Real-time expense automation: How PEX puts you in control

Finance teams are drowning in the daily chaos of manual work. And they’re not just overwhelmed; they’re constantly playing catch-up.

Staff spend hours chasing missing receipts, correcting GL codes and tracking down unfamiliar charges. Finance teams enforce policies after the fact, not at the point of purchase. Overspending often shows up days or weeks too late, if at all. It’s a frustrating, time-consuming cycle—and it’s not just inefficient. It’s unsustainable.

At the same time, the pressure on finance leaders is mounting. Teams are leaner and deadlines are tighter. Expectations for strategic guidance are only increasing, but the time and tools to deliver often haven’t kept up.

That’s why real-time expense automation isn’t just a nice-to-have anymore. It’s a must. In this post, we’ll explore what real-time automation looks like, and how PEX puts finance leaders back in control. Let’s start with five ways automation changes the way finance teams manage day-to-day operations.

What real-time expense automation means for finance teams

Automation in finance transforms how teams work. Instead of reacting after the fact, teams get clean, accurate data the moment spending happens. This makes it easier to stay on track, enforce policies and move faster across the board.

No more data chasing

Instead of chasing receipts and patching together spreadsheets, finance teams receive organized, reliable expense data as purchases happen. That means no delays and no detective work, just the right information exactly when it’s needed, to close faster and plan with confidence.

Confidence in every number

When expense data is automatically captured, coded and verified at the point of spend, finance leaders can trust what they’re seeing. From audits to board reports, they know the numbers are accurate, reducing risk and reinforcing compliance without extra work.

Complete, preemptive spending control

With a spending framework built into the process, finance teams no longer have to rely on after-the-fact investigation. Expense control software enforces limits at the point of purchase and blocks unauthorized spend automatically. The result is complete control over who spends, how much and where, without needing to chase down violations later.

Visibility that drives real-time decisions

With every transaction surfaced as it happens, finance teams don’t have to wait until month-end to understand where money is going. That instant clarity helps leaders adjust budgets early, spot risks faster and support strategic decisions with confidence.

Effortless reconciliation

When accurate expense data flows directly into your accounting system, reconciliation stops being a separate project for finance staff.Transactions align as they happen, books stay accurate and finance teams can close faster without the usual end-of-month scramble.

How PEX puts finance leaders back in control

PEX gives finance teams the tools to stop reacting and start leading. With automation built into each stage of the expense process, finance leaders can regain control without adding complexity. Here’s how PEX brings each of these benefits to life through purpose-built automation.

Every transaction, captured & categorized

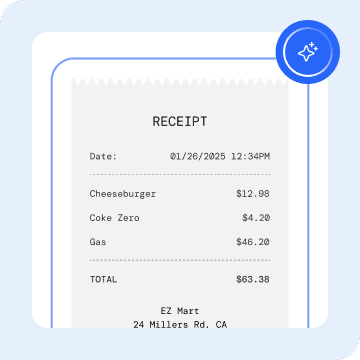

PEX automates expense reporting by recording, matching and coding transactions in real time. Automated receipt capture enables receipt submission via email, text or mobile app upload, capturing receipts at the point of purchase. AI-based receipt matching scans incoming receipts and matches them to the correct transactions on card statements. And with AutoTagger, every transaction is pre-coded according to your chart of accounts. Expense data arrives already categorized and ready to reconcile.

Financial data you can stand behind

With PEX’s receipt capture, matching and tagging automations, there’s a reliable foundation for financial accuracy. From there, real-time transaction tracking gives finance teams a live view of every dollar spent, so nothing falls through the cracks. And with a built-in audit trail for each transaction, every detail is documented and accessible, from initial charge to final reconciliation. Data is continuously organized, verified and ready to go.

Spending with guardrails

PEX makes it easy to set clear spending boundaries and enforce them. With custom spend rules, finance teams can restrict employee spending by role, merchant, day and time or even physical location. Auto approval workflows route expense reports through the appropriate management channels without email bottlenecks. And with Auto Enforcer, admins can automatically block card usage when employees fail to submit receipts. The result is total control without micromanagement.

Clarity without the wait

With PEX, finance leaders have instant financial visibility through live dashboards that update as transactions occur. They can see a current, comprehensive view of activity across the organization, project or department. Custom alerts and notifications flag issues the moment they arise, whether it’s a budget nearing its limit or potential fraudulent activity. With information that’s both timely and actionable, decisions can happen in the moment.

Month-end, minus the mess

By capturing receipts at the point of purchase, matching and coding them instantly, PEX ensures that every transaction enters your system clean and complete. That foundation of accuracy makes it easy to push data directly into your accounting platform, through seamless ERP integrations with QuickBooks, NetSuite, Sage Intacct, and more. No manual entry. No backlog of uncoded charges. Just a faster, smoother close, every time.

From chaos to clarity: PEX’s impact in the real world

Want to see what real-time control actually looks like in practice? Here’s how finance teams are using PEX to bring order to the chaos.

Family in Christ Community Church cuts reconciliation time by 93%

Managing expenses for a busy staff and dozens of volunteers used to mean long hours sorting through paper receipts and manually reconciling purchases. With PEX, Family in Christ automated receipt collection and expense categorization at the point of spend. The result? Monthly reconciliation time dropped from five hours to just 20 minutes—a 93% time savings that gave their finance team back valuable hours and peace of mind.

Compass to Care gains real-time control over program spend

As Compass to Care expanded its travel assistance programs, manually tracking card activity made it difficult to monitor how and when funds were used. By switching to PEX, the team gained real-time visibility into every transaction, along with the ability to instantly fund or restrict cards as needed. That meant faster reimbursements for families, fewer delays for staff and two hours saved per week that used to be spent following up on spending activity.

Artisan Capital frees up $150K by automating reimbursements

As Artisan Capital scaled from a two-person team to over 130 employees, its manual reimbursement process became unsustainable, often taking six to nine months to complete. By combining PEX Visa® Commercial Cards with SAP Concur, the team automated receipt capture, enforced spend limits upfront and accelerated reconciliation. The result: reimbursements are now processed within 30 to 40 days, and over $150,000 in working capital was unlocked by eliminating long reimbursement delays.

Your path to financial control starts with PEX

Real-time expense automation isn’t just about speed. It’s about giving finance teams the clarity, confidence and control they need to lead strategically. PEX makes that possible by automating the day-to-day work that used to slow you down, and surfacing the insights that help you drive strategic growth.

If you’re ready to eliminate manual bottlenecks and take control of your company’s spend, PEX can help you make it happen. Contact us for a customized demo today.

Similar resources

Opinions, advice, services, or other information or content expressed or contributed here by customers, users, or others, are those of the respective author(s) or contributor(s) and do not necessarily state or reflect those of The Bancorp Bank, N.A. (“Bank”). Bank is not responsible for the accuracy of any content provided by author(s) or contributor(s).