Automate your financial workflow with AI-powered features & time-saving tools

2025 is already off to the races at PEX, with new features highlighting enhanced AI for receipt matching and bulk actions to save even more time as you manage your daily workflow. If you’re not taking advantage of these recently released features, you’re missing out! Plus get a sneak peak at features coming soon and an opportunity to get early access to our new intelligent tagging tool coming in Q2. Join the beta to try it first.

Our Q1 webinar was a success with over 600 attendees.🎊 Catch-up on the latest product releases, plus, see what’s coming to PEX in 2025. Watch the webinar here.

Level up your tagging game

Filter & bulk tag GL accounts

PEX has expanded its capabilities with a powerful new feature—filtering by tag values. This enhancement allows admins to quickly sort and locate transactions with greater precision.

In addition, PEX now offers the ability to bulk apply tags to multiple transactions at once. This game-changing feature streamlines workflows, making it easier than ever to manage multiple projects with efficiency and ease.

Watch the how-to video here.

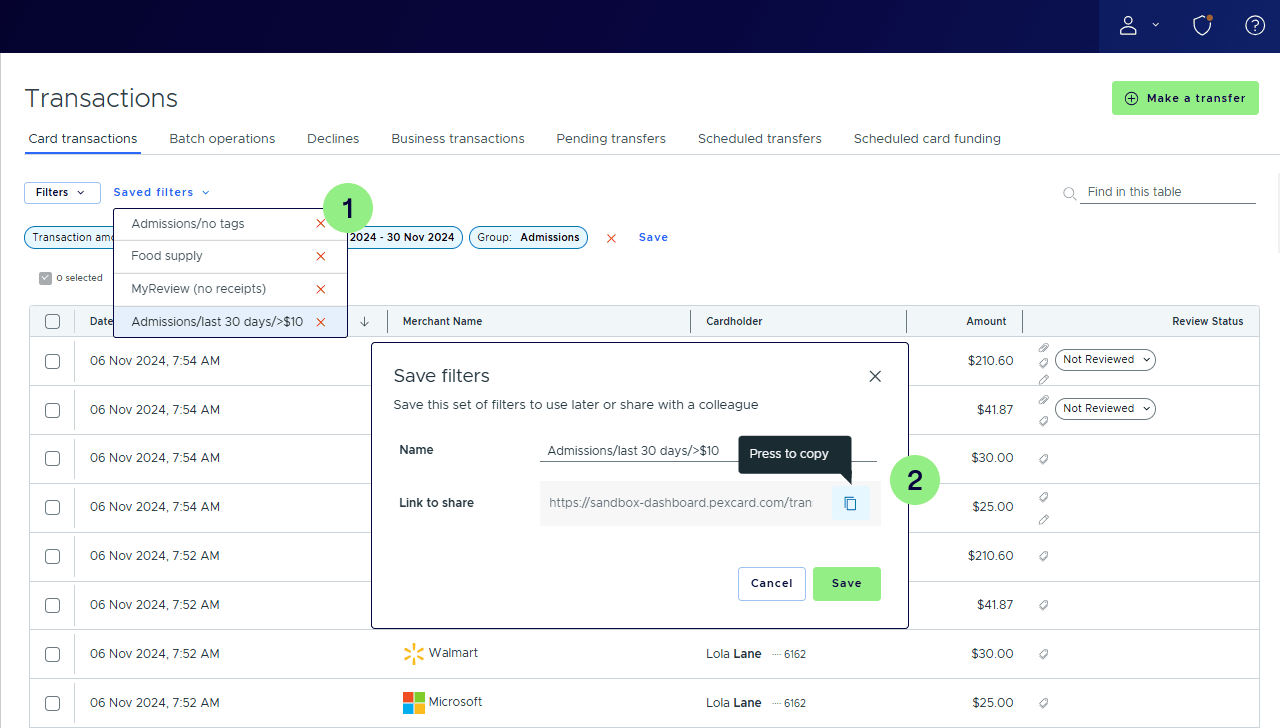

Share saved searches

Admins can now create and save filters directly from the transactions tab. Apply filters, name your search and access it anytime under “saved filters.” You can also share these with your team via a link that instantly applies the same filters to their transaction view—streamlining workflows and saving time.

Add AI to your daily workflow

Advanced receipt matching logic

PEX continues to improve its AI-powered receipt matching capabilities. Now, PEX can automatically categorize up to 90% of transactions with 100% accuracy. This latest enhancement will try to rematch any receipts that weren’t automatically matched based on typical settlement times for a particular merchant. This will be most helpful for PEX purchases made at merchants including Amazon, hotels and airlines / travel agencies.

For these purchases, admins may see a “Waiting for a match” message, which means PEX is waiting for your transaction to appear in order to auto-match it. Admins can hover over the clock icon to see the next scheduled attempt for auto-matching.

The bottom line: We’re getting you closer to 100% of receipts being matched without any manual work.

Improved capabilities for email receipts to PEX

Mid 2024 we rolled out a program called ‘Email to PEX’ making it easier for cardholders to submit receipt images to [email protected]. We have improved the AI reading & matching capabilities and now support multipage receipts via email for vendor invoices.

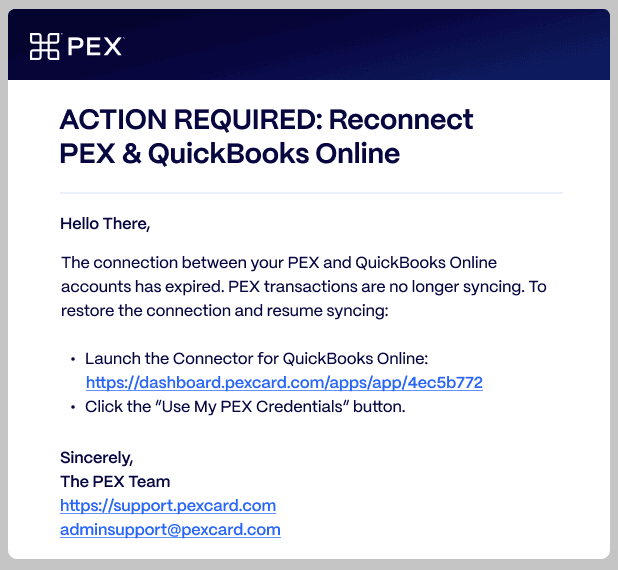

Automated account re-linking alerts

This new feature will automatically notify admins when your account is unlinked from a third-party accounting software. The admin email associated with the account will receive an email with easy instructions to reconnect PEX with your accounting app. This is available for Quickbooks and more.

Coming soon: intelligent tags, out of policy management and more

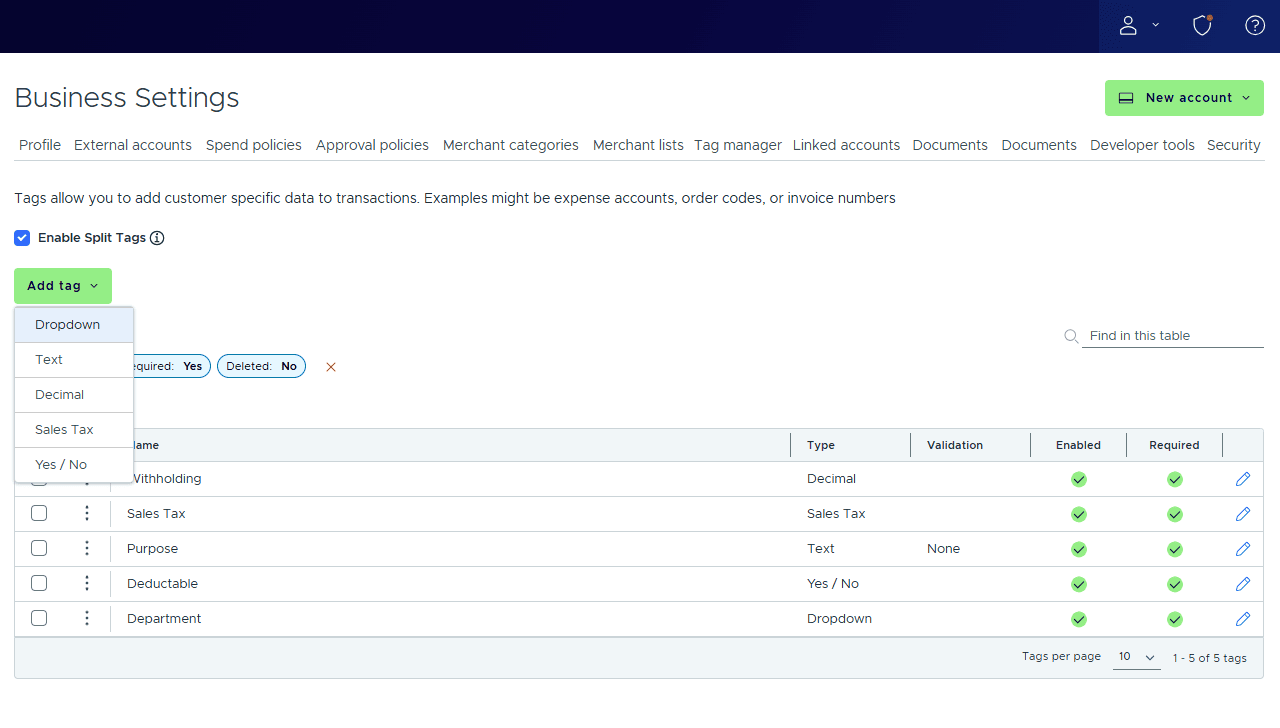

Intelligent tags

The PEX team has been working hard to improve tag experience from start to finish. Last month, we showed you how admins can now filter by tag value on the transaction screen. Now, setting up tags is easier than ever. The new and improved tag manager page makes it easy to sort tag values, multiselect to enable/disable tags and view which codes are limited to cardholder groups – all with a faster speed to load pages with many code values.

PEX is infusing AI to pre-categorize transactions based on past tagging behavior. If you’re already a customer, learn more about this feature and participate in the BETA here.

Streamline vendor management

We know managing vendors is a consistent part of your day to day so we’ve made some improvements. PEX corporate card delivery is a seamless way to issue card payments quickly and securely. This is just the beginning — coming soon, expanded back-office capabilities will provide even more control and flexibility in vendor management. Stay tuned for more updates.

Out-of-policy rules

Approval policies are crucial, but exceptions can sometimes cause delays. Currently, auto-approval by dollar threshold is available to bypass approval rules. Soon, we’ll be introducing out-of-policy rules, giving you a streamlined way to handle critical approvals while retaining full control. This ensures smoother workflows, eliminates unnecessary delays and keeps your business processes running seamlessly.

Want to learn more?

Reach out to your customer success manager to explore how these new features can streamline your workflows and improve efficiency. If you’re not yet a customer, reach out to our team for a demo.

Similar resources

Opinions, advice, services, or other information or content expressed or contributed here by customers, users, or others, are those of the respective author(s) or contributor(s) and do not necessarily state or reflect those of The Bancorp Bank, N.A. (“Bank”). Bank is not responsible for the accuracy of any content provided by author(s) or contributor(s).