Product updates: Low risk, more control, new features give you real-time control

As summer winds down and finance teams gear up for a busy fall—conference travel, budget planning, and year-end close—it’s a good time to revisit how you manage company spend.

Many finance teams are shifting away from traditional bank cards—and for good reason. Shared cards create audit headaches, lack of visibility slows reconciliation, and disconnected systems make it harder to track spend across departments. Without built-in controls, custom integrations, or flexible policy enforcement, these tools leave modern finance teams without the agility and resilience needed to support a distributed, fast-moving workforce.

PEX gives you a better option. Our spend management platform gives you built-in controls, real-time accountability, and fewer surprises. The latest updates help you process requests faster, enforce policies automatically, and stay in control—without losing control or visibility.

Real time control for admins

Admin time is valuable—especially when fielding requests from travelers, reviewing flagged transactions, and chasing down receipts. These new tools help reduce the noise to help keep spend in policy with simple automations.

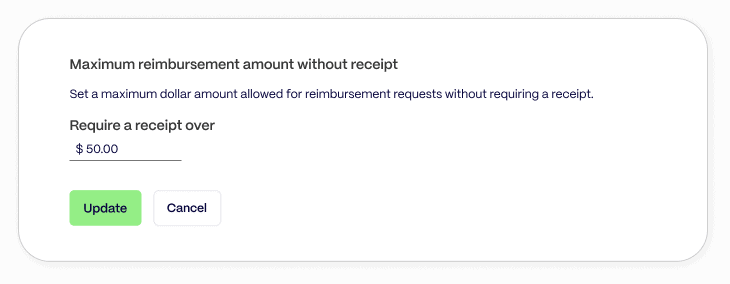

NEW: Reimbursement rules

Now you can set a minimum reimbursement amount that requires a receipt. If a request is under that threshold, no receipt is required. If someone accidentally charges a work Lyft or DoorDash order to their personal card, you can process the reimbursement without extra back-and-forth. Simply head to ‘Business setting” and add a custom reimbursement rule.

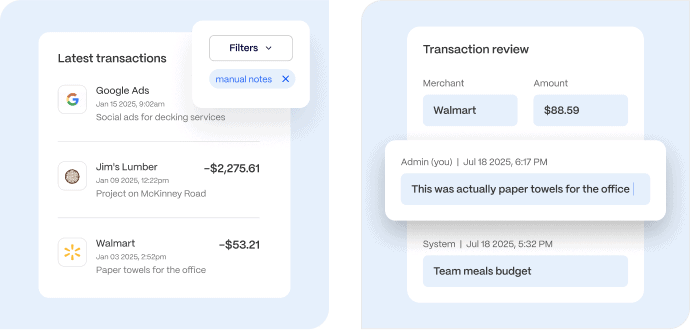

NEW: distinguish between system generated & manual notes

With the latest update you can now filter transactions to see which notes were added automatically and which were entered by an admin or team member. Filter by the note’s author to separate exceptions from auto-assigned rules—giving you a clear view of each transaction.

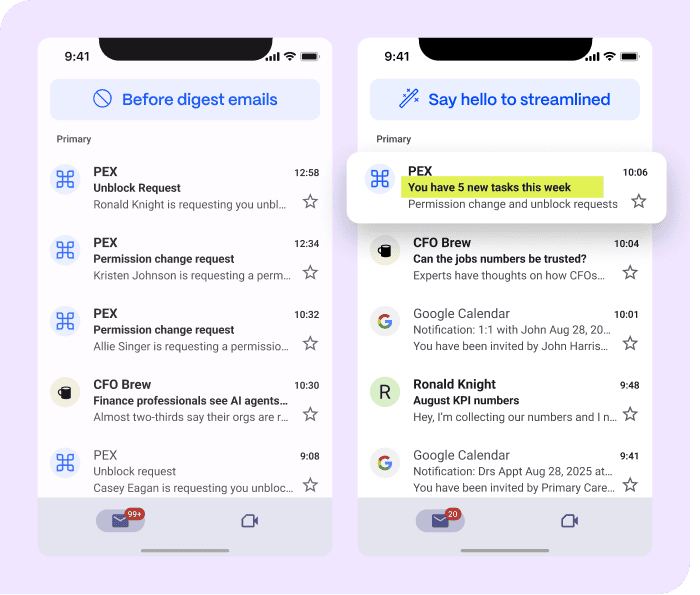

Too many emails? Get your entire to-do list in one email

Stop logging into your dashboard just to check if something needs attention. With Admin digest emails, you can get a daily, weekly, or monthly snapshot of:

- Pending approvals

- Reimbursement requests

- Purchases

How to set it up:

Go to My Profile → Notifications and choose how often you want your summary. One email gives you full visibility into your open approval tasks.

Get your weekly reminder email

Set and enforce policy rules with a system admin

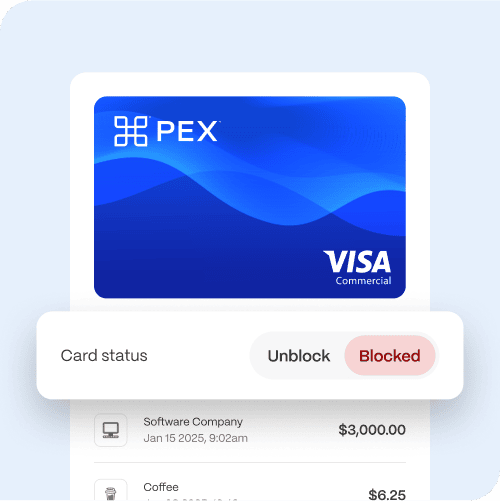

Are you still trying to manually chase down receipts? Following up with managers when their team members make an out of policy purchase? Auto Enforcer removes the friction by ensuring spending stays in policy, with automatic rules that block cards and spend that falls out of policy.

First, set a policy rule and select the groups or cardholders it should apply to. Then, if there is a missing receipt, the PEX VisaⓇ Cards will get flagged and blocked by the system setting until the policy requirement has been met.

- Set policies that apply to all current and future cardholders and enforce rules with a ‘system persona’. All automated by the system—without having to play good-cop, bad-cop with your management team.

- As requested by many customers, you can require cardholders to add a note to a purchase; otherwise, it will not be deemed compliant and may result in a card block.

- Auto Enforcer will send daily reminders about missing transaction items, even after a card is blocked. So that cardholders can provide the required information and have their cards unblocked as quickly as possible.

The result? Less manual oversight and more consistent controls. Turn on auto-enforcer for free.

Empower cardholders with real-time tools

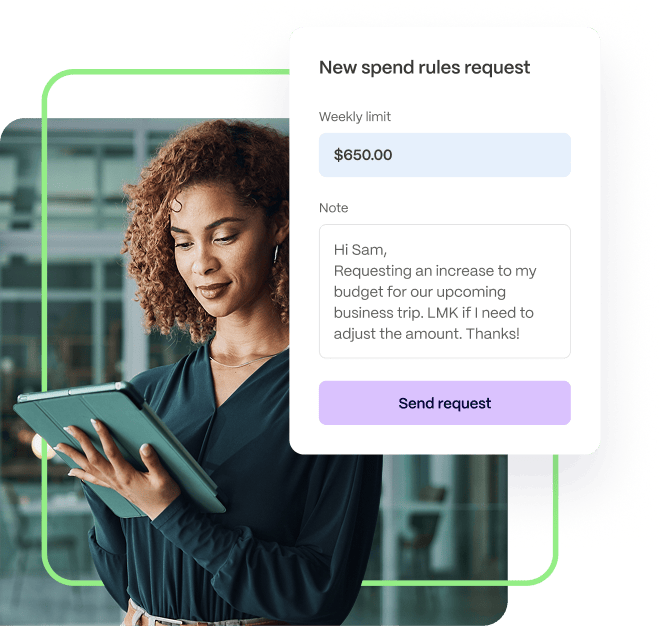

Having a clear process for cardholders to request and manage their card balance is a great way to reduce admin overhead. With the PEX mobile app, cardholders can quickly request funds or updates to their spend rules, while you stay in control and approve changes in real time.

More flexibility, fewer delays

Cardholders can easily request funds and policy changes directly in the app, without sending you an email or starting a chat thread. Keeping things moving, even when they’re on the go.

Prepaid cardholders with auto-funding turned on and Credit Expense cardholders can now request spend policy updates directly in the mobile app. If a transaction is declined, they’ll see the reason and can request more funds or a policy change on the spot.

The best part? Everything happens in the PEX dashboard—so you can review and approve in minutes. No scattered messages. No bottlenecks. Just a smooth, transparent process that keeps your team moving.

How it works

Julia, a field operations manager, is on a week-long trip to Mexico to evaluate and negotiate with a new supplier. Her company recently updated her card spend rules, giving her more autonomy while maintaining financial controls.

Receipt reminders & international support

Ahead of her trip, Julia makes multiple travel purchases and receives real-time text reminders to submit receipts. Once she landed though her card is declined, instead of emailing the finance team, she checks the decline reason using the PEX app, which tells her why the transaction was blocked due to a policy against international transactions.

Fast resolution without the runaround

With flexible spend requests through the mobile app, Julia can request a temporary rule change to enable international spend for this trip. She submits a quick justification and the finance admin approves it within minutes.

Now, the finance team can easily track and report on any spend rule changes with a simple report, up to 12 months at a time. Julia gets what she needs. The company stays in control.

No delays, no surprises.

(see how you can generate a report)

Integration enhancements with Greenslate

PEX has deepened its integration with GreenSlate to seamlessly sync PEX purchases, cardholder fees and receipt images. PEX receipt images are stored directly in your GreenSlate account, serving as your system of record.

You can also map GreenSlate fields to PEX tags, ensuring that purchases and cardholder fees sync to GreenSlate with the correct Project, Account, Episode, Location, and more, immediately.

The connector for GreenSlate enables you to:

- Sync PEX receipt images and store them directly in your GreenSlate account for review and use at any time

- Sync purchases and cardholder fees

- Customize configuration settings to meet individual business needs

We’ve also upgraded our QBO & Blackbaud connectors to support reimbursement payments. Now teams can merge the spend & reimbursement reporting from PEX into their accounting platform. Set up a connection to GreenSlate

Run teams with real-time accountability

Q3 and Q4 often mean lots of travel, conferences and end of year financials. Juggling approvals, chasing receipts, and reviewing transactions across time zones and departments. It adds up to more manual work, more questions, and more room for errors.

Tackle your end of year with confidence, knowing PEX has the tools to help keep everything in check without adding to your workload. These quick updates will help you stay ahead:

How to enforce your corporate card policy:

- Update your reimbursement threshold so small expenses can be submitted without a receipt while larger transactions require them

- Turn on digest emails to spot items pending approval to keep things moving quickly for the entire team

- Enable Auto Enforcer for all current and future cardholders so policies are always applied

A few small changes now can save hours of admin time—and keep spending under control with confidence, knowing PEX has the tools to help keep everything in check without adding to your workload.

Similar resources

Opinions, advice, services, or other information or content expressed or contributed here by customers, users, or others, are those of the respective author(s) or contributor(s) and do not necessarily state or reflect those of The Bancorp Bank, N.A. (“Bank”). Bank is not responsible for the accuracy of any content provided by author(s) or contributor(s).