Leveraging PEX for automated reconciliation and reporting

It’s pretty unbelievable that with the developments in the last few years, specifically in AI, CFOs are still drowning in manual reconciliation work.

In a recent study by Tipalti, over three-quarters of finance executives report that manual work still takes up too much of their team’s time.

And it isn’t just the manual work itself that’s a problem. CFOs and their teams have to do more work with less resources (according to the same Tipalti report). That means smaller budgets and fewer headcount with higher expectations of output. And all while trying to retain staff during a massive accounting talent shortage.

CFOs and their teams desperately need change in the tools and processes they use to perform reconciliation. They are increasingly looking to automation to save time, reduce errors and increase visibility.

How automation transforms reconciliation and reporting

Automation is simply taking work that humans are currently doing and transferring the load to software. Finance teams can build their own automations that connect with existing tools, or leverage external platforms that have built-in automation. Regardless of how you implement it, automation is the key to transforming manual, repetitive reconciliation tasks into streamlined processes.

Increased efficiency and error reduction

The most prevalent problem with reconciliation is a double-whammy: the massive time-suck of manual work, which in turn causes high error rates.

Over three-quarters of CFO respondents in a recent DataRails report said “they have the most manual, labor-intensive role on a day-to-day basis compared to other C-level executives.”

And nearly 90% of finance leaders in Pigment’s the State of FP&A 2024 report are knowingly making decisions based on incomplete or faulty data.

CFOs are spending tons of time on manual work and worrying about accuracy. They may have made errors that require correction later. They could also make recommendations on inaccurate financial data, which can have long-term effects.

Automated processes can address both of these issues by increasing efficiency, reducing errors, and freeing up valuable time for strategic decision-making. Finance teams with lower budgets and/or less staff can get back hours (or even days) per month – allowing them to really do more with less.

Examples of automations that create time-savings and reduce errors are:

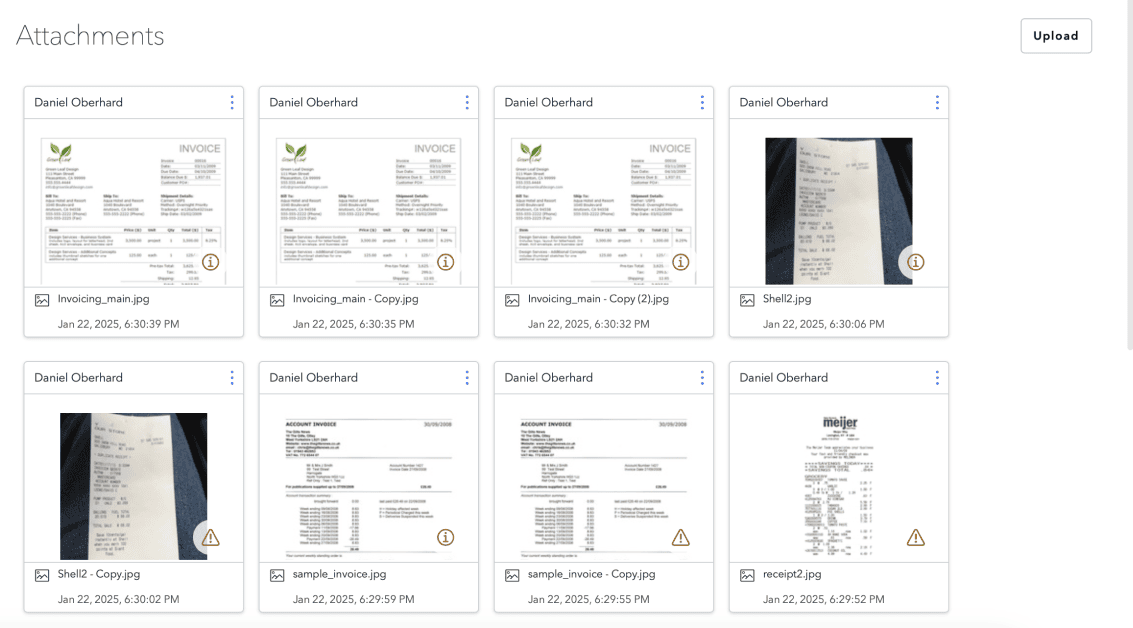

- Automated receipt capture in place of manual receipt chasing – automation can prompt employees to upload receipts and store those receipts in a central location

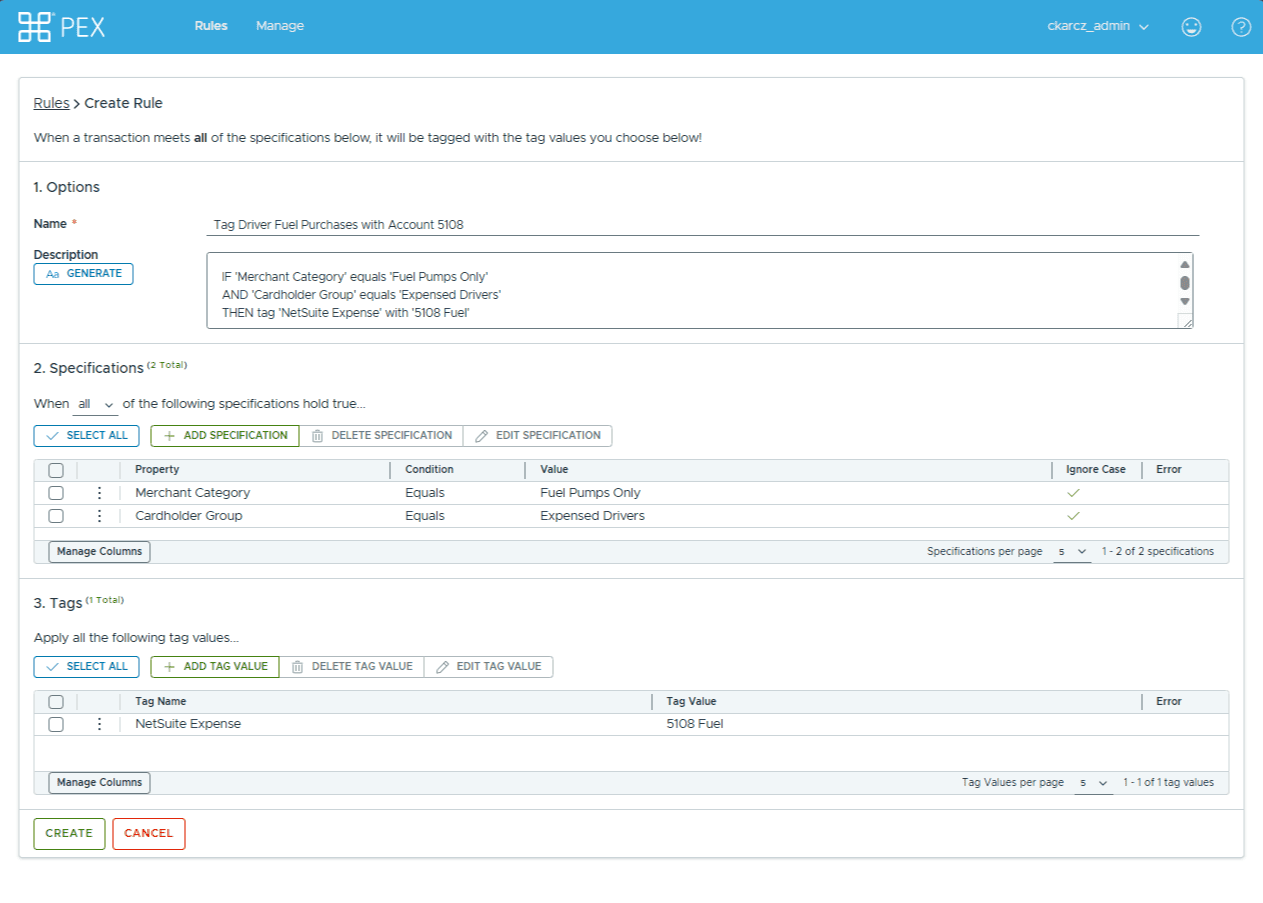

- Pre-programming GL codes per merchant to tag expenses automatically – finance staff can create a master list of GL code-to-merchant mapping. Automated processes use this mapping to tag each purchase with the appropriate GL code

- Automatically matching receipts to cardholder transaction details – automated workflows can parse data on receipts and match it to transaction details on cardholder statements.

PEX’s automations drive real results for customers. By automating receipt capture, GL code tagging, and ERP syncing, Family in Christ Community Church reduced their reconciliation time from 5 hours to 20 minutes per month. First Baptist Church of Argyle saved 5 hours per month on receipt chasing and manual expense processing.

Real-time visibility

Another big issue for CFOs and their teams is visibility into financial data. According to the Economist’s report, “The Strategic CFO in a Rapidly Changing World,” nearly two-thirds of reporting CFOs say they don’t have total visibility into their organization’s transactions.

When you’re manually entering hundreds of receipts and GL codes, there’s not much time left over to analyze spending patterns. And even if there was, manual data entry takes so long that by the time you’re finished, you’re only able to get a historical view.

By leveraging automation, CFOs can suddenly access data in real time. All that formerly manual work is done instantaneously through automation. When finance leaders can view spending while it’s happening, they can identify spending patterns, course-correct in the case of overspending and make recommendations on current (rather than historical) spend data.

Chelsea Williamson, Office Manager at KnightVest Management, had this to say about her experience using PEX: “I like how everything is very transparent. You can see in real-time who is spending what and where it is going.”

A 360-picture of financial data

At PEX, we talk to CFOs and their teams every day. There’s another big issue that comes up in most conversations, which is the data-syncing process between ERPs and external platforms.

Finance staff will sometimes keep track of spend data in a spreadsheet, or maybe a platform that doesn’t integrate with their ERP. In those cases, a team member will have to download the data in question, format it to meet the ERP’s requirements, upload it to the ERP and check to make sure the upload was processed correctly. This process can take hours at a time. As soon as it is done, it’s out-of-date.

With a pre-built connector or integration, an automated process can pull a data set and upload it to an ERP (like NetSuite or Quickbooks) automatically. Accounting data is regularly updated with transaction details, giving CFOs and their teams a centralized data set in one location – making reconciliation much faster and easier.

Wheelhouse Group saved 4 hours per month on reconciliation work through PEX’s integration with their accounting partner, GreenSlate.

Simplify your monthly reconciliation with PEX

With PEX, CFOs and their teams can upgrade to automated reconciliation to increase efficiency, slash errors, and get real-time visibility into financial data. Learn how the PEX platform can reduce your team’s manual efforts and free up time for strategic planning. Contact us today for a customized demo.

Similar resources

Opinions, advice, services, or other information or content expressed or contributed here by customers, users, or others, are those of the respective author(s) or contributor(s) and do not necessarily state or reflect those of The Bancorp Bank, N.A. (“Bank”). Bank is not responsible for the accuracy of any content provided by author(s) or contributor(s).