PEX Credit Expense

Put your working capital to work

Get up to $2M per month in purchasing power, plus earn 1% back1 to invest in your business or organization

Key benefits

Power your business and get rewarded with PEX

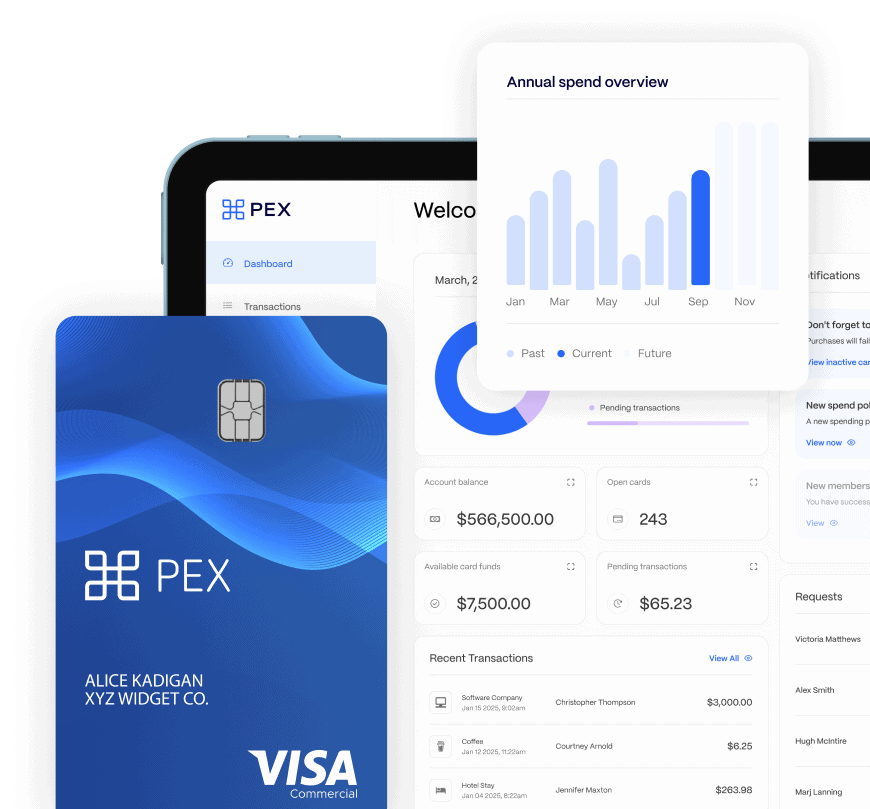

Issue physical and virtual cards aligned to your spend policy

Earn 1% back 1 on all qualifying purchases

No personal guarantee or credit check required

Spend Use Cases

A corporate card for all your spending needs

Pay vendors, power team travel or use business credit as a flexible financing tool

Back office spend

Optimize your cash flow and earn rewards on invoices that accept card payments

Vendor payments

Prevent overspend by issuing virtual cards to specific merchants, like SaaS and advertising vendors

T&E

Enjoy worldwide Visa® acceptance with an easy-to-use mobile app

for use on-the-go

Purchasing

Instantly issue cards tied to custom spend policies and enhanced approval workflows

Fuel

Distribute corporate cards to team members in the field with custom spend and merchant limits

Spend smarter and close your books faster

PEX automates manual tasks, improving team productivity by up to 25%2

Automate finance team tasks

Customize spend limits and controls

Set limits by cardholder, card, MCC or merchant - plus, enforce day of week or state-based spend limits, and more

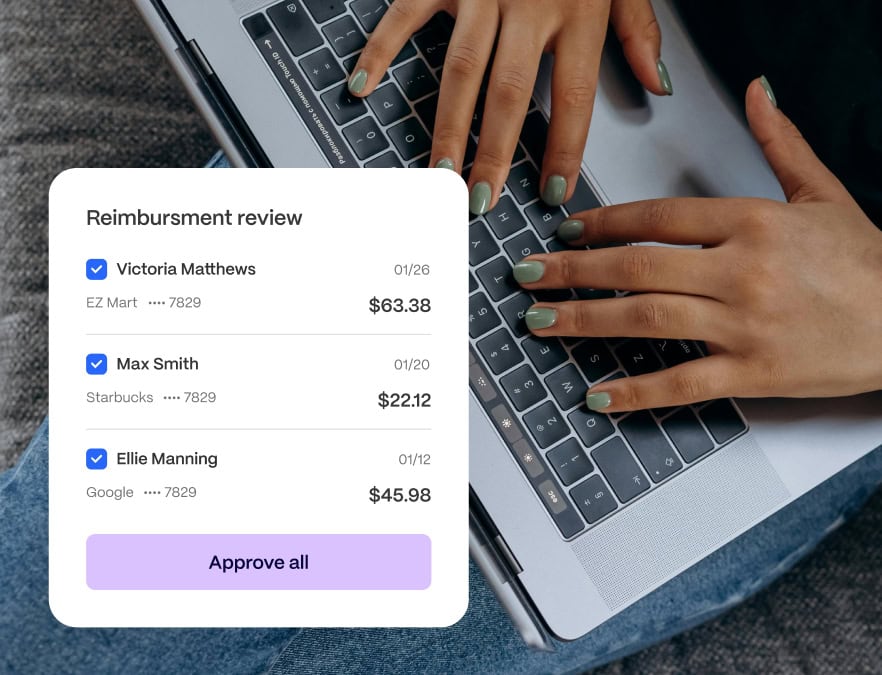

Automate

approval workflows

Pre-approve purchases to prevent overspend, or enforce compliance for purchases that already occurred

Get real-time

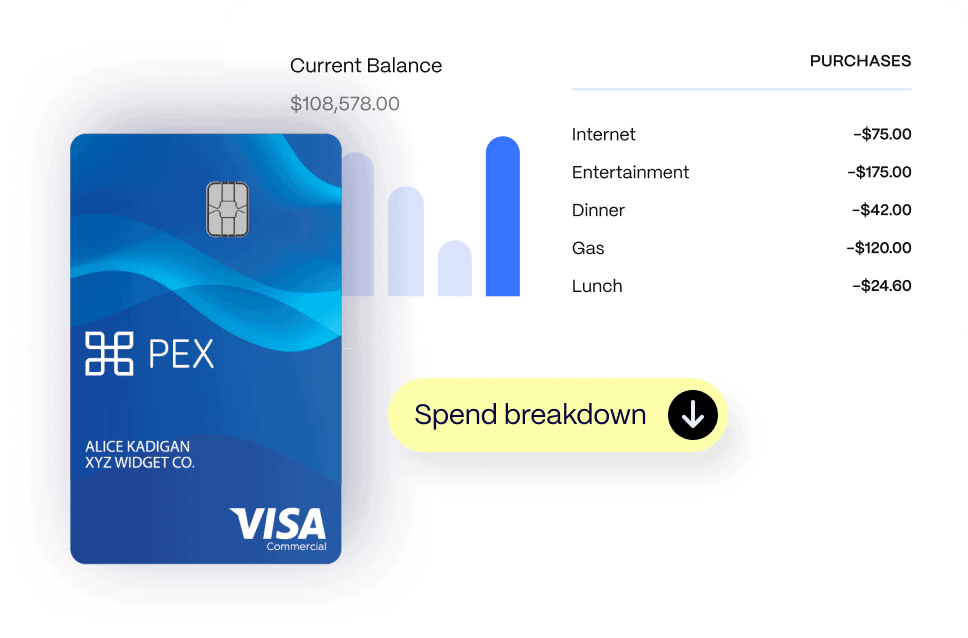

spend visibility

Monitor employee, project or department spend to maintain accurate forecasts and oversight

Empower your employees

Reimburse out-of-pocket expenses

Pay employees back for mileage and non-card spend, directly through the PEX platform

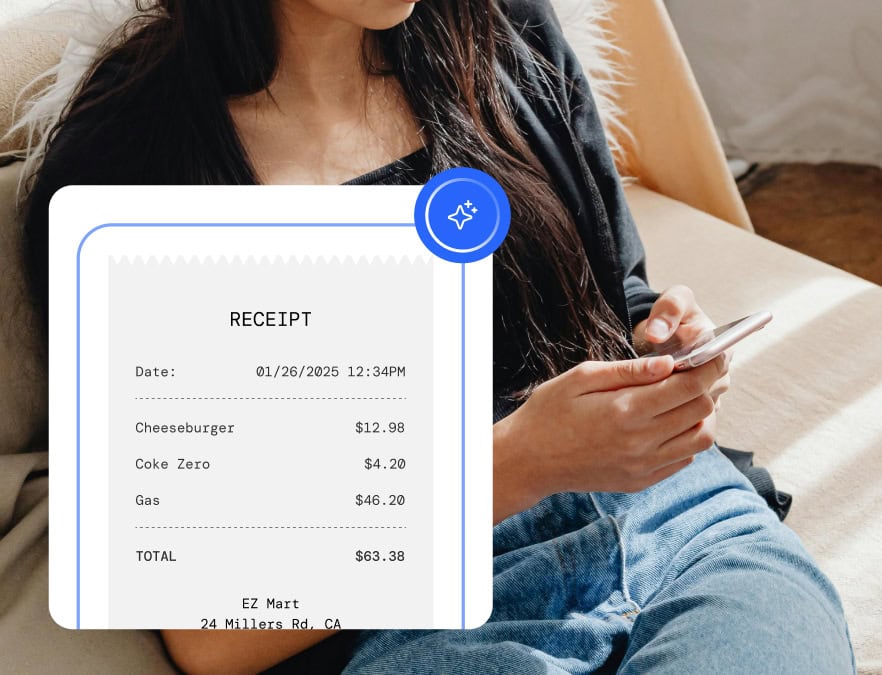

Eliminate the receipt chase

Employees can snap, text or email receipts to PEX, ensuring timely and compliant submission

Integrations

Improve productivity - connect PEX to your accounting software, at no extra cost

PEX offers us the ability to restrict company-wide spending to specific areas of purchases. This allows our employees to feel they have the freedom to purchase what they need. I would call it a credit card with guard rails."

Brenton H., Current customer

How we stack up against the competition

PEX offers an extensive and easy to use platform, comprehensive support and a seamless approval process

Frequently asked questions

PEX Credit Expense is a complimentary program that offers a non-revolving line of credit for small to medium businesses featuring weekly or monthly auto repayment. Payment is due in full at the end of the statement period.

Book a meeting

Talk to an expert

Learn how PEX can help you streamline your expense management process, improve receipt collection and close your books faster. Talk to an expert today.