A smarter guide to employee expense reimbursement

Manual employee expense reimbursement processes sorely need an overhaul. Look no further than the myriad horror stories online and you’ll understand why.

Employees are frequently forced to use personal funds for reimbursable expenses, carrying the debt until expense reports get paid. In one example, an employee on a 3-week business trip had to request a credit limit increase to cover $10K worth of business expenses on their personal card. If the employee couldn’t cover the balance, they could rack up huge interest fees as a result.

And it isn’t just employees that are suffering from outdated expense reimbursements. Finance teams feel the pain too, frequently from employees submitting personal purchases as business expenses. One CFO reported $15,000 in “Covid medical relief” – for a purchase of windsurfing gear. Another shared a founder submitting their wedding and honeymoon as a business expense. The accounts are just unbelievable.

These examples are just the tip of the iceberg. In addition to the financial burden on employees and egregious, unapproved spend for finance teams, manual reimbursements waste time, strain cash flow and frustrate employees and finance teams alike.

Common problems with traditional expense reimbursements

Lost productivity

Manual reimbursement processes are incredibly time-consuming. An employee making business purchases might use cash or their own personal card. They’ll have to keep track of paper receipts and manually fill in a spreadsheet to submit expenses for reimbursement. With the average expense report taking 20 minutes to complete, this process could rob the employee of several working hours per week.

Finance teams lose time on the other end of the equation. They’re stuck chasing paper receipts, GL codes and transaction details when those items are missing from expense reports. After that, they’re requesting approvals and reimbursing employees on a case-by-case basis. All this manual work takes time finance leaders could use on strategic guidance for the business.

High error rates

The scenarios described above are not just manual – they’re incredibly error prone, considering that nearly 20% of expense reports have errors. Employees can mistype amounts on receipts, forget about specific expenses or accidentally duplicate expenses. Finance teams can easily reimburse employees for the incorrect amount. And errors in any of these categories can cause later errors in financial reporting, which can have large downstream effects.

Lack of spending control

With manual reimbursements, employees can purchase and submit any expense. They can buy a bottle of wine at dinner even if alcohol purchases are prohibited. They can exceed spending thresholds for hotel stays in order to increase credit rewards point balances. Finance teams have no control over their spending and only see charges after they happen.

Negative impact on cash flow

With employees making purchases using cash or personal cards, finance leaders have no idea how cash flow is impacted. It might be positive today, but if a huge chunk of expenses come in next week, the organization could suddenly be in the red.

It makes it incredibly difficult to make financial decisions for the business when you have no idea what will happen to your cash reserves. For example, Artisan Capital Group was frequently out-of-pocket for $150,000 due to unpaid reimbursements. After partnering with PEX + SAP Concur, they slashed reimbursement times by 90% – from 6-9 months to 30-40 days.

Low employee satisfaction

Repetitive, manual work can make employees unhappy, regardless of their role. Employee travelers get frustrated by tracking receipts and taking hours to fill out expense reports. These manual efforts are pretty common: almost half of reporting workers spend 25% of their workweek on manual activities. The stress of waiting on reimbursements is another big issue, especially if employees can’t cover the costs and end up with high interest payments.

Finance staff get overwhelmed working on the flip side of the equation. They’re stuck chasing receipts and approvals, processing reimbursements and manually updating accounting software. These processes can contribute to burnout and eventually turnover.

How to reimburse employee expenses with modern tools

Automation increases efficiency and eliminates errors. Expense management platforms are game-changers for finance teams. Automation and AI enable electronic receipt capture in varied forms – email, text and sometimes upload to a mobile app. That process alone gets rid of the headache of tracking paper receipts.

AI tools can eliminate errors by matching data sources for accuracy. Admins can pre-program GL codes into expense management tools. They can build workflows for approval submission and sync data to accounting platforms without manual intervention. All these functions reduce the opportunity for errors at each step of the process.

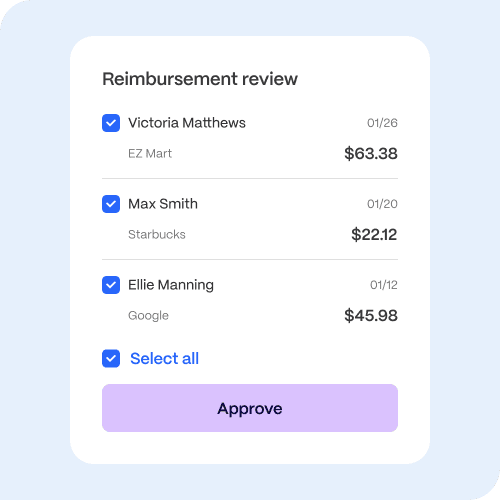

Finance teams can also receive submissions and pay reimbursements (including mileage) via expense management tools, using these same workflows. And these platforms frequently offer a variety of payment options. Finance leaders have the opportunity to shift personal card reimbursements to methods that provide more control and sometimes cash back rewards.

Financial controls create a rigid framework for spending. Finance teams choosing to shift personal reimbursements to corporate cards have access to spending limits that prevent unapproved spend before it happens. They can create rules that limit spending by merchant, location, day and time or department. When employees attempt purchases that are outside the rules, the system blocks the transaction – saving the business money, time and headaches.

Real-time expense tracking creates cash flow visibility. Automation and AI speed up expense workflows so that finance teams can see spending in the moment. That means they can see how much cash is on hand based on today’s spending, and what they’re working with for tomorrow’s financial modeling. And if spending is eating up too much cash or going over budget, they can pivot quickly – changing spending rules or moving funds as needed.

Streamlined operations = happier employees. Removing manual work through automation can contribute to increased employee satisfaction. Let’s say you’re a finance manager spending a quarter of your time per week, or 10 hours out of a 40-hour workweek, on manual expense management. Because of the heavy load, you’re having trouble completing your core work, which causes you to work overtime.

If automation drops that time to 1 hour per week, imagine what you could do with the extra time and headspace. And if the company gives employees access to corporate cards, so they don’t have to carry the expense load on their personal cards, financial stress levels will drop significantly.

How PEX simplifies employee expense management

With PEX, finance teams can take advantage of our automation and AI features to streamline financial operations. Our AI-based receipt matching, pre-programmed GL codes, electronic receipt capture and automated workflows reduce the administration burden of expense management.

Custom spend rules and approval workflows put policy enforcement on autopilot. Access to real-time expense tracking data empowers finance leaders to take control of cash flow and make decisions with confidence. And auto-syncing expense data with accounting systems ensures financial accuracy without the manual lift.

We also offer a range of payment methods, including prepaid, corporate and virtual cards. Businesses that want to stick with personal reimbursements can use the PEX platform workflows to manage them, for both standard purchases and mileage reimbursements. Or they can choose to sunset personal card usage in favor of one of our card options, depending on the role and spending needs of the individual. PEX customer First Baptist Church of Argyle issued corporate cards to both staff and volunteers, which saved them 5 hours per month, created real-time visibility and increased profitability through PEX’s 1% cash back.

These functions combined can save companies up to 657 hours per year on manual work. That equates to a labor cost savings of $35,467 annually, which works out to a 10.85% effective ROI through cash back rewards and productivity gains.

Want to learn how much effective ROI you could earn by migrating manual expense processes to PEX’s automated platform? Contact us for a customized demo.

Similar resources

Opinions, advice, services, or other information or content expressed or contributed here by customers, users, or others, are those of the respective author(s) or contributor(s) and do not necessarily state or reflect those of The Bancorp Bank, N.A. (“Bank”). Bank is not responsible for the accuracy of any content provided by author(s) or contributor(s).