4 reasons why your business needs granular financial controls

Granular financial controls are absolutely essential for successful business functioning. If you don’t believe it, just ask Macy’s.

In November of 2024, the department store chain announced that a team member responsible for the accounting of small package deliveries had hidden roughly $154 million in expenses for almost three years. Questions about the massive breach abound, but here’s the main one:

How did an employee conceal the fact that they “intentionally made erroneous accounting accrual entries” for three years?

While we may never learn the specific answer in this case, it’s clear that the business was operating without granular financial controls. If those controls had been in place, this never would have happened.

What are financial controls?

Here’s the Corporate Finance Institute’s definition of financial controls:

“Financial controls are the procedures, policies, and means by which an organization monitors and controls the direction, allocation, and usage of its financial resources. Financial controls are at the very core of resource management and operational efficiency in any organization.“

This definition encompasses broader financial controls like the segregation of duties, reconciliation, cash flow management and internal audits.

In contrast, granular financial controls go much deeper. They empower organizations to determine the who, what, when and how – which employees have financial data access, when and how they can access that data and what they are allowed to do with it.

For example, individual contributors may have view-only rights of the transactions on their corporate card and/or expense report. Managers may have access to employee expenses, the ability to approve and reject transactions, and a dashboard to track departmental spend. The CFO and other execs will likely have access to everything managers and employees see, plus forecasting capabilities to create different budget scenarios.

Why are granular financial controls so important?

Fraud is a huge problem for businesses worldwide, with organizations reporting that they “lose 5% of their revenue to fraud annually.“

By determining upfront which employees have specific privileges in terms of financial data, businesses can prevent fraud from occurring. Limiting individual contributors to read-only access, for example, can keep funds from disappearing or being misappropriated.

In addition, lack of compliance with industry-specific regulations, accounting standards and expense policies can have wide-ranging consequences. Regulators can slap organizations with big financial penalties. Lawsuits can drain businesses with litigation fees. Organizations suffer financially if cash flow isn’t managed properly.

Granular financial controls ensure compliance by dictating regulatory reporting standards and creating a rigid, pre-programmed framework for corporate spending – so there’s no way to overstep.

Putting these types of controls in place requires automation, which allows organizations to define controls upfront. With privileges set by user, department and timeframe, for example, the system dictates access – not the individual. Granular financial controls increase efficiency by removing the manual burden from finance staff and employees.

With these controls in place, finance leaders feel confident in their data and are empowered to make informed financial decisions. They can step back from formerly manual finance work and provide strategic guidance to the business.

4 ways businesses use granular financial controls

Preventing fraud

Using granular financial controls, finance teams can pre-program a list of approved and unapproved merchants for specific cardholders or cardholder groups. This merchant-specific coding can stop unauthorized transactions from occurring.

They can also set spending limits per cardholder to prevent overspending, for example, on corporate employee travel. And by leveraging virtual cards for set SaaS subscriptions, they can block surprise vendor charges – rather than having to argue about them later.

They can also determine the access rights for each employee to reduce errors. For example, if the Macy’s employee had read-only access to accounting journal entries, they wouldn’t have been able to enter incorrect accounting journal entries and hide charges.

Ensuring compliance

Granular financial controls can take the weight off of individual finance staff and stop making them the bad guy. Instead of finance teams chasing receipts, they can create controls that block card usage until receipts are submitted. They can also automatically apply GL codes to transactions instead of having employees do it manually.

Creating approval workflows per employee or team ensures that the appropriate managers review expenses – and approve or reject them accordingly. And syncing tightly-controlled expense data with accounting software means finance staff can discontinue time-consuming, manual data checks.

Many accounting platforms have built-in reports for highly-regulated industries. That means there’s no manual manipulation in spreadsheets. Once the data is available, finance teams can review reports for any exceptions and send them to regulators and board members when ready.

Increasing efficiency

By taking these manual processes and pre-programming them into an automated system, finance staff can take the work they are doing repeatedly and just do it once, upfront.

Instead of chasing down receipts and GL codes, hounding managers for approval, matching receipts to card transactions and arguing with employees about unapproved purchases, they can create a framework and let automation do the rest.

Leveraging automation allows finance teams to scale without increasing headcount. In the manual scenario, a finance team might need to budget for 1 new headcount per 50 employees. With automation, the organization scales based on automated processes – not the number of finance staff.

Making informed financial decisions

According to Pigment’s The State of FP&A 2024 report, almost 90% of responding finance leaders are “making monthly decisions they know are based on inaccurate or incomplete data.“

With granular financial controls, it doesn’t have to be that way. Employee access is configured upfront. Rigid spending controls are pre-programmed into the system. Manual work is a thing of the past, freeing up time for finance teams and eliminating the opportunity for errors.

Knowing these granular controls are in place gives finance leaders confidence that accuracy is high and errors are virtually non-existent. They have increased confidence in the decisions and recommendations they make to drive the organization’s growth.

Best practices in building granular financial controls

Think big picture

Before you start thinking about granular controls, map out your vision for the finance team and its interaction with the company. If you could create the best-case scenario, what would it be? Understanding your vision will help you tie broader goals to more granular financial controls.

Seek external guidance

Leverage your network to ask others in the finance space for feedback on your vision. What’s important that you are leaving out? What’s included that’s maybe not so important? What was their experience like going through this process, if applicable? You can learn a ton from people who’ve done it before.

Evaluate systems and providers

Do you have access to in-house developers who could build automations? Or do you want to start with external providers and see what they have to offer? Either way, create a prioritized list of the types of functions you need to achieve your vision. Review those functions against what’s available – whether that’s in-house or pre-built software – and then decide on which solutions to use.

Communicate your plans

Let employees know how things are going to change before they happen. Sure, they won’t have to think about it because it’s all automated. But it’s still frustrating (and embarrassing) when an employee tries to make an out-of-policy purchase and the card gets declined. Make sure to tell employees multiple times and document all of it in a central location.

Review granular controls frequently

Even after the new processes and systems are live, you’re not done. It’s important to monitor the controls you’ve implemented and update them based on the changing needs of the organization. Maybe you realize that unauthorized spending is still happening because you missed a large merchant category, or a change in finance team functions means that more staff needs oversight/reporting capabilities.

PEX’s granular controls can support your financial vision

With PEX’s expense management platform, our combination of automation and AI provides the granular financial controls you need to drive growth.

Custom spend rules prevent fraud by creating a rigid framework for spending. Features like AutoTagger, Auto Enforcer, AI-based receipt matching and Advanced Approval Workflows ensure compliance while also increasing efficiency. All these functions eliminate manual work and increase accuracy, freeing up finance leaders to make decisions with confidence.

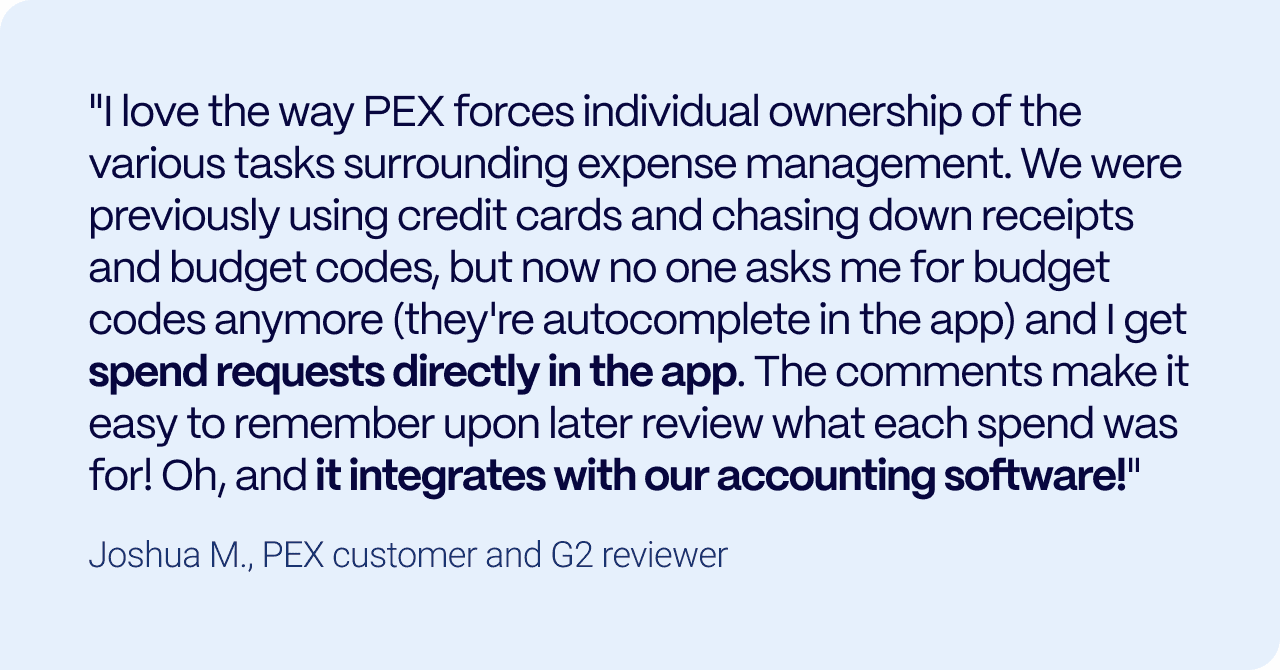

Joshua M., PEX customer and G2 reviewer, shared his experience:

Learn how PEX’s granular controls can apply to your unique financial stack.

Contact us for a customized demo.

Similar resources

Opinions, advice, services, or other information or content expressed or contributed here by customers, users, or others, are those of the respective author(s) or contributor(s) and do not necessarily state or reflect those of The Bancorp Bank, N.A. (“Bank”). Bank is not responsible for the accuracy of any content provided by author(s) or contributor(s).