Most CFOs today understand that their organizations should strive to use big data more effectively — distilling it into meaningful insights that leadership can use to make smarter, more strategic decisions. However, that can take time, and according to a new survey from Deloitte, “the practice of using data to manage information and performance […] is only at the beginning of its impact as a competitive resource for organizations.”

The survey's findings also suggest that many CFOs are unsure of how to even begin the big data analytics journey — and whether they should be the ones leading the charge.

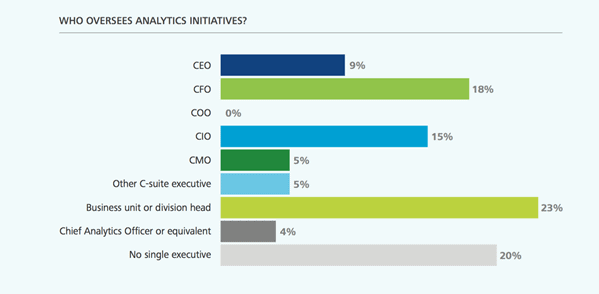

It's easy to see why many CFOs are confused about their role in analytics. Deloitte's survey found that the question of who should own analytics is open in many organizations. In fact, 20 percent of companies surveyed said they do not have a single overseer of analytics. In about one-quarter (23 percent) of companies, the “business unit or division head who also typically has significant budgetary responsibility” oversees analytics. In 18 percent of organizations surveyed, CFOs own analytics.

But even in organizations where a CFO is the designated owner of analytics, it doesn't mean these finance leaders are well-positioned to help the business generate relevant insights and apply them in a way that drives value. This brings us back to the first question on many CFOs' minds: How do I begin the analytics journey?

In an accompanying CFO insights article, Ajit Kambil, managing director of Deloitte's global CFO program, suggests that CFOs who want to “truly own analytics […] should bridge the gap between strategic and operational decision-making with analytics.” That, Kambil acknowledges, is a big change to the traditional CFO role. Typically responsible for managing the business at a high level and with a longer-term view, this C-suite leader is suddenly tasked with making real-time decisions in the trenches.

To help CFOs embrace this new role and drive analytics throughout the business, Kambil recommends finance leaders take these two steps:

1. Define the analytics advantage

First, determine which areas of the business are likely to realize value and gain competitive advantage through the use of data analytics. Areas to consider include procurement, business units, sales and marketing, supply chain and information technology.

2. Deliver operational value with analytics

Once CFOs have made their case to lead analytics in operational decision-making and identified the value of doing so, they need to back up their words by delivering value. Consider starting with one analytics-focused initiative “that cuts across areas to make a major impact at the operational level.”

Kambil recommends CFOs get creative when identifying these types of opportunities and ask themselves: What business decision or goal would drive margin or growth through analytics outside finance?

Of course, no matter how committed a CFO is to helping the business take advantage of real-time analytics for both strategic and operational decision-making, there are obstacles that can impede progress — at least in the short term.

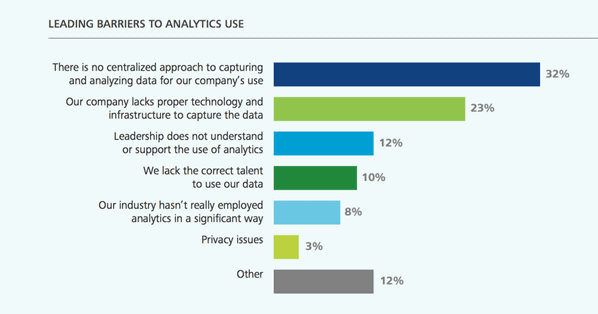

Technology is one. Survey respondents cited lack of proper technology and infrastructure to capture data as a top barrier to their organizations' ability to use analytics. Another barrier? Leadership's inability to understand or support analytics.

These barriers may be related. An organization's inability to work effectively with its data due to technological constraints could be a key factor in leadership struggling to see the value of using analytics.

But many CFOs appear to be up to the challenge of overcoming these hurdles. In a separate report from The Economist Intelligence Unit, 74 percent of C-level executives, including CFOs, said they would like to achieve a deeper understanding of the technologies underlying big data tools. Half of the respondents acknowledged that they need this level of understanding to be successful in their positions.

So, as organizations invest more in big data technologies, it's likely their CFOs will be among the first in line to learn how these solutions can be used to generate real-time insights that will help them to drive value throughout the business.

Jane Irene Kelly, who has two decades of professional writing, editing and reporting experience, writes about business and technology. Jane is a graduate of Syracuse University’s S.I. Newhouse School of Public Communications and resides in Pennsylvania.

Jane Irene Kelly, who has two decades of professional writing, editing and reporting experience, writes about business and technology. Jane is a graduate of Syracuse University’s S.I. Newhouse School of Public Communications and resides in Pennsylvania.

Stay up to date on the latest PEX news!

Thank you, you're now subscribed!

Opinions, advice, services, or other information or content expressed or contributed here by customers, users, or others, are those of the respective author(s) or contributor(s) and do not necessarily state or reflect those of The Bancorp Bank, N.A. (“Bank”). Bank is not responsible for the accuracy of any content provided by author(s) or contributor(s).