Master month-end close: A guide to unlocking productivity through automation, control, and efficiency

Does month-end close feel like a never-ending struggle?

The work finance teams perform to get to month-end close is like pushing a giant boulder up a mountain. And if we’re being honest, it is never really done. Once last month is closed, it’s on to the next one.

Consider this scenario: To start, you do a transaction pull from the bank. You sort those transactions and separate them by individual cardholder. Then you send an Excel file of transactions to each employee, asking them to backfill and code transactions and submit back to you. Some get it right, but others miss receipts, fail to enter descriptions, or forget entire transactions. Now you’re spending days chasing down missing receipts and transaction details and manually entering everything.

So, you’re stuck spending days tracking down what’s missing or incorrect, and manually entering it all as it arrives. You’re working 12-hour days (and sometimes until 3 am), wishing you had moved your work back by a week. You wonder if the errors are going to come back to haunt you.

At PEX, we talk to finance leaders every day—from fast-growing businesses to Fortune 500 companies—facing this exact same struggle. In fact, many CFOs we know are still doing much of their work on spreadsheets! We built PEX to change this narrative—to simplify the life of finance teams and give them back what’s most valuable: time.

Here’s how PEX customers improve productivity and save money:

- 25% of customers save 10+ hours per month using the PEX platform (PEX customer survey, 2023)

- 60% of customers save money using PEX’s custom spend rules

- Plus, customers receive 1% cashback on every qualifying purchase

Customers save, on average:

- 2.92 minutes adding GL codes to each transaction (PEX customer success webinar, Q3 2024)

- 4.01 minutes getting receipts from employees per transaction

- 3.47 minutes uploading receipts per transaction

One customer, Family in Christ Community Church, reduced their reconciliation time by 93% with PEX, allowing their team to focus on more strategic projects.

Fragmented systems + massive change = chaos

So what happened in the business sphere that brought us to such a frustrating, time-consuming and manual process to manage a company’s finances?

Finance teams generally used a combination of disparate spreadsheets for employee expense reports, PDF copies of receipts, an accounting tool that was a central record of the company’s books and maybe another spreadsheet (an export from the accounting tool) for financial projections. And it may have been manageable and even reasonable for some amount of time – but not after the pandemic hit in 2020.

The result: A never-ending expense management mess

Adding stressors to an already fragmented system created a host of problems. Finance teams scrambled to gather missing expense details like receipts, GL codes, and descriptions. All that time spent on manual work delayed critical financial reports, slowed employee reimbursements and contributed to their loss of control of spending.

All of these problems have serious implications. Repetitive, time-consuming work drastically reduces the efficiency and productivity of staff and diverts resources from mission-critical work to tasks that should be on autopilot.

Manual processes aren’t just time-consuming—they also carry risks like fraud and reporting errors. Check fraud, in particular, is a common issue because checks are easy to forge and intercept. Switching to a purchasing card can simplify operations, enhance security by reducing fraud opportunities and offer real-time visibility into transactions. Plus, businesses can save between 55% and 80% of traditional processing costs, with average savings of $63 per transaction, according to an IOCP evaluation.

In industries like construction, where hundreds of payments are made across multiple projects, this level of control and visibility is crucial. It allows finance teams to pay vendors easily and securely, track payments in real time and avoid delays that can disrupt project timelines and vendor relationships.

Finance teams need to make sure not only pay vendors easily and securely – they also need to see which payments have been made when and which ones are still due (and when). Without that knowledge, projects get delayed, customer satisfaction drops and vendor relations can suffer as well.

Three critical components to transform your team’s productivity: automation, control, and efficiency

Finance teams are the backbone of any organization. Without their role in managing cash flow, paying employees and handling operational expenses, businesses would quickly grind to a halt. Yet, despite this crucial responsibility, finance teams often bear the brunt of frustration from across the company:

- “Why is my expense report taking so long to process?”

- “When are you going to recognize revenue for my new customer?”

- “Why are we late paying this vendor?”

Finance teams need some love – in the form of systems and processes that work with them, not against them. To keep organizations running smoothly and reduce stress on finance teams, it’s essential to focus on how to transform month-end close with three critical components: Automation, control, and efficiency.

Automation: Free your team from repetitive tasks in month-end close

All that time spent chasing down receipts, coding transactions and reconciling accounts has got to go. According to a recent report by the Global Business Travel Association (GBTA), the average expense report costs $58 to process. And it’s no wonder it costs so much – just consider the time finance staff spend trying to track down details and multiply it by their hourly rate.

Automation is the key to transforming manual, repetitive finance tasks into streamlined processes that reduce errors and free up valuable time for strategic decision-making. For CFOs in fast-moving industries, the need for accurate, timely data is critical to both day-to-day operations and long-term planning.

PEX’s expense management platform can shift that manual work to automated processes that run behind the scenes – increasing productivity and cost savings and giving finance staff peace of mind. Here’s how:

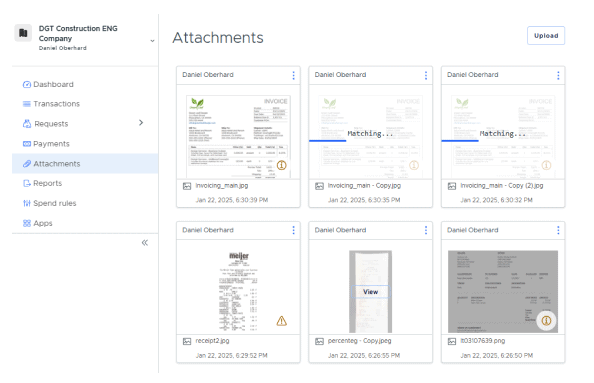

- With receipt capture, employees can text, email, or upload receipts directly to PEX’s expense management platform. AI scans receipts and matches them to the appropriate transaction in the system, reducing manual input and chase-down efforts.

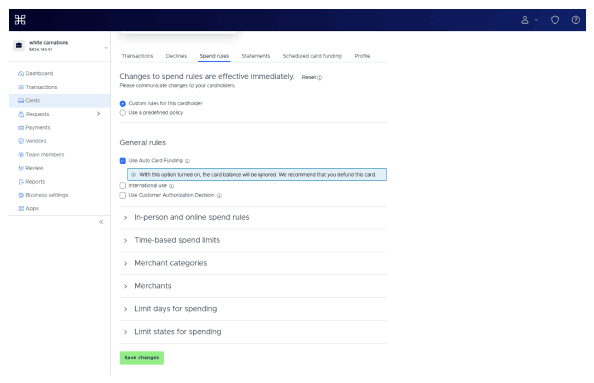

- Using auto enforcer, finance staff can leverage the PEX platform to block corporate card usage until an employee submits the necessary expense details. Once receipts and account codes or tagging are uploaded, the employee’s card is automatically unblocked. No more playing “bad guy” for Bob in accounting – he can just say, “Hey, it’s not me, it’s the system!”

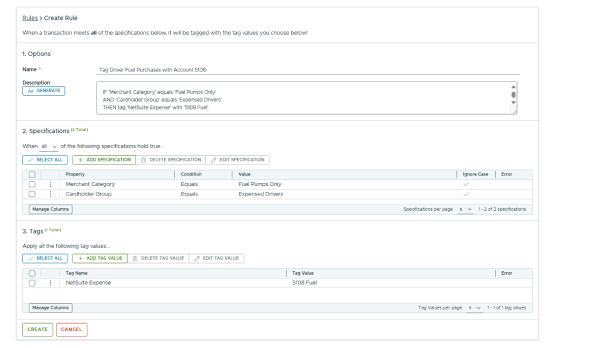

- Auto tagger enables users of the PEX platform to automatically apply GL codes to transaction records. Getting started with PEX means programming in the GL codes up front, so you tell the system once which GL codes go with which types of transactions. This process eliminates the dreaded download from the accounting tool to manually enter GL codes.

- AI-based receipt matching automatically matches data from card transactions to corresponding data on employee receipts. It looks at the amount on the card transaction and connects it to the line item on the receipt submitted by the employee. No more squinting at PDF receipts and bank transactions to try to match up numbers, or worrying about whether you read it wrong.

- PEX integrations also help to sync purchases to accounting software like Quickbooks, CMiC, Sage Intacct, SAP Concur, Netsuite and more. CFOs can close the books faster without worrying about errors in their work or duplicate transactions.

PEX customers have experienced massive time savings from these automations. They saved on average:

- 4.01 minutes getting receipts from employees per transaction

- 3.47 minutes uploading receipts per transaction

- 2.92 minutes adding GL codes to each transaction

25% of PEX customers reported that they saved 10+ hours per month. One PEX customer, Family in Christ Community Church, slashed their time spent on reconciliations by 93%. What could you do with all that extra time?

Control: Take charge of your corporate spending

Many finance teams still use bank cards or checks because they are familiar territory, they don’t require new software and they avoid credit card fees. But there is one thing bank cards and checks don’t offer and that’s any amount of control over spending.

Sure, bank cards and checks are limited to the balance in the bank, but that’s it. There’s no way to limit purchases to specific amounts or merchants, for example. And when you’ve got employees using bank cards and a ton of cash in the bank, staff can drain accounts quickly without much warning.

For a company like Papillon, which once had employees using a debit card linked to an $80K operating account, PEX provided the ability to tighten controls and prevent overspending, all while empowering employees to buy what they need.

PEX’s expense management platform enables administrators to create a framework for corporate spending that protects the company’s assets and gives peace of mind to both finance staff and employee spenders.

- PEX’s advanced approval policies enable you to stay in control of spend policies without micromanaging. These provide the ability to create a variety of workflows for expense approval. Administrators can create their own rules for each department, purchase type, tag, or any other combination. They can also set how many levels of approval are needed for each type of purchase, and who specifically needs to do the approving. Conversely, admins can also auto-approve purchases below a certain threshold.

- Custom spend rules augment PEX’s advanced approval policies by allowing admins to create unlimited rules to manage corporate spending. They can restrict spending by merchant type, physical location and even day of the week, to name a few. Admins can also create cardholder groups to set role-based spending privileges and restrictions. Attempts to use card outside the pre-approved rules will be declined. Want to make sure no one buys anything over the weekend? Done.

“PEX offers us the ability to restrict company-wide spending to specific areas of purchases. This allows our employees to feel they have the freedom to purchase what they need. I would call it a credit card with guard rails. I love that I can give PEX cards to everyone on my team and fund them as needed or that they can request funds as needed. It is quick, and once the initial set up is complete it is easy to implement.” – Brenton H., G2 Reviewer

- PEX’s user management function enables administrators to add other administrators and new team members to any of the accounts they have set up in PEX. Different departments throughout the company may have varying levels of spend and certain categories of spend. For example, marketing may allow larger spend amounts at hotels during the busy conference season. With User Management, admins can create a cardholder group for specific departments and add the appropriate team members.

PEX customers stand to recoup major losses from uncontrolled spending and expense fraud. Consider this: according to the Association of Certified Fraud Examiners (ACFE), “organizations lose 5% of their revenue to fraud annually.” For a company with $5M in revenue, that’s a $250,000 loss – every year!

Efficiency: A centralized hub for all your financial data

Finance staff are constantly hopping in and out of different tools to do their work. Email programs, Google Drive, expense report spreadsheets, reconciliation spreadsheets, accounting software….and the list goes on.

When data exists in separate silos, there’s plenty of lost productivity due to switching costs. Processes that should be pretty straightforward and accurate can become very error-prone. And trying to figure out how to marry data between tools can take hours, if not days. Imagine pulling multiple spreadsheets from different data sources and trying to merge them into one pivot table. There’s really no way to know if you’ve messed up a formula or pulled in an incorrect data source.

- With PEX’s integrations, finance leaders can begin to centralize resources by syncing PEX’s expense management data with mission-critical platforms. Seamlessly sync data from PEX to accounting platforms like QuickBooks, Oracle NetSuite, SAP Concur, GreenSlate, CMiC, BlackBaud, Sage Intacct, Xero and more. They can also leverage PEX’s bulk import capacities for batch card Ffunding, auto tagger, and auto enforcer, and connect to a company’s single sign-on (SSO) application.

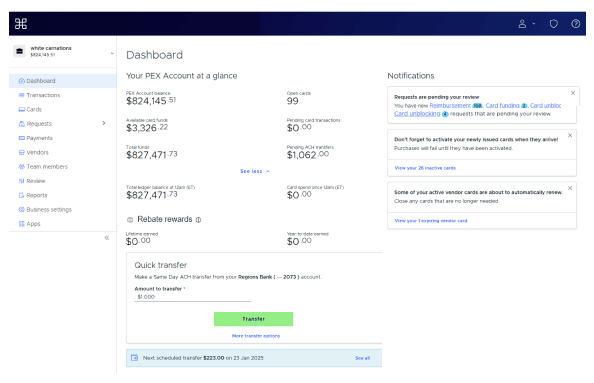

- Multiple account management allows admins to see various accounts all within one PEX login. A media company might have multiple accounts open at any given time, based on where they are in the production cycle. Admins can log into PEX and select the account they need to work on, and see a consolidated view of all accounts.

- Instead of cutting checks or paying employees out of petty cash, PEX customers can use employee reimbursements. Team members can log into PEX, create a reimbursement request, upload a digital copy of their receipt and submit for approval. They can track the status of their reimbursement request as it goes through approval channels and then view the payment status once it is approved. Funds go directly into the bank account details provided by the team member.

- Dashboard notifications give the PEX administrators oversight to see what’s happening around the organization. Notifications can be anything from each cardholder’s open items relative to submitting expenses, to new features in PEX that an administrator or user might want to take advantage of, to the status of customer projects relative to funding. Admins can determine the specific notifications that show up on each user’s dashboard.

What’s the vision for future finance teams?

When finance teams are stuck in the grind of manual processes, they can’t contribute to the big-picture strategy the way they want to. But by automating these time-consuming tasks and centralizing control, PEX empowers finance leaders to step into a more strategic role.

As your team frees up hours each week, you’ll have more time to focus on the real financial questions that drive the business forward—how to grow profitably, where to invest and how to align finances with broader company goals.

A voice in the C-suite

The behavior of the C-suite has evolved from a top-down approach where the CEO dictates everything to staff, to delegating work to key executives, to today’s model – one where the increasing complexity of business requires integration and collaboration between executives. And there are tangible benefits to this collaboration.

An Ernst & Young report that examined collaboration between CFOs and CHROs reported that increased collaboration resulted in higher EBIDTA, increased productivity, and improved employee engagement. A similar Ernst & Young report found that “a strong finance-marketing relationship can spell the difference between high-growth organizations and those that stagnate or are left behind.”

Just with their collaboration and participation in the modern workings of the C-suite, CFOs can lend their voice – and drive positive business outcomes as a result.

Strategic financial modeling

Finance teams have always been sitting on a treasure trove of data, including historical and current revenue, funding, business expenses, salaries and wages, real estate, operating costs and the like. Leaders throughout the organization would love to get their hands on this data so they can model out different scenarios.

Historically, it wasn’t just the manual, disparate processes of month-end close that kept data analysis from happening. It was also the tools available to evaluate and manipulate the data. Let’s say the CEO wants to know several scenarios for a 5-year plan to get to $100M in revenue. Each scenario could take several days of eye-crossing work in spreadsheets.

But now, with integrations and data connectors commonly available across platforms, and data platforms that can ingest and analyze huge amounts of data, there’s much less time required for modeling. And it’s a lot easier to make changes and see a different view.

Financial alignment with strategy

CFOs can do a great deal to help the strategic growth of an organization. A common example is a tech startup that wants to quickly increase market share. In order to do so, the company may favor investment in marketing and sales over profitability in the near term. That means finance would map out budgets, allocate resources, and measure performance with growth in mind.

By aligning financials with strategy, CFOs can ensure their teams are contributing to the success of organization-wide goals.

Reclaim time and improve productivity with PEX

The work of finance teams has grown infinitely complex in recent years and the systems they use have failed to keep up with the pace of change. The results are heaps of repetitive, manual work, the loss of spending control and limited to zero visibility into financial operations.

Not only do these problems cost organizations in terms of low productivity and higher costs, they make it incredibly difficult for finance leaders to make space for any sort of strategic guidance for the business. CFOs are stuck in the cyclical processes of month-end close.

To break free from these constraints, finance teams need a solution that provides automation, control and efficiency. By automating key processes, establishing clear spending controls and centralizing oversight, PEX empowers finance teams to reclaim their time and focus on what matters most.

Imagine what your team could achieve with an extra 10+ hours every month. Or imagine a month-end close that’s not a marathon but a simple, efficient process.

With PEX’s expense management platform, powered by AI and automation:

- Automate your month-end reconciliations, freeing up hours once spent on manual tasks like chasing down receipts, adding GL codes and matching transactions.

- Control spending with customized spend rules and approval workflows, ensuring that every transaction stays within your policies, giving peace of mind to both administrators and employees.

- Efficiency is boosted through centralized oversight, allowing finance teams to manage all accounts from a single platform, making it easier to track, reconcile and report financial activity.

By taking advantage of PEX’s robust platform, CFOs can rest easy in the knowledge that month-end reconciliations are taken care of, employees are spending within their approval window and finance staff can easily view everything they need. With that peace of mind, they can shift their thoughts to collaborating with the rest of the C-suite, modeling a variety of financial scenarios and aligning finance with overall business strategy.

Chris Lothrop, General Manager of the Lothrop companies, said it best:

“Tech solutions [like PEX] have really allowed us to maximize our resources by augmenting the capabilities of our administrative staff. Keeping things simple, focusing on reliable and cost effective, but also high impact, cannot be overstated.”

Want to learn how PEX’s expense management platform can help you save 10+ hours every month? Contact us today for a customized demo.

Similar resources

Opinions, advice, services, or other information or content expressed or contributed here by customers, users, or others, are those of the respective author(s) or contributor(s) and do not necessarily state or reflect those of The Bancorp Bank, N.A. (“Bank”). Bank is not responsible for the accuracy of any content provided by author(s) or contributor(s).