New mileage reimbursement and AI features simplify expenses

Managing expenses and reimbursements can often be a daunting task, but with PEX’s latest automated features, we’re here to make your spend management process simpler and more efficient. Let’s explore how these innovations can help streamline your financial operations.

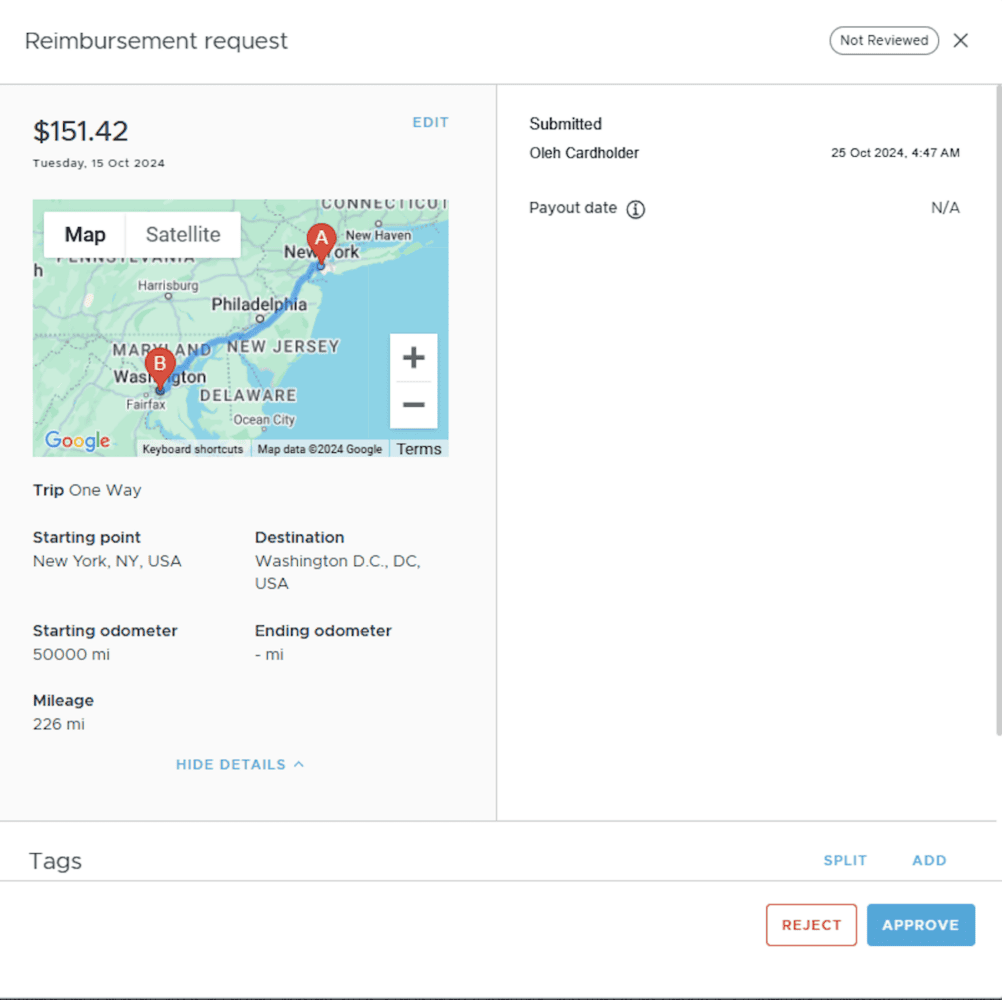

Submit mileage reimbursements for business travel

By popular demand, Cardholders can now easily request mileage reimbursements for their business travel directly through the PEX app. Simply enter key trip details, including the travel date, starting and ending destinations, or your odometer reading. PEX will automatically calculate the payout based on a fixed rate set by your Admin, sending the approved funds directly to your personal account. Currently available on the web, and mobile support will be coming soon. If you’re interested in mileage reimbursements and they aren’t yet available, please reach out to your customer success manager.

Never run out of funds: Low-balance transfers for Prepaid PEX accounts

Don’t let running out of funds disrupt your plans while on the road. With our new Low-Balance Transfers feature, admins can set up automatic ACH transfers whenever your PEX account balance drops below a certain threshold. This ensures your account stays funded without the need for manual action, giving you peace of mind. Learn more here.

Auto sync rebates into QuickBooks Online

If you’re using QuickBooks Online, you’ll love this new feature. Customers can now sync rebates earned on PEX Visa® Prepaid Cards and PEX Visa® Commercial Cards directly into their accounting platform. To activate this, simply navigate to the Apps tab, launch QuickBooks Online, edit the Connector, and toggle on rebates. For detailed instructions, check out our guides for Prepaid Expense Customers and Credit Customers.

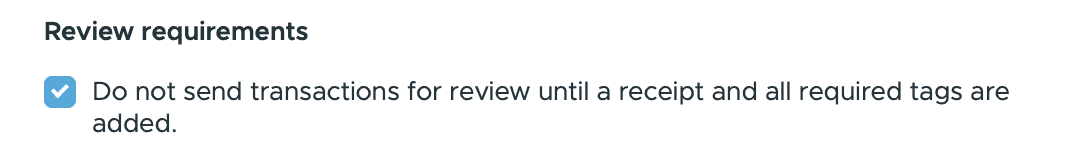

Set review criteria for transactions ahead of time

We understand that an Admin’s time is precious. That’s why we’ve enhanced our platform with Review Requirements, allowing Admins to set specific criteria for transactions that need to be reviewed. This could include tags or receipts. To set this up, go to the PEX dashboard, click on the Business Settings tab, and select the Review requirements checkbox. More info here.

Request card unblocking

As an Admin, having control over the card activation process for your cardholders can be valuable. For example, you might want to keep cards active only during a business trip for certain users. If a PEX card is blocked due to a missed receipt submission in line with your Admin policy set in Auto Enforcer, the Card Unblocking feature offers a solution. Cardholders can now submit real-time unblock requests to Admins. Learn more about Creating and Approving requests.

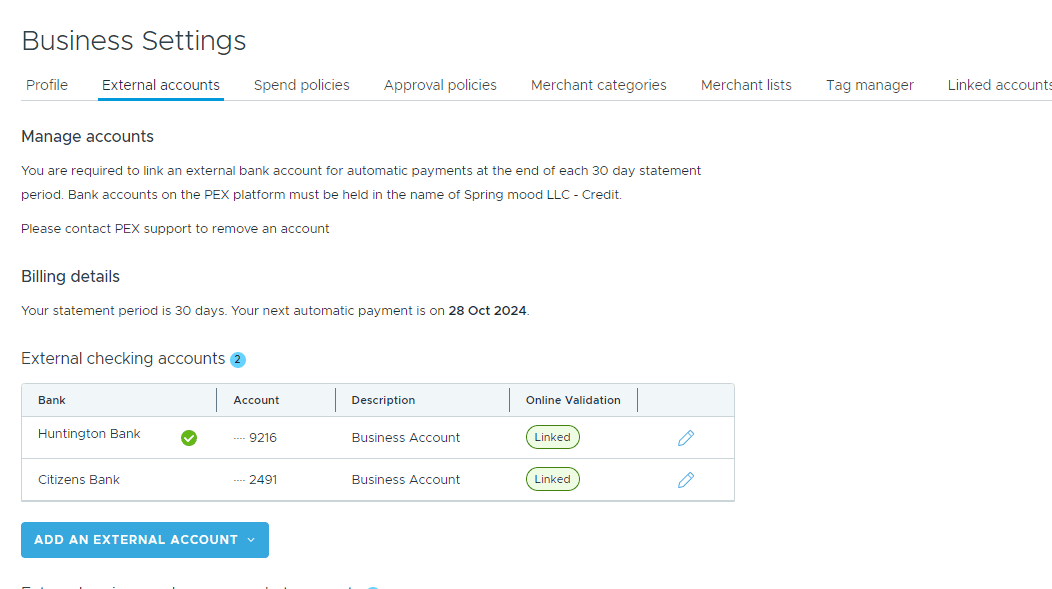

Relink external accounts faster than ever

Customers using an external bank account for Same Day ACH transfers or our Credit Expense product will now experience enhanced stability. Relinking your external bank account through our third-party partner, Plaid, is now simpler than ever.

Credit Expense now available in New Mexico and South Dakota!

Exciting news for residents of New Mexico and South Dakota! You can now access PEX’s Credit Expense product. Learn more and get started here.

Coming Soon: Advanced approval workflows

Thanks to your valuable feedback, PEX continues to enhance our Approval Policy capabilities. We previously introduced the ability to set workflows based on threshold, tag, or group. Soon, you’ll be able to create even more complex rules tailored to fit your specific business needs.

Coming Soon: Intelligent tags with AI

PEX is expanding our AI capabilities to make coding transactions easier than ever. Soon, Cardholders and Admins will receive tag suggestions based on popular tags used in the past. Suggested tags will appear at the top of the dropdown list, streamlining the coding process for everyone involved.

With these new features and improvements, managing expenses and reimbursements has never been easier. If you have any questions or would like to learn more about how PEX can simplify your spend management, feel free to reach out to your customer success manager today!

Similar resources

Opinions, advice, services, or other information or content expressed or contributed here by customers, users, or others, are those of the respective author(s) or contributor(s) and do not necessarily state or reflect those of The Bancorp Bank, N.A. (“Bank”). Bank is not responsible for the accuracy of any content provided by author(s) or contributor(s).