Digital wallets and virtual cards: Smarter business spending, built for control

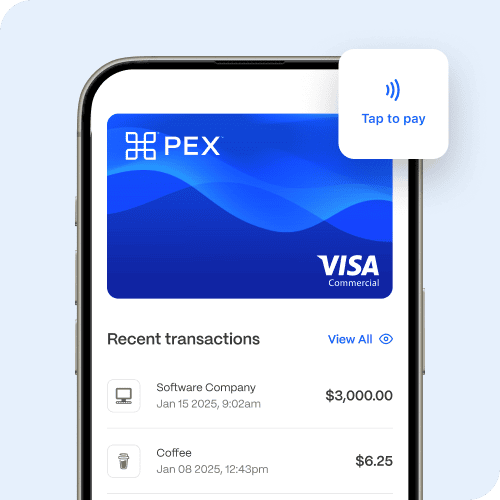

Digital wallets and virtual cards are modern tools that let your team spend safely and efficiently, without relying on physical cards or outdated systems. They’re fast to set up, easy to control and built for teams that need instant access to card solutions without losing control of spend.

Whether you manage travel, vendor payments or recurring software bills, virtual cards simplify the payment process and provide additional rebate opportunities.

What is a digital wallet?

A digital wallet is a secure app on a phone or computer that stores payment information. Your team can use it to pay for purchases without needing a physical card. Apple Pay®, Google Pay™, and Samsung Pay™ are common examples.

Digital wallets are also a great way to store virtual cards in a secure way. Reduce fraud with instant controls to freeze or cancel a card instantly without disrupting other payments. Whether it’s a recurring vendor bill or a one-time use card for a software subscription, digital wallets visibility and control to manage virtual cards.

Why finance teams use digital wallets

- Instantly create and issue cards for immediate spend

- Supports contactless, secure payments

- Enables remote teams to spend without physical cards

- Reduces the risk of lost or stolen cards

What is a virtual card?

A virtual card is a digital version of a payment card that exists only in electronic form. Instead of a physical plastic card, it provides a unique card number, expiration date, and CVV that your team can use for online or in store purchases. It works like a regular card, but with more control and versatility.

Finance teams can create virtual cards instantly, apply spend limits, restrict by merchants, and even set expiration dates. It’s ideal for travel, subscriptions and vendor payments.

Common benefits of virtual cards

- Real-time alerts and spending visibility

- Merchant-locked controls and budget limits

- Built-in fraud protection and instant freeze options

- Custom rules by user, department or project

- Easy reconciliation with ERP integrations like QuickBooks and NetSuite

Where digital wallets and virtual cards help the most

Travel and rentals

Quickly issue virtual cards for hotels, flights or car rentals. Limit spending to travel merchants and get instant insights into who spent what and where.

Best for: construction crews, field teams, nonprofits

Back-office bills

Use virtual cards for reoccurring spend like rent, utilities or software. Each vendor gets a dedicated card, which makes tracking and reconciling easier.

Real life example: Wheelhouse Group, a media production company, implemented virtual cards to eliminate delays caused by physical cards and streamline vendor transactions. Automated spend controls helped the team manage budgets across multiple projects while maintaining oversight.

As a result, they saved over an hour each week on reconciliation tasks and even earned more than $2,000 in rewards on team spend with virtual card rebate opportunities.

Best for: schools, nonprofits, healthcare providers, entertainment companies

SaaS and subscriptions

Prevent surprise renewals and overcharges by assigning a virtual card to each platform. When it’s time to cancel, just deactivate the card.

Best for: tech firms, agencies, startups

Why finance leaders are switching from bank cards to digital wallets and virtual cards

Traditional corporate cards slow down finance teams. Manual reconciliations, shared logins and surprise charges drain time and energy. With many teams prioritizing productivity, automation and financial transparency virtual cards are a clear solution for modern teams.

- Easy to issue digital and virtual cards on demand

- Configurable spend controls that protect your budget

- Real-time insights to simplify reconciliation and reporting

How PEX helps you take the next steps

With PEX you can confidently equip your team with modern tools to create and assign virtual cards in seconds, getting real-time alerts and detailed reporting. Plus;

- Save up to 657 hours annually with automation

- Reduce fraud by locking cards to specific vendors or categories

- Get up to $35K in annual labor cost savings

- Earn 1% back on eligible purchases using PEX Credit Expense

That’s an effective 10.85% ROI, just by switching your team to virtual cards!PEX makes it simple to issue, track and control any type of spend. You stay in control, your team stays productive, and your finances stay clear.

Ready to simplify spend? Get started with PEX virtual cards

What people also ask:

- How do digital wallets work for business?

Digital wallets are a convenient way for team members to keep multiple cards on hand using their mobile device. Digital wallets are password protected with your device, making them a secure method of payment, keeping payments secure and cards out of wallets. - What’s the difference between a virtual card and a digital wallet?

A virtual card is a fully functional digital version of a card (with its own number, expiration date, and CVV) and can be used to make purchases online and in person. Virtual cards only exist electronically, not as plastic. A digital wallet is an app that stores virtual or physical cards, allowing you to make purchases from your mobile device. - Are virtual cards safer than traditional corporate cards?

Yes. Physical cards and shared corporate cards pose a higher risk for fraud or getting lost. Virtual cards are password protected and allow you to instantly create cards and freeze funds at any time, reducing the exposure to risk and fraud.

Similar resources

Opinions, advice, services, or other information or content expressed or contributed here by customers, users, or others, are those of the respective author(s) or contributor(s) and do not necessarily state or reflect those of The Bancorp Bank, N.A. (“Bank”). Bank is not responsible for the accuracy of any content provided by author(s) or contributor(s).