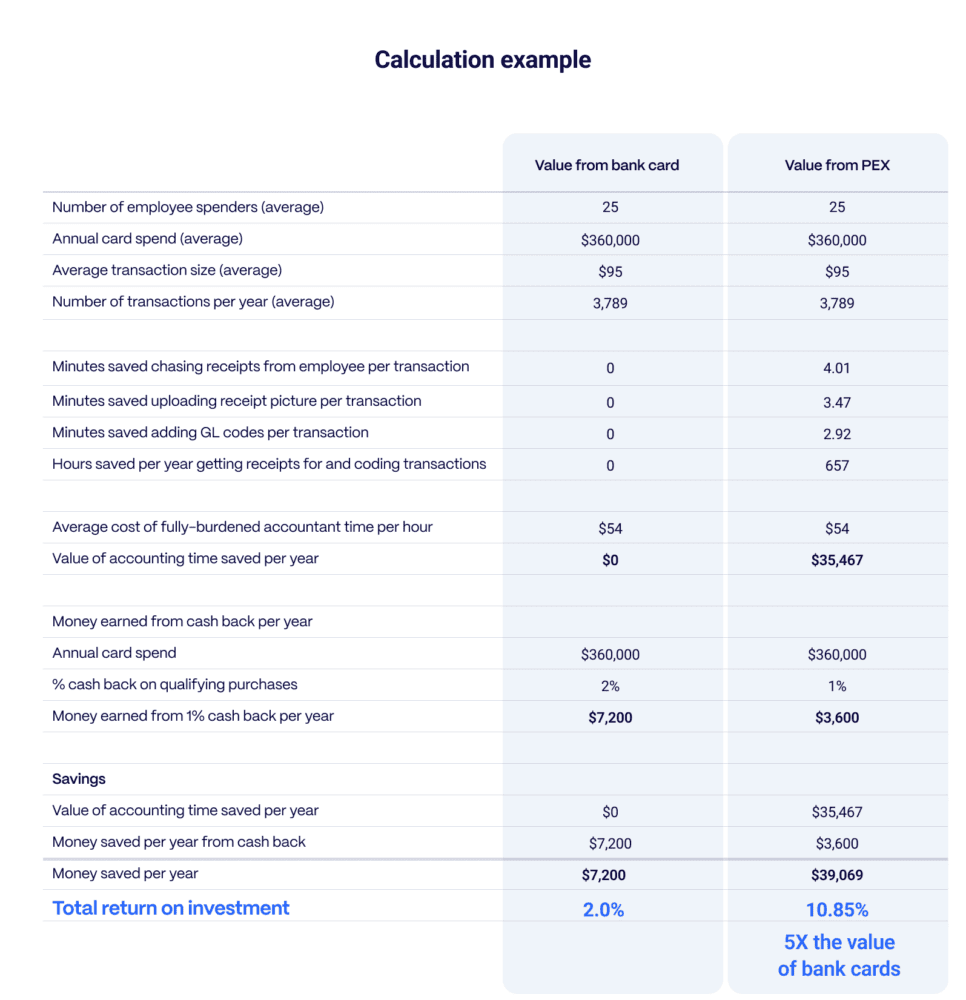

PEX vs. traditional bank cards: the value breakdown

PEX rewards businesses through a combination of productivity savings and cash back on spend. Below, we breakdown the value of PEX for a company of 25 team members and $360,000 in annual company corporate card spend:

- Productivity savings: 9.85% productivity improvement = $35,467 in saved labor costs and overspend

- Cash back: 1% rebate = $3,600 back in rewards each year

- Total savings: Combined labor savings and rebates exceed $35K annually—an effective 10.85% return on spending, far outpacing the typical 1-2% rebates offered by traditional credit cards by as much as 5X!

These savings enable teams to focus on tasks like financial forecasting and cost optimization instead of receipt chasing.

PEX: A strategic investment for finance leaders

PEX isn’t just a tool—it’s an investment in your team’s productivity and your company’s bottom line:

- Boost productivity: Automate tedious tasks, freeing your team to focus on company goals

- Save money: Reduce labor costs and eliminate wasteful spending with better controls

- Make better decisions: Access integrated, real-time financial data for a clear picture of your finances

By combining competitive rebates with substantial operational efficiencies, PEX enables finance teams to focus on what really matters.

Ready to save money and improve your team’s productivity? Book a demo today.

Similar resources

Opinions, advice, services, or other information or content expressed or contributed here by customers, users, or others, are those of the respective author(s) or contributor(s) and do not necessarily state or reflect those of The Bancorp Bank, N.A. (“Bank”). Bank is not responsible for the accuracy of any content provided by author(s) or contributor(s).