3 ways to reduce T&E expenses without limiting employee travel

If you think your organization is spending a lot on travel & expense (T&E), you’re not alone.

T&E budgets generate a massive amount of spend for the economy. The Global Business Travel Association (GBTA) estimated that spending on worldwide business travel would exceed $2 trillion by 2028.

Varying sources project that companies spend anywhere between 6-12% of annual revenues on T&E. That’s a huge chunk of change. If a company generates $10M in annual revenue, for example, their T&E spend could range from $600K to $1.2M.

And with travel costs rising, T&E budgets are not going to get smaller anytime soon. According to NerdWallet, travel costs are 4% higher than they were in January of 2024 – exceeding the inflation rate.

Business travel is critical for growth, so that T&E spend isn’t going anywhere. But rising costs make it challenging for companies to reduce spend while still allowing essential employee travel.

Common challenges regarding T&E policies

Employee self-enforcement of spend policies

Let’s say an employee needs to travel for business. They’ve skimmed the expense policy, which probably lives on an internal intranet somewhere. The employee books their travel and makes purchases throughout the trip.

When they return and submit their expense report, they find out that they missed the part about the per-night cap on hotel stays, for example. Either the employee is out-of-pocket for the overage, or the organization takes on the unapproved expense – neither of which is an optimal result.

Employees are responsible for remembering what’s covered (and not covered), which is not a reliable way to maintain compliance. Many of us are guilty of forgetting about spending thresholds and buying out-of-policy items by accident – which frequently results in unapproved spending.

Limited visibility into employee travel expenses

With manual expense management processes, employees make T&E purchases and then submit expense reports after returning from a trip. Finance teams don’t get access to employee spend data until after the fact. They can’t see what employees are spending while they’re traveling, and there’s no way to restrict spending until after it’s already happened.

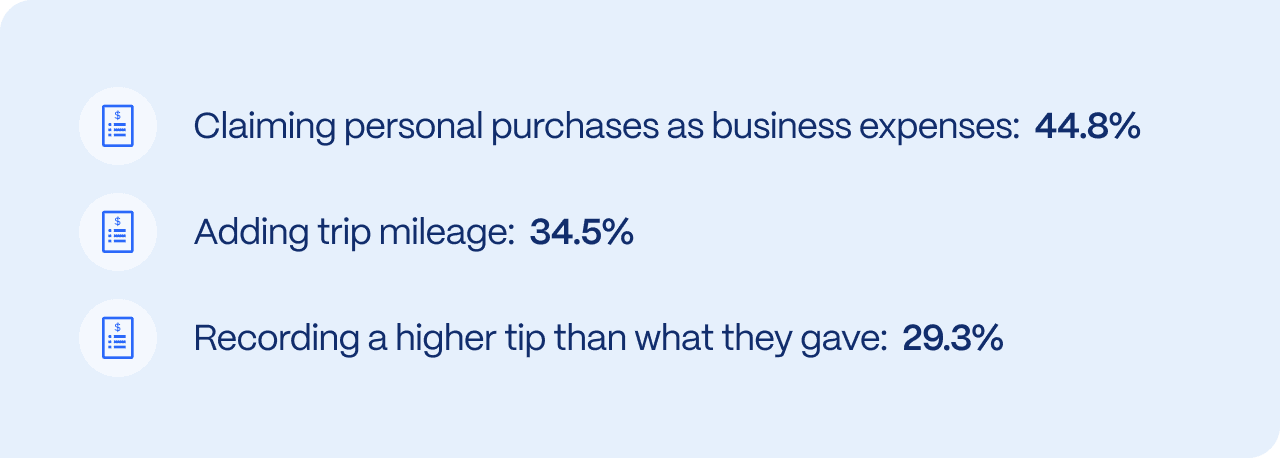

Expense fraud is a common side-effect of limited visibility into T&E spending, which accounts for $2.8 billion in the U.S. alone. Looking at the most common types of expense fraud, it’s easy to see how manual processes make it easy to slip by.

When finance teams have after-the-fact access to T&E spending, budget overruns frequently occur. Consider a construction company that has 50-100 projects running concurrently. Their finance team only sees spending per project after it happens and goes over budget – which can reduce access to working capital and even put the business in debt.

Inefficiencies due to manual processes

Manual expense reporting is incredibly time-consuming. Employees submit expense reports in disparate spreadsheets that frequently require corrections and follow-up. Finance teams are constantly chasing down receipts, transaction details, GL codes and approvals from managers. And all this data has to be hand-keyed into a spreadsheet for uploading to accounting software, which frequently throws errors.

The time-suck of manual processes can cause long working hours for finance staff, worries about incorrect expense data and delayed reconciliation. Floqast’s Controller’s Guidebook found that almost 90% of respondents had to re-open their books once annually due to errors – with nearly 50% having to re-open the books at least 3 times per year. Both of these issues can contribute to delayed reconciliation, pushing it out from days to weeks (or months) depending on the organization.

3 ways to control T&E costs without limiting mobility

Leverage smart spend controls to enforce T&E policies

Instead of putting the onus on employees to self-police T&E spending, look for corporate card options that offer spending controls. These controls allow finance teams to pre-program spending rules, so employees can only make approved purchases.

They can limit spending by merchant, location, timeframe, amount and cardholder, for example. The employee booking a hotel stay will only be able to spend up to a certain threshold. Anything above the threshold will be declined. Using pre-programmed spend controls empowers employees to spend within policy limits and finance teams to prevent unapproved spend.

Use tools that offer real-time access to T&E spend

Finance teams frequently get stuck with corporate cards that provide PDF statements only, or an online portal that provides transaction updates every few days. Sometimes corporate cards aren’t compatible with accounting software, making it impossible to see an accurate picture of spending.

When evaluating corporate card options, finance staff should look for cards that have an online platform where transactions post in real time – with all relevant transaction details. Bonus if the platform has a pre-built integration to their accounting software. Using a real-time view, they can identify spending patterns for T&E, course-correct on budget overruns and make recommendations based on current spending data.

Automate T&E workflows wherever possible

Manual expense management creates so many headaches for traveling employees and finance staff. Employees have to keep track of receipts – not an easy task, especially when you’re traveling. Many times employees don’t know GL codes or remember transaction details, which means finance staff are stuck tracking them down.

Finance teams should automate as many of these steps as possible to make business travel less stressful for employees and easier to manage for themselves. Instead of holding on to a bunch of paper receipts, offer employees tools that capture receipts from their phones. Create a merchant-to-GL code matching list that auto-populates the GL code in expense reports.

Prompt employees to submit transaction details as soon as they make a purchase, eliminating the opportunity to forget. And if employees are out of compliance, offer finance teams the ability to block card usage until they submit the appropriate data for expense reports.

The future of cost-effective corporate travel

Imagine your organization with these improvements in place. Employees are free to make travel arrangements and trip purchases without worries – any out-of-policy spending is blocked.

Travelers upload receipts via mobile devices, enter transaction details and then toss receipts. They can submit for approval as they travel or when they get back. Either way, receipts are auto-matched to transactions and GL codes auto-populate.

Finance staff are simply tasked with oversight, watching as transactions roll in to identify spending patterns and make recommendations. Expense data is auto-synced with accounting software, making tedious reconciliation work a thing of the past.

At PEX, we’ve worked hard to make this streamlined future available today. Contact us for a demo of our T&E workflows. We’d love to show you how the PEX platform can make business travel easier and more seamless for travelers and finance teams.

Similar resources

Opinions, advice, services, or other information or content expressed or contributed here by customers, users, or others, are those of the respective author(s) or contributor(s) and do not necessarily state or reflect those of The Bancorp Bank, N.A. (“Bank”). Bank is not responsible for the accuracy of any content provided by author(s) or contributor(s).