PEX CREDIT EXPENSE

The corporate card for construction that never slows you down

Unlock project cash flow with flexible spending limits and purchasing power at every job site

Trusted by 10,000+ customers

PEX automates manual tasks, saving teams more than 10+ hours per month1

Automate finance team tasks

Customize spend limits and controls

Set limits by cardholder, card, MCC or merchant - plus, enforce day of week or state-based spend limits, and more

Automate

approval workflows

Pre-approve purchases to prevent overspend, or enforce compliance for purchases that already occurred

Get real-time

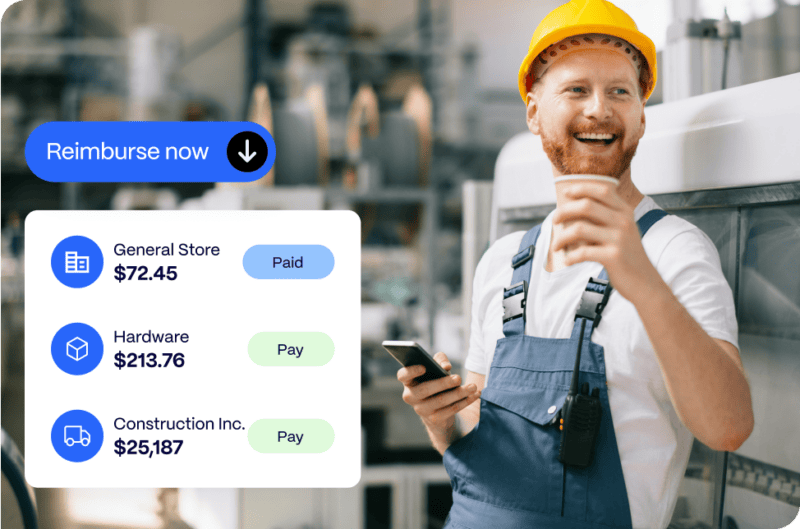

spend visibility

Monitor employee, project or department spend to maintain accurate forecasts and oversight

Empower your crews

Reimburse out-of-pocket expenses

Pay employees back for mileage and non-card spend, directly through the PEX platform

Eliminate the receipt chase

Employees can snap, text or email receipts to PEX, ensuring timely and compliant submission

use cases

Corporate cards for all your project needs

Pay vendors, power team travel or use business credit as a flexible financing tool

Project spend

Preserve cash flow and earn rewards on vendor or subcontractor invoices that accept card payments

Back office spend

Prevent overspend and issue virtual cards to specific merchants, like software and ad vendors

T&E and fuel

Enjoy worldwide acceptance with an easy-to-use mobile app for travel and fuel expenses

Per diem

Allocate funds to your crew for meals, travel and any other job-related subsidies

Petty cash

Go cashless and pay for small, everyday expenses like supplies or errands

Key benefits

Increase your cash flow access without taking on long-term debt

Get up to $2M per month3 in spending power

Issue instant cards for crews and contractors

Stay on budget with pre-defined custom card limits

Earn 1% back* on qualifying

purchases

Save time with AI-powered receipt matching

Get started fast – no personal guarantees or credit checks needed

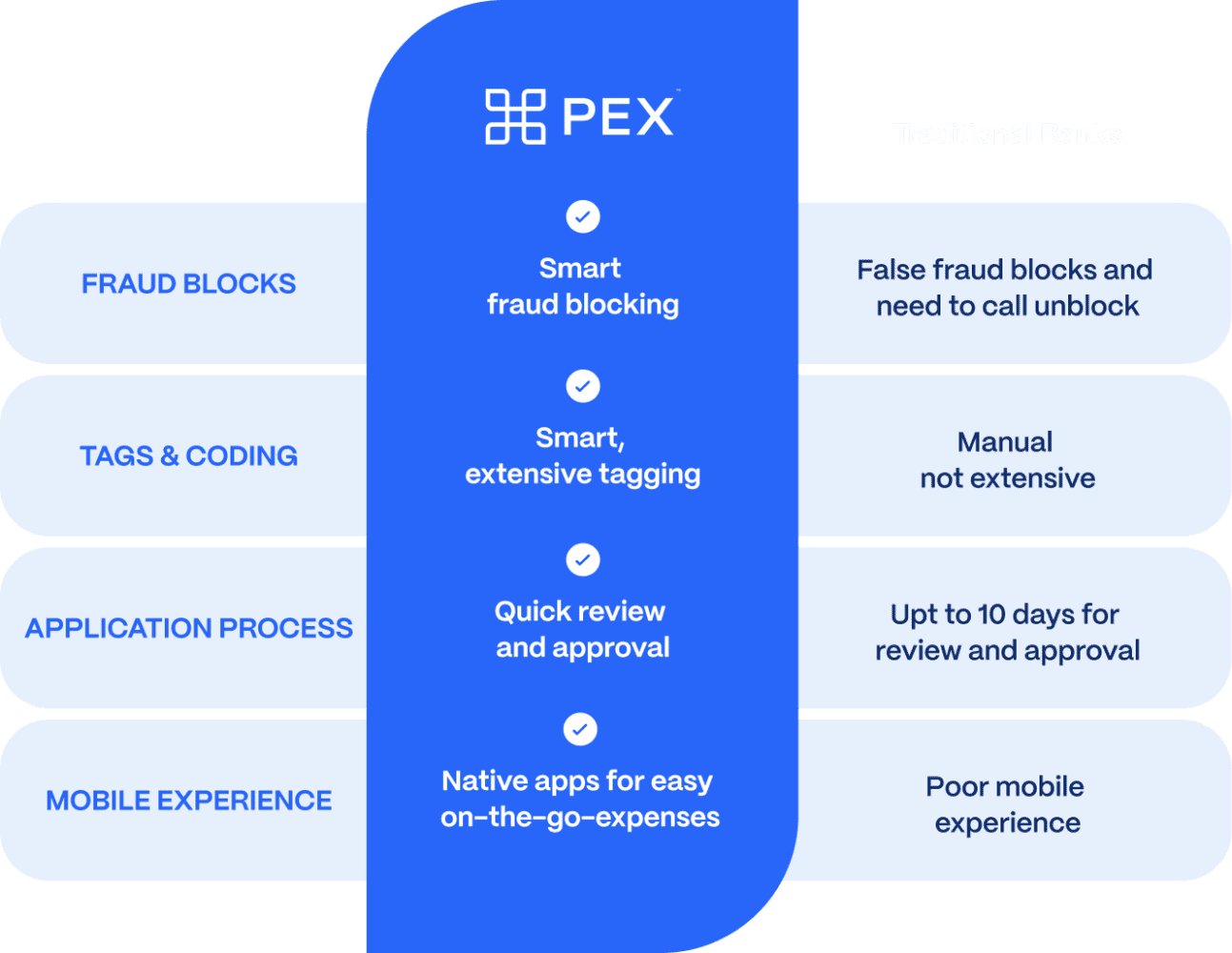

The best corporate card for construction

PEX offers a seamless approval process and comprehensive support that traditional banks don’t offer

Integrations

PEX integrates with your accounting software and ERP

Explore our integrations library and discover time-saving applications

Today's modern finance leaders trust PEX

PEX’s intuitive platform and top-rated customer service.

"PEX makes it easy to put funds in employees hands when and where they're needed, yet still limit what can be spent - all from my desk."

Sarah C.

"PEX has been life-changing and easy for employees and employer, from managing expenses and receipts, to integration with accounting."

Darci H., VM West

Frequently asked questions

PEX offers a seamless solution tailored for the unique financial challenges of construction companies, including real-time expense tracking, enhanced spend controls, and integration with leading software like NetSuite, Sage Intacct, SAP Concur, Quickbooks, CMiC, Procore, and more. Unlike competitors, this integration is included with the platform at no extra cost.

With PEX, construction businesses can reduce administrative overhead and gain better visibility into project expenses, ensuring cost efficiency and compliance.

Book a meeting

Talk to an expert

1 The PEX Visa® Commercial Card is not a credit card.

3 PEX requires linking an external business bank account for credit approval & mandatory autopay enrollment. With PEX Credit Expense, repayment of charge card purchases is due in full every seven days at the end of the statement period. A minimum bank account balance is required to qualify. Please view the PEX Master Service Agreement for more information.

© 2007-2025 Prepaid Expense Card Solutions, Inc., All Rights Reserved. The PEX Visa® Prepaid Card, PEX Disburse Visa® Prepaid Card, and PEX Visa® Commercial Card are issued by Fifth Third Bank, N.A., Member FDIC, or The Bancorp Bank, N.A., Member FDIC, pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa Business Prepaid and Visa Commercial Cards are accepted. The PEX Visa® Prepaid Card, PEX Disburse Visa® Prepaid Card, and PEX Visa® Commercial Card are not credit cards. Please see the back of your card for its issuing bank.