Choosing the right expense management application: A buyer’s guide

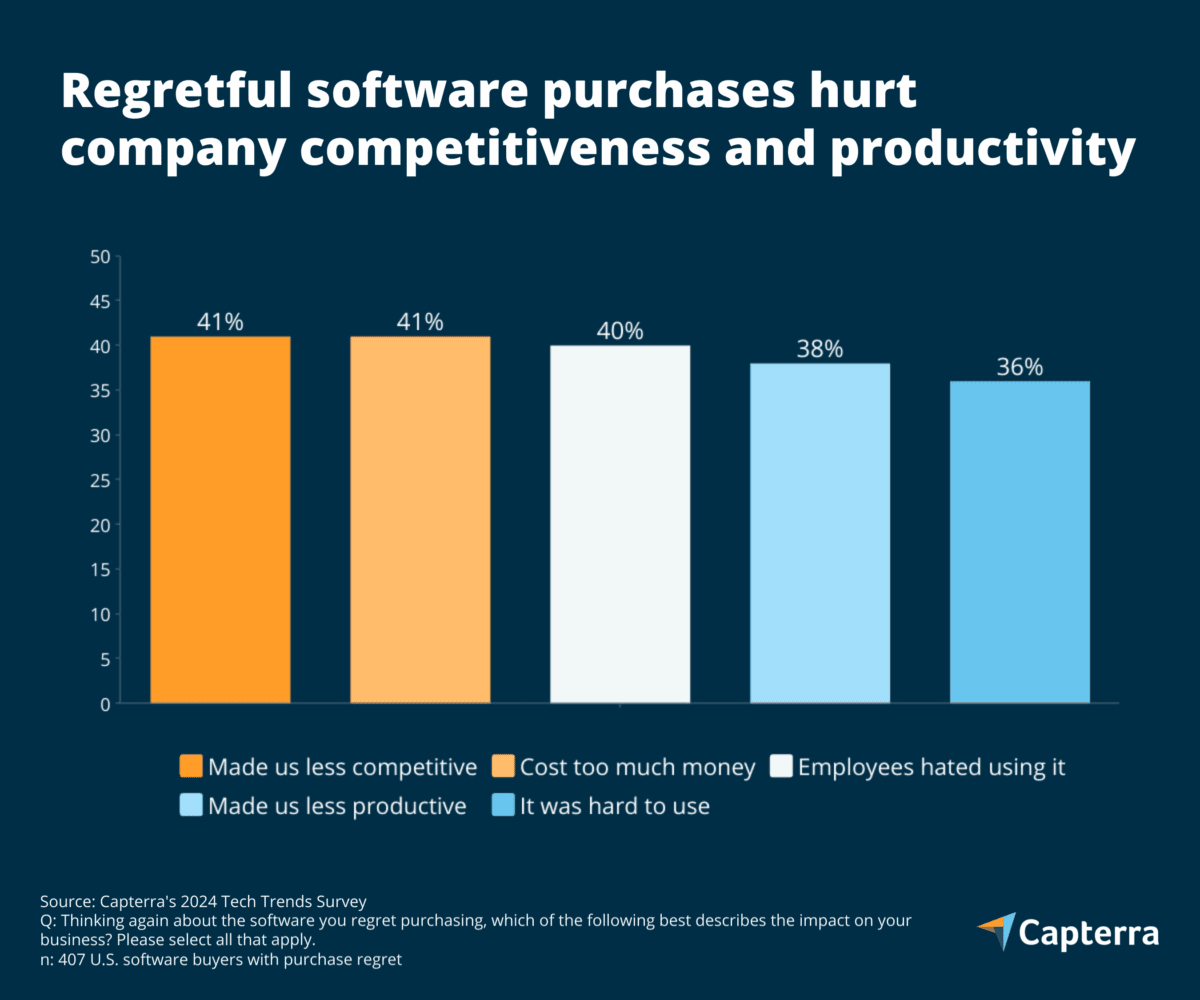

Choosing the wrong expense management software doesn’t just waste money. It costs time, visibility and control. Nearly 60% of U.S. businesses regret at least one software purchase in the past 18 months, and over half say the financial impact was significant or worse.

Here are the most common reasons why these software purchases damage companies:

Source: https://www.capterra.com/resources/us-tech-trends/

With numerous platforms on the market that promise automation and efficiency, it’s no wonder that finance leaders are struggling. They must navigate a complex landscape to find a solution that truly delivers.

This guide aims to cut through the clutter, helping you choose an expense management application that meets your needs, reducing reconciliation time, tightening controls and accelerating your month-end close.

Find the right expense management application in 5 steps

Step 1: Define your goals

You’re considering expense management software for a reason, likely because your current setup isn’t supporting your goals. Whether you’re looking to reduce reconciliation time, control spending or improve financial visibility, define those outcomes clearly before evaluating tools. It’s the only way to make an informed decision.

Maybe the top goal is to allow admins to easily reconcile employee reimbursements without manual changes to payroll or 1-off invoices. Another goal could be to control spending in order to reduce errors and fraud, or to increase financial visibility for key stakeholders. You might even want to increase retention and satisfaction for finance staff by eliminating manual work.

Step 2: Review your current processes

Before evaluating expense reporting software, map out your current expense workflows. What’s working? What’s not? This could mean reviewing your own processes or interviewing your team. Note which workflows run smoothly and which are time-consuming or error-prone.

Regardless of team size, make sure you understand each workflow and the tools you and your team use to complete it. Make a note of the workflows that run seamlessly, those that are painful and time-consuming and those that are just ok.

Step 3: Stack-rank your workflows

Once you’ve reviewed your workflows, rank them by priority. Focus on where your team loses the most time or faces the most friction. For example, if chasing down receipts is a daily hassle, find a software that automates text reminders for every purchase, with easy text to upload. Prioritize tools that solve real pain points without creating new ones.

Review your list of workflows and consider them based on your finance team’s biggest needs. And remember: it’s just as important to understand (and prioritize) the things that are working well as it is to address pain points. You don’t want to make a software purchase that solves one problem but creates another.

As our CEO Toffer Grant recently shared:

“Finance doesn’t need more software—it needs the right one. The best tools don’t replace your process, they clarify it.”

Toffer Grant, PEX CEO

Step 4: Leverage external sources to create a shortlist

With hundreds of platforms to choose from, start by asking trusted peers for recommendations. Look at LinkedIn posts, Reddit threads and review sites like G2 to spot recurring favorites. Then, narrow your list to 3–4 platforms to explore further through demos and deeper research.

For any peers or colleagues who made recommendations, consider a call to understand their specific experience. Schedule demos with each platform and make sure they are tailored to your requirements list. Invite your team so they can provide feedback.

Step 5: Compare your top 3-4 choices

With your shortlist in hand, it’s time to compare options. The table below outlines how PEX, Brex, Ramp and Expensify perform across critical features like automation, spend controls and ROI. Use it to identify the platform that aligns best with your finance team’s goals and operational needs.

| Capability | PEX | Brex | Ramp | Expensify |

|---|---|---|---|---|

| Credit, prepaid and disburse cards | ✔ | 𝗫 – only credit cards | 𝗫 – only credit cards | 𝗫 – only credit cards |

| Unlimited physical cards | ✔ | 𝗫 – limited, delayed physical cards | 𝗫 – limited, delayed physical cards | 𝗫 – limited, delayed physical cards |

| Instant, unlimited virtual cards | ✔ | ✔ | ✔ | ✔ |

| No monthly or annual fee | ✔ | 𝗫 – per card monthly fee for over 5 cards | ✔ | 𝗫 – monthly service plan ($5-$9) required for card |

| Quick & easy setup | ✔ | ✔ – mostly self-service | ✔ – requires several calls | ✔ |

| Intuitive user interface | ✔ | ✔ | ✔ | ✔ |

| Real-time expense tracking | ✔ | ✔ | ✔ | ✔ |

| 24/7 human support | ✔ | ✔ | 𝗫 | Mon-Fri, 9 am to 9 pm ET |

| SMS, email & mobile app receipt capture | ✔ | 𝗫 – only mobile app capture | ✔ | 𝗫 – only mobile app capture |

| AI-based receipt matching | ✔ | ✔ | ✔ | ✔ |

| Automated GL code tagging | ✔ | ✔ | ✔ | 𝗫 |

| Compliance-based card blocking | ✔ | 𝗫 | ✔ | 𝗫 |

| Customizable spend limits | ✔ | 𝗫 – inflexible spend limits | ✔ | 𝗫 – limited spend controls |

| Automated approval workflows | ✔ | ✔ | ✔ | ✔ |

| Integrated expense & mileage reimbursements | ✔ | ✔ | ✔ | ✔ |

| Custom reporting | ✔ | ✔ – dynamic visual reporting | 𝗫 – lacks deep customization | 𝗫 -limited customization |

| Mobile app | ✔ | ✔ | ✔ | ✔ |

| Accounting integrations | included | included | extra fee | Included in paid plans |

| Unlimited administrator accounts | ✔ | ✔ | ✔ | ✔ |

| Multi-entity access | ✔ | ✔ | ✔ | 𝗫 |

| Custom API integration | ✔ | ✔ | ✔ – extra fee | ✔ |

Brex

Brex offers a sleek, user-friendly experience with dynamic visual reporting and fast onboarding. It lacks disbursement and prepaid options and offers limited spend control customization, which can restrict policy enforcement at scale. And it offers an API but with limited functionality. It’s important to note that Brex only serves VC-backed companies and startups with funding.

Ramp

Ramp delivers robust controls, automated insights and cashback rewards. It suits finance teams that prioritize efficiency and granular tracking. However, its rigid workflows, extra fees for integrations and limited custom reporting can make it overly complex and less adaptable for smaller or mid-sized businesses.

Expensify

Expensify is mobile-first and simple to deploy, making it a good fit for teams focused on reimbursements. But limited spend controls, restricted reporting capabilities and lack of scalability with card options make it a weaker choice for organizations that need deeper control and visibility.

PEX

PEX offers credit, prepaid and disbursement cards on a single platform, with instant virtual issuance, advanced spend controls and real-time visibility. Features like multi-entity access, custom reporting and API integration come included, with no surprise fees or charges per seat. And our API can be embedded into software to create custom cards. PEX was previously limited to prepaid card options but in the last few years has launched a robust credit program.

Designed for operational scale and policy enforcement, PEX is a strong fit for finance teams seeking control and ROI, delivering an effective 10.85% return through productivity and financial savings. In fact, 25% of PEX customers save over 10 hours each month, reclaiming time for strategic initiatives. That translates to 657 hours or $35K in annual labor savings for the average team.

- NewCorp, a growing behavioral health provider, chose PEX for both credit and prepaid expenses. By consolidating on one platform, they tightened controls, streamlined operations and eliminated the need for multiple tools

- Southwestern Healthcare, serving thousands of patients across Indiana, improved employee compliance using PEX’s mobile receipt capture. Before PEX, receipt submission hovered around 50%. After implementing the platform, receipt compliance surged to 95%, cutting reconciliation time by days and ensuring audit readiness.

- Artisan Capital Group slashed their reimbursement cycle from two weeks to just two days using PEX’s virtual cards. With over 50 team members managing transactions across 20+ properties, they gained real-time visibility and eliminated the lag of traditional reimbursements—saving hours per week and boosting operational agility.

Make month-end close faster, easier and more accurately with one platform. Centralize with PEX and strengthen your financial foundation. Schedule your custom demo today.

FAQs

What are spend controls, and why do they matter?

Spend controls are rules that limit how, when and where funds can be used. They prevent budget overages and help teams stay compliant.

How do virtual cards help manage employee spending?

Virtual cards can be issued for specific uses or vendors, set with limits and canceled after use, reducing fraud and simplifying reconciliation.

Can PEX integrate with my accounting software?

PEX integrates with QuickBooks, NetSuite, Sage Intacct and more—syncing transactions automatically for faster close.

How do I know if I’m getting a good ROI with PEX?

PEX customers save over 657 hours a year and earn up to $3,600 back annually on spend. That’s a 10.85% ROI compared to the typical 2% offered by traditional cards.

How long does the PEX implementation process take?

With PEX, most teams are up and running in days, not weeks. The onboarding process is streamlined and designed for busy finance teams.

Similar resources

Opinions, advice, services, or other information or content expressed or contributed here by customers, users, or others, are those of the respective author(s) or contributor(s) and do not necessarily state or reflect those of The Bancorp Bank, N.A. (“Bank”). Bank is not responsible for the accuracy of any content provided by author(s) or contributor(s).