Your all-in-one expense management platform

Spend, submit, track and reconcile your expenses - all in one place

Trusted by 10,000+ customers

Your all-in-one expense management platform

Say goodbye to spreadsheets, and hello to improved productivity

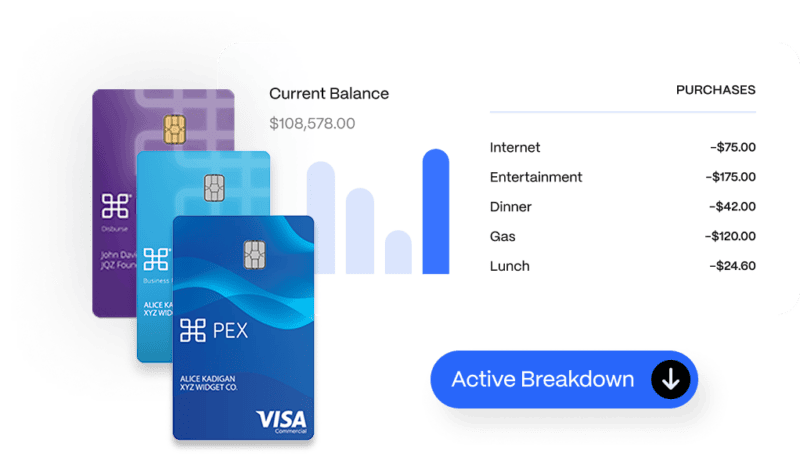

Smart corporate cards

Issue physical and virtual cards with control - set and forget your spend policies and permissions

Automated expense management

Automate approval workflows, auto match receipts using AI, auto tag transactions - and more

Accounting & productivity integrations

Sync transactions to your accounting or productivity software - at no extra cost

Spend visibility & real-time insights

Get real-time insights into company spend - stay in budget and close your books on time

key benefits

Smart spending, bigger rewards with PEX's corporate cards

Automate expense policies

Monitor and adjust spending limits using PEX card management tools

Scale with confidence

Issue physical and virtual cards from PEX - set and forget your spend policy

See and control expenses

Define rules for card usage, approve transactions, and eliminate receipt chasing

Earn rewards

Get up to 1% back2 on qualifying purchases with corporate cards

use cases

Pay vendors, power team travel or use business credit as a flexible financing tool

Back office spend

Preserve cash flow and earn rewards on invoices that accept card payments

Vendor payments

Prevent overspend by assigning virtual cards to specific merchants, like SaaS, advertising vendors, and subcontractors

T&E

Enjoy worldwide acceptance and an easy to use mobile app with AI-powered receipt matching

Per diem

Allocate funds to team members for meals, travel and any other job-related subsidies

Petty cash

Go cashless and pay for small, everyday expenses like office supplies or errands

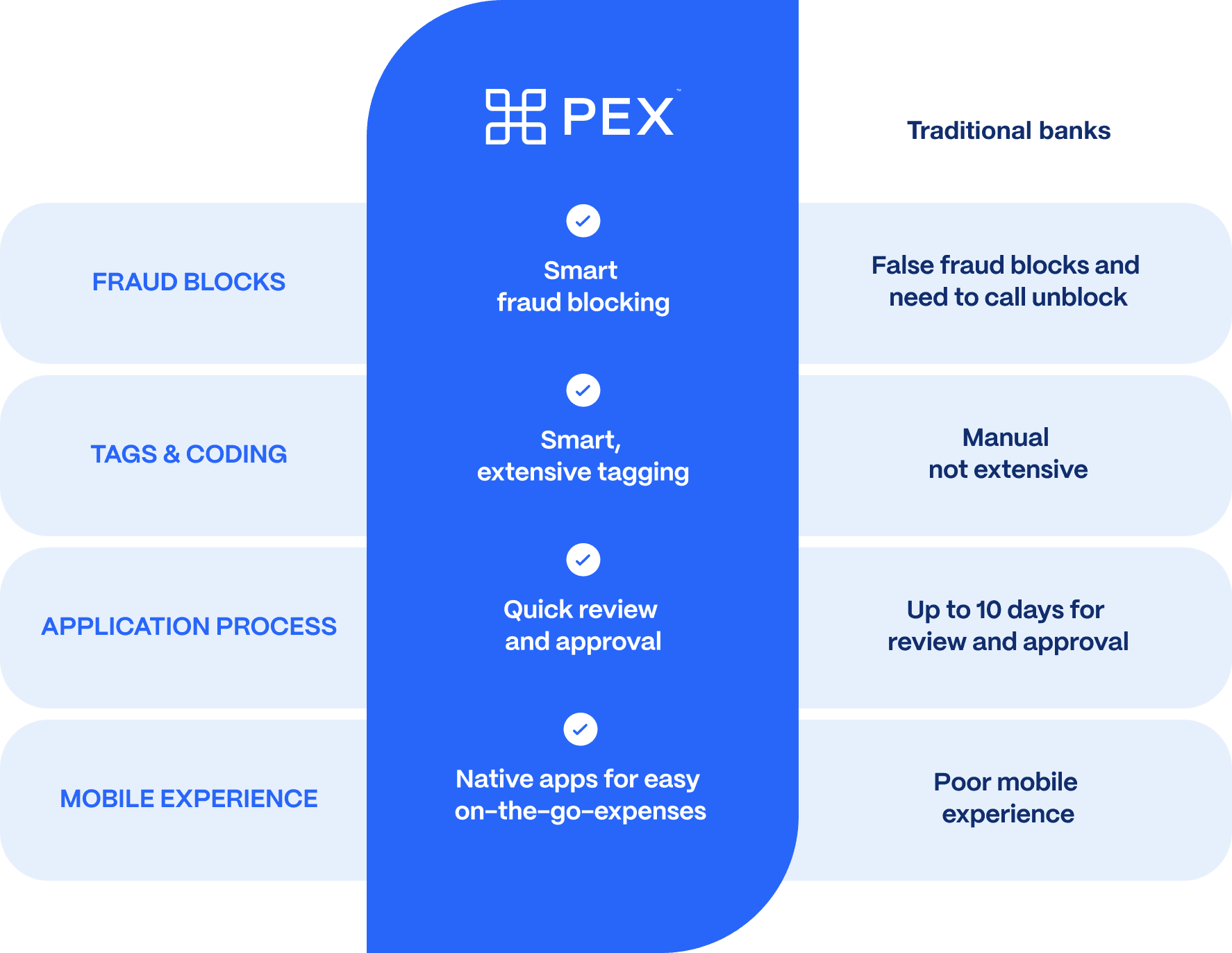

The best corporate card alternative to bank cards

PEX offers a seamless approval process and comprehensive support that traditional banks don’t offer

Integrations

PEX integrates with your accounting software and ERP

Explore our integrations library and discover time-saving applications

Today's modern finance leaders trust PEX

PEX’s intuitive platform and top-rated customer service.

"PEX makes it easy to put funds in employees hands when and where they're needed, yet still limit what can be spent - all from my desk."

Sarah C.

"PEX has been life-changing and easy for employees and employer, from managing expenses and receipts, to integration with accounting."

Darci H., VM West

Ready to get started?

Spend smarter and simplify your expense management process today

1To qualify for PEX’s Credit Prescreen offer, customers must apply and be approved for a PEX Credit Expense Account (“Account”) on or before December 31st, 2025. In order to qualify for the $1,000 rebate, Customers must spend $20,000 USD or more in the first 90 days of opening an Account,. Spend must be on a single Account.

- The $1,000 Rebate for a calendar month will be posted to the Qualifying Customer’s Account within 30 days after the end of the calendar month of their third month since Bank verification.

- Purchases made outside of the US and non-Visa network transactions do not qualify for this promotion. The following transactions are not purchases and will not be eligible for a Rebate: items returned for credit, disputed or unauthorized purchases, fraudulent transactions, any cash or cash-like transactions, fees and charges. We may determine that a transaction is excluded from eligibility for earning a Rebate in our sole discretion at any time. In addition to any other rights of recovery we may have, we will have the right to offset any Rebate amount paid for an ineligible transaction against future Rebate payments.

- If a customer’s Account is closed for any reason, faces any delinquency, or is not in good standing during the calendar month or subsequent month, they will not earn a Rebate. If PEX sees evidence of fraud, misuse, abuse, or suspicious activity, as determined by us in our sole discretion, we reserve the right to take action. This may include, without limitation and without prior notice, any or all of the following: canceling any accrued but unpaid Rebate; reversing any prior Rebate credit made; taking legal action to recover any Rebate made in connection with such activity, including without limitation to recover our monetary losses, any litigation costs and fees, and damages.

- Reimbursements, or purchases submitted through PEX Reimbursements do not qualify for promotions or rebates.

- PEX reserves the right to change the criteria or terminate this Rebate promotion, with or without written notice, at any time in our sole discretion.

2The PEX Visa® Commercial Card is not a credit card.

2PEX requires linking an external business bank account for credit approval & mandatory autopay enrollment. With PEX Credit Expense, repayment of charge card purchases is due in full every seven days at the end of the statement period. A minimum bank account balance is required to qualify. Please view the PEX Master Service Agreement for more information.

© 2007-2025 Prepaid Expense Card Solutions, Inc., All Rights Reserved. The PEX Visa® Prepaid Card, PEX Disburse Visa® Prepaid Card, and PEX Visa® Commercial Card are issued by Fifth Third Bank, N.A., Member FDIC, or The Bancorp Bank, N.A., Member FDIC, pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa Business Prepaid and Visa Commercial Cards are accepted. The PEX Visa® Prepaid Card, PEX Disburse Visa® Prepaid Card, and PEX Visa® Commercial Card are not credit cards. Please see the back of your card for its issuing bank.

The Bancorp Bank, N.A., is issuer of PEX Card products only and does not endorse or sponsor the associated products, services or offers from PEX.