Streamline end of month with automated expense reporting

Tired of feeling like you’re wasting hours each week on tedious expense reporting? Automated solutions may be the answer.

With all of the AI tools out there, it’s hard to tell what’s all “buzz” and what’s actually worth the hype. At PEX, we’re focused on making life easier, by freeing up the time normally spent on repetitive tasks (like chasing down Jimmy from Sales for receipts after every event) and giving you more time to focus on strategic work. That includes giving you smarter ways to categorize expenses, build reports, and reconcile spending – all the things you love to hate (and for good reason).

In this post, we’ll explore how PEX’s expense reporting features, including AI-powered recommendations and report filtering, can help your finance team save hours each week.

Say goodbye to manual sorting: Automated expense reporting just got smarter

We know that monthly reporting can feel like Groundhog Day. Chasing down receipts and figuring out which expense is missing is repetitive, manual and a drain on your team’s time. Plus, constantly switching between tools can eat up valuable hours that could be better spent on strategic initiatives.

At PEX, we’re making that easier. We’ve introduced new custom reporting capabilities in PEX that make it easier than ever to generate custom, filtered expense reports tailored to your team’s needs.

Streamline reporting for multiple teams and projects

We know that managing expenses across diverse teams, projects, and cost centers is a challenge for many organizations. Now you can create custom report filters based on tags, allowing you to quickly pull reports for specific departments, initiatives, or spending categories.

Rather than piecing together data from multiple sources, you can generate comprehensive reports directly from the PEX platform. This means your finance team can efficiently track and reconcile spending for each business unit, project, or expense type – all with just a few clicks.

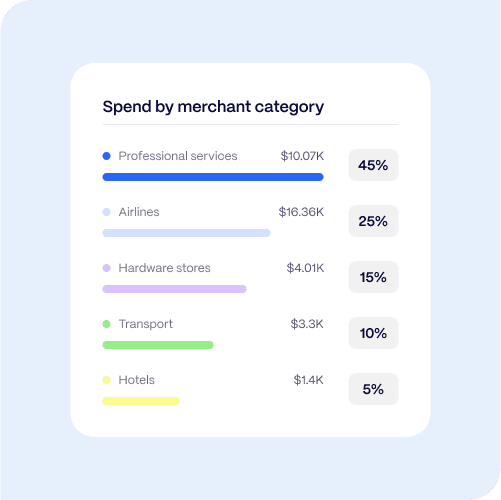

Get visibility into spending patterns

With custom tags and filters, you get more than a report, you get answers through “a single pane of glass.” That means you don’t have to search through five different tools to find the answers you’re looking for. Drill down into specific cost centers or budget categories to uncover trends and identify opportunities for optimization to make more informed decisions.

For example, you can quickly generate a report to see all travel-related expenses across the organization, or view a breakdown of marketing spend by campaign. This reporting empowers you to better understand your company’s financial health and allocate resources accordingly.

See how PEX’s enhanced reporting capabilities can significantly streamline your monthly close and reduce the time it takes to generate custom reports.

Whether you’re managing expenses for a single department or overseeing a complex, multi-faceted organization, PEX’s custom reporting features empower you to work smarter and focus on the big decisions.

In case you missed it

Automating your workflow starts with connecting to your accounting platform. Explore PEX’s updated integrations page to see the 50+ available platforms to integrate with your tech stack.

Automating expense categorization with AI

Repetitive tasks like expense categorization and GL coding slow everyone down. But by harnessing existing data, these manual processes can be streamlined and automated.

Coming soon…

Our latest AI-powered feature analyzes historical expense data to provide intelligent recommendations for categorizing new transactions. The system can automatically suggest the appropriate GL code or expense category based on factors like the team making the purchase, the type of expense, and any attached receipts or invoices.

You set the categories. PEX matches it to the transaction.

The more you use it, the smarter it gets. With these intelligent recommendations built in, you speed up reconciliation, reduce errors, and free your team to focus on work that matters. Improve the reconciliation rate and speed up your end of month with AI-powered suggestions.

Get early access to the beta to speed up your end of month.

This AI-powered feature unlocks several key benefits for finance teams:

- Enhanced efficiency: By auto-populating expense categories, the system can save team members up to 3 hours per week on manual coding tasks. Freeing up time to focus on higher-level financial analysis and strategic initiatives.

- Fit seamlessly into existing processes: Finance leaders can configure their organization’s unique GL codes, expense policies, and reporting requirements. AI-powered suggestions will learn from previous transactions and match expenses based on the organization’s unique coding rules.

- Data backed decisions: Finance teams gain enhanced visibility into spending patterns and trends across the business–empowering teams with more data to inform their decision-making.

With PEX, finance teams can transform repetitive monthly tasks into a streamlined, automated process. With intelligent expense categorization, your team can work smarter, not harder, to close the books faster and focus energy on high-impact initiatives.

How automated expense reporting can save you time

The Wheelhouse team had a dilemma when they came to PEX looking for an expense management solution–streamline reporting and control spend for their whole team.

After creating a PEX account, they were able to create cards and set up spend rules for different teams based on their budget, MCC category or even vendors. With these rules in place the team was able to set up custom categories to track spending by department, project, or other criteria. This makes it easy to generate reports and enforce reimbursement policies.

These features, along with their automated workflows with GreenSlate, combined saved the team 4+ hour each month on reconciliation tasks, helping them close the books on time every month. See the full case study here.

The bottom line

With PEX intelligence driven solutions, teams are more empowered than ever to streamline their workflows and automate repetitive tasks, leading to increased efficiency and cost savings.

Already using PEX? Schedule time with your CSM if you have any additional questions.

Or, are you ready to learn more about automating your expense management system? Book time with our sales team to learn more about how you can automate your end of month.

Similar resources

Opinions, advice, services, or other information or content expressed or contributed here by customers, users, or others, are those of the respective author(s) or contributor(s) and do not necessarily state or reflect those of The Bancorp Bank, N.A. (“Bank”). Bank is not responsible for the accuracy of any content provided by author(s) or contributor(s).