Remember those offers from your bank?

Today’s new reality means a virtual office, where paperless is no longer a want-to-have, but a no-choice-to-have. It’s no longer a “need” vs “want,” but the way we have to do business. As we wrote in earlier posts, transitioning to a working from home staff requires changes to workflow and processes. Expense tracking and reporting is one of the biggest changes. And frankly, one where the old way of doing things always included a healthy dose of frustration and annoyance.

Working from home means paper cannot move from person to person. There are tools like Slack, Google Apps, Zoom, etc., all built around collaboration and communication. Funny enough, what we are hearing from new customers is that the last thing to go paperless is expense reporting. Remember taping receipts to a piece of paper (or maybe you’re still doing it)? How do you move that paper around the “office”? Do you take cell phone photos and email it? We probably hear from 10 companies a month that are doing just that. Or just meeting in person. As if expenses weren’t annoying enough already….

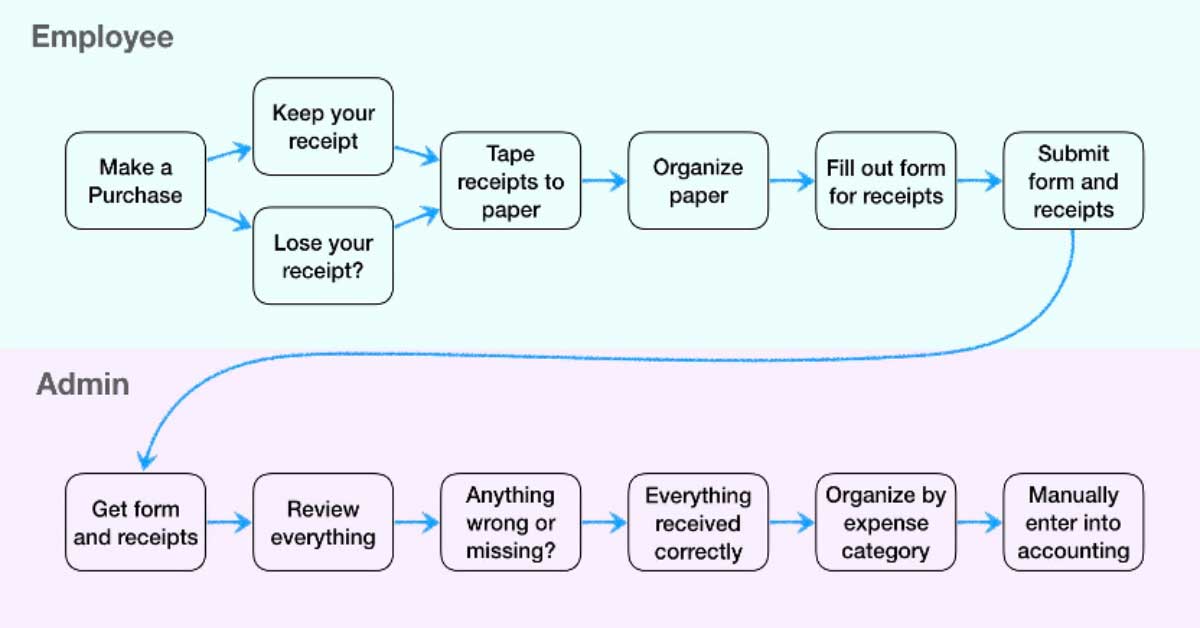

That’s why “receipt capture,” a fancy name for taking photos of your receipts with your cell phone, is increasingly critical. Here’s the process we all know and hate:

We’re probably missing a few steps, such as photocopying the receipts before submission….

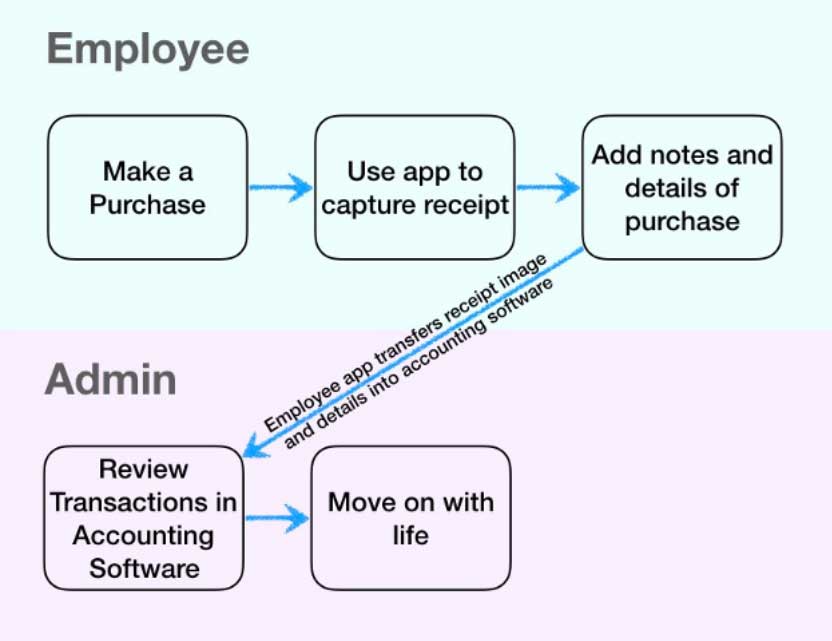

More importantly, here’s what we think it should be:

We’re not kidding. It’s that much more straightforward (or should be). Connecting cards, automating approved employee spending, expense tracking with receipt capture, and integrating with major accounting packages, significantly reduces effort and simplified what you or your staff need to do. Connecting actual spend activity to expense tracking also gives you a real-time view of that part of your cash flow, which is extraordinarily important today.

Basically, a paperless office should also be one with much less manual entry. Going paperless works best when a lot of effort is automated away. It should also save on review time, reduce your workload, and help you get a better handle on your company’s cash position.

So how do you do it? Learn more about how we addressed all of this with the PEX platform, cards and apps.

Stay up to date on the latest PEX news!

Thank you, you're now subscribed!

Opinions, advice, services, or other information or content expressed or contributed here by customers, users, or others, are those of the respective author(s) or contributor(s) and do not necessarily state or reflect those of The Bancorp Bank, N.A. (“Bank”). Bank is not responsible for the accuracy of any content provided by author(s) or contributor(s).